Biotech Event – Amicus Therapeutics (FOLD) Options Positioning into Highly Anticipated POMPE Data

Amicus Therapeutics (FOLD) will have key data upcoming in Q1 for their POMPE treatment AT-GAA, the ‘crown jewel’ of their portfolio which they think could become the new standard of care. The study (PROPEL) looked at over 120 patients with late-onset Pompe disease, a genetic disease where glycogen builds up within cells. The inability to break down this build up into glucose can cause damage to organs and tissues especially the heart and skeletal muscles. The lifespan of individuals with early-onset is only around 30 years and there is no current cure for Pompe. Late-onset of the diseases can manifest itself in leg weakness and deterioration in the muscles of the face and torso. There are 5,000 to 10,000 patients worldwide with Pompe. The current Standard of Care is Myozyme and Lumizyme from Sanofi. These are enzyme replacement therapies which are given every two weeks and has shown to boost strength in the leg muscles so the 6-minute walk test is up 25 meters.

FOLD management is targeting 15-20 meters further than Lumizyme and they think the study will show significantly better results. AT-GAA is a novel enzyme replacement therapy that is well glycosylated and designed to be absorbed into all of the muscles of the patient. They also include an ‘enzyme chaperone’ which makes it more tolerable as well. The company at JPM last week discussing the depth of their study on AT-GAA:

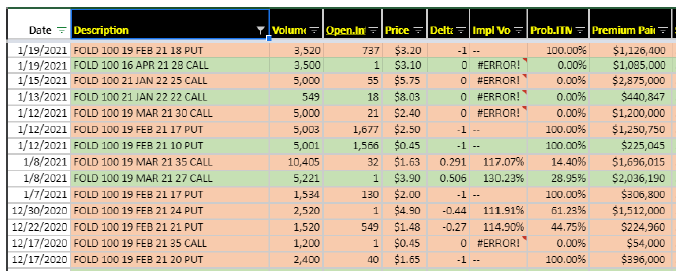

“We wanted to have a medicine that had the potential to transform people’s lives. You saw we’ve done years of Phase II studies. We’ve tested this in patients who had been on enzyme therapy and switched. We tested the medicine and people who had never been on an enzyme therapy. We tested this in Pompe patients who could walk. We tested this in Pompe patients who were wheelchair-bound, Pompe patients on ventilators. And what struck us and the experts across these years of Phase I and II studies was the magnitude of response, the consistency of response across all patient groups and the durability of response going out years.” BAML out on 1/20 noting they think positive results are worth $26/share to FOLD. The bear case – Pompe has zero value – would value share at $14. They think the study design is well constructed and likely shows benefits above peers which will give them a best-in-class molecule in the $1B market. Cowen thinks the stock could move 30% to 40% with data. Cantor out positive on 12/28, expecting the data to be positive, and also citing “strong” year-over-year YoY growth in Galafold sales year-to-date, which may allow the company to reach management’s guidance of achieving over $500M in revenue in 2023. Data is most likely around mid-February. Short interest is 11.4% and down from around 14.5% in March. Redmile and Perceptive are two top holders and FOLD is a top 3 position for both. The options snapshot shows more protective positioning recently.