Buying vs. Selling Options

As an option trader it’s important to realize you have options, literally. A trader doesn’t have to only buy options in order to profit but can also sell options to open a trade and give themselves a much higher probability of profit. There’s different reasons why a trader might want to buy options versus selling them or combining the two methods with spreads. If I buy an option outright I am usually doing that for only a few reasons. Either to speculate on the direction of the stock, hedging a portfolio or buying protection against an event or price move that shows potential risk. If a trader is selling an option to open a trade they are generally hedging via overwriting calls on an existing long stock position or potentially trading the odds when selling a cash secured put showing willingness to own stock at the strike price. This is often a way to bet on where a stock won’t go while still collecting a premium for selling the option.

Buying Options

If I buy a call option on a stock then I am making a bet that the stock will rise in price before the expiration date of the option. The profit potential is unlimited but the stock must move high enough to offset the theta decay of the option. The risk in buying an option is that the stock moves higher but not fast enough as option buyers are needing the velocity of the move to also work in their favor. This can result in a small loss or partial profit at expiration depending how close to being in the money the option is. When long options it is often beneficial to buy enough time to be able to hold the position for the move you see coming. This is why knowing your timeframe as a trader or investor is so crucial to being successful as an options trader. The benefit of this is also that you can only lose the premium you paid for an options contract. Whether you’re willing to risk the full premium or not, that is the most that can be lost.

Speculation

One main reason to buy an option instead of the stock is if I wanted to speculate on a move in a specific time period. Let’s say SPY stock seems like a good buy but buying 100 shares for 460 per share doesn’t seem like a great use of capital for a trade I plan to be in less than a month. Instead I can buy a slightly in the money call option that expires in 2 months. From the graph below you can see the SPY Dec 460 call costs about 11.10 so for one contract I would pay $1110. Instead of speculating on upside for the next month using shares and paying $46,000 I can get a similar upside exposure for a fraction of the price. The trade off being of course the expiration date is in 6 weeks. The move I am expecting to see should happen in that time frame otherwise I would buy a different expiration month or I can later adjust and roll to the different further out month. All in all, buying this call option allows me to risk only what I am willing to lose while still having unlimited upside in the timeframe I choose.

Protective Puts

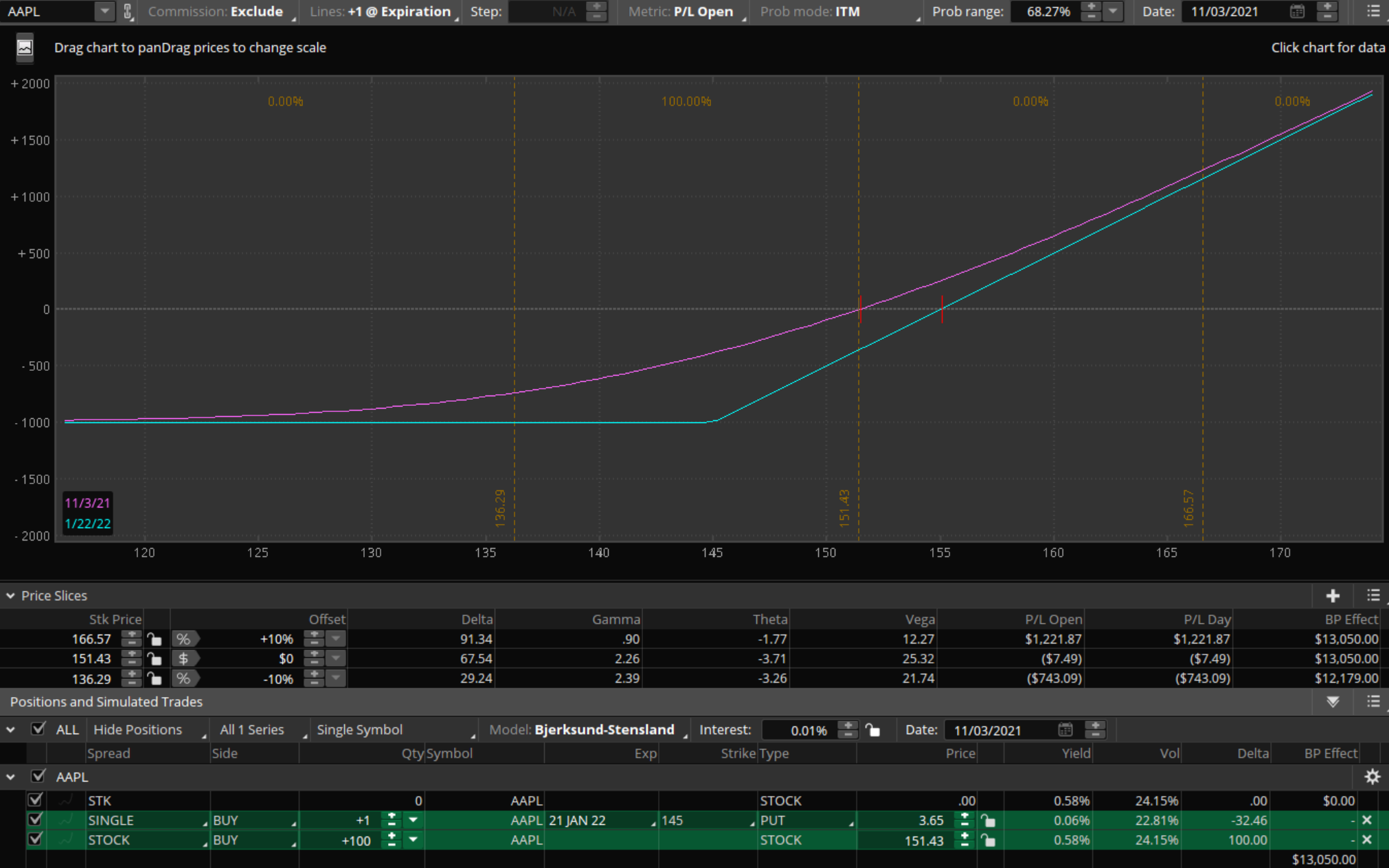

Another way to buy options is through the use of hedging against a long stock position. Let’s say I own 100 shares of AAPL and it’s been on a large run higher. I want to continue owning my stock but I think the market overall may enter a rocky period for the next 3 months and I want to protect my position from a possible correction. I can buy a put option slightly out of the money to hedge my stock. This is often called a married put or stock tied trade when made together with long stock and long puts. By owning a downside put I am paying a premium to be protected against a large outsized move if it comes. This can be a popular way to strategize for longer term shareholders or investors that do not want to sell to avoid short term capital gains or if they just see potential for a correction that the options market can help buffer the position against. From the graph below you should notice something very similar about this long stock, long put position. It’s almost identical to the risk profile of the long call. When a trader buys AAPL stock and also buys a slightly out of the money put, say at the 145 strike, they are protected below that 145 level and the potential loss is maxed out no matter how low the stock drops. At the same time if the stock rallies higher the trader participates in the upside, albeit giving up the small premium paid to own the put protection, in this example 3.65 per contract.

Selling Options

When it comes to selling options there are also multiple ways to form a trade idea. Whether you want to hedge a long stock position through the use of covered call selling or to start a trade by selling a cash secured or naked put to open, you can sell options to give your portfolio a higher probability of success. The beauty of options is that a trader can form a specific strategy based around their assumption or overall bias in the stock. Oftentimes we see large funds opening positions by selling puts in a stock they are willing to own at the strike price. This is one of the more bullish signals, especially when a stock has pulled back to a level of support and an institution is willing to mark a line in the sand at a specific level they feel there is value. The higher the delta of that put option being sold the more bullish the outlook might be as the seller is betting more on price movement of the stock when they sell a put closer to being at the money.

Hedging

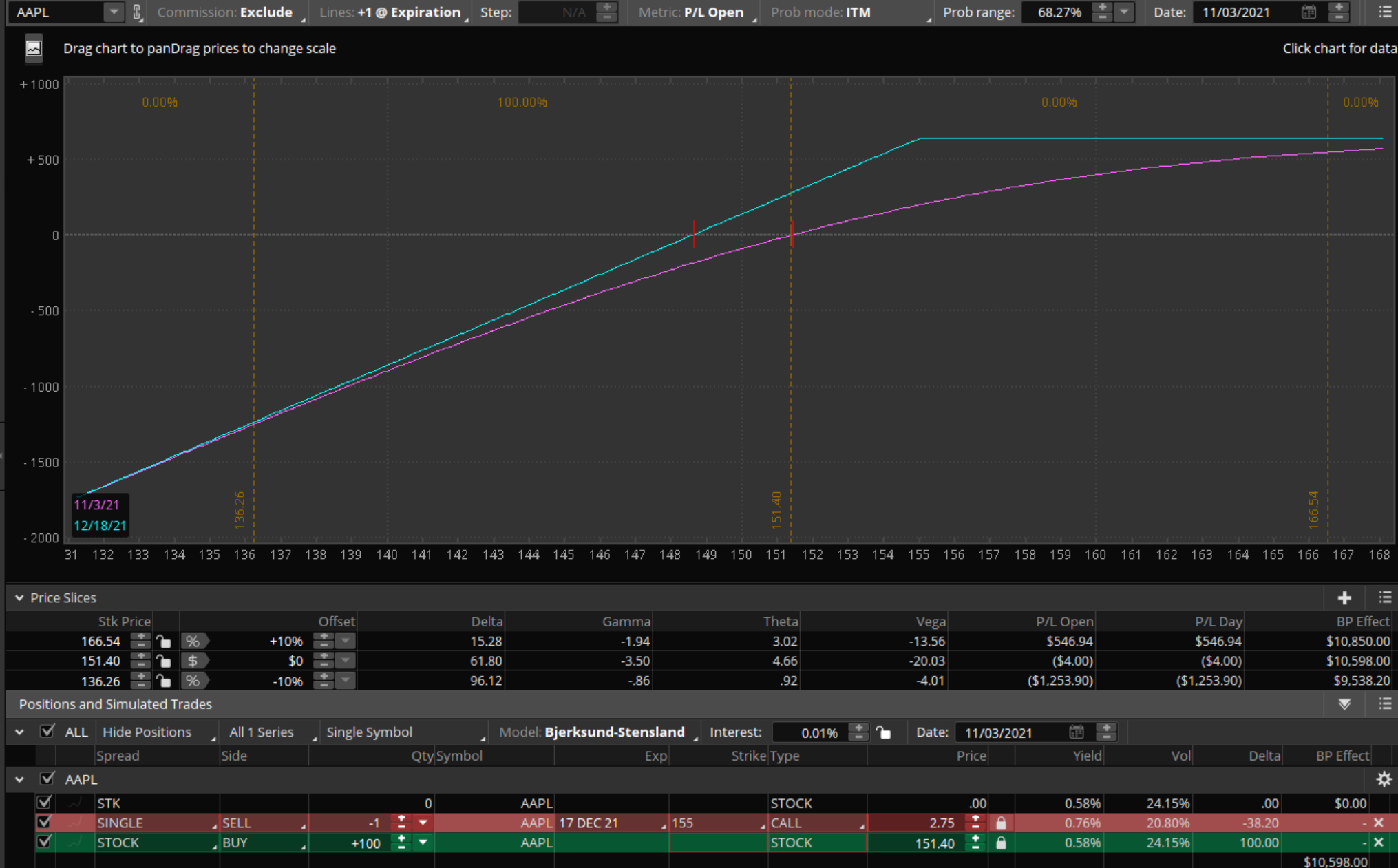

To hedge a stock position with options is also a great way to add yield or protection to an account. If I own 100 shares of a stock I can sell a call option against that position and this is known as a covered call. One of the more basic ways to hedge a long stock position against a potential pullback or just using higher implied volatility to add yield to a portfolio. By doing this I am willing to swap out unlimited upside potential for guaranteed cash today in the form of selling call premium. Selecting an out of the money call strike that has a higher probability of expiring worthless is more beneficial if you would prefer to collect some premium but also keep your shares. By selling an at-the-money call strike you collect more premium but also it’s more likely you can get called away from your long shares as the stock moves through your sold strike before expiration. Of course you can always roll the position to a further out strike price or expiration if you prefer. The risk graph below shows a covered call position on AAPL. If I bought 100 shares at 151.40 and sold a December 155 call for 2.75 then I am willing to sell my stock at 155 for the added premium I get to pocket. This 2.75 in premium cushions my downside breakeven also and as the blue line shows at expiration my breakeven is closer to 148.50. Collecting this premium from selling a covered call adds yield to my portfolio and can be done monthly if I think the stock might languish or go sideways to lower.

Cash Secured Puts

The other way to sell options is to start a position by selling a put cash secured or naked. By selling a cash secured put you are able to have the cash needed to buy 100 shares of the stock at the strike price. This is a high probability trade that gives you a greater than 50% chance to be profitable. Since options decay in price the faster it gets to expiration, selling a put option allows a trader to profit some time value erosion, implied volatility declining or simply the stock rising in price. You can see below that the risk profile of a short put is identical to that of a covered call. They are essentially the same thing. If I wanted to sell a put option on AAPL I can look at the chart and see where support might be, then sell that strike price. In this example below I can sell a December 145 puts which is about 6 points out of the money and a 27 delta. This option has roughly a 75% theoretical probability of expiring worthless. As you can see the breakeven at expiration is well below the current stock price of 151. If we subtract the 2.00 premium from the 145 strike price we get a breakeven at 143. Pretty cool considering the stock can go up, stay sideways, or even drop over 6 points and I still make profit on this trade. Of course the trade off for a high probability trade is that I can only make a max of 2.00 or $200 per contract even if the stock flies higher. But if you want to own stock at a specific level in the future, selling cash secured puts is a fantastic way to enter into a position while getting paid to wait.

Takeaways:

- Buying options can serve several purposes but selling options can also effectively do similar things while protecting a portfolio.

- Investors can buy options to speculate on price moves of an underlying stock or buy options to hedge the downside of a long stock position.

- Traders can use covered calls to add yield to a long stock position if they want to hedge against a potential short term dip in shares.

- Investors can use long puts to marry a stock position and synthetically stay long shares while being protected from outsized moves lower.

- Selling a cash secured put to enter a position is a high odds way to get long a stock.