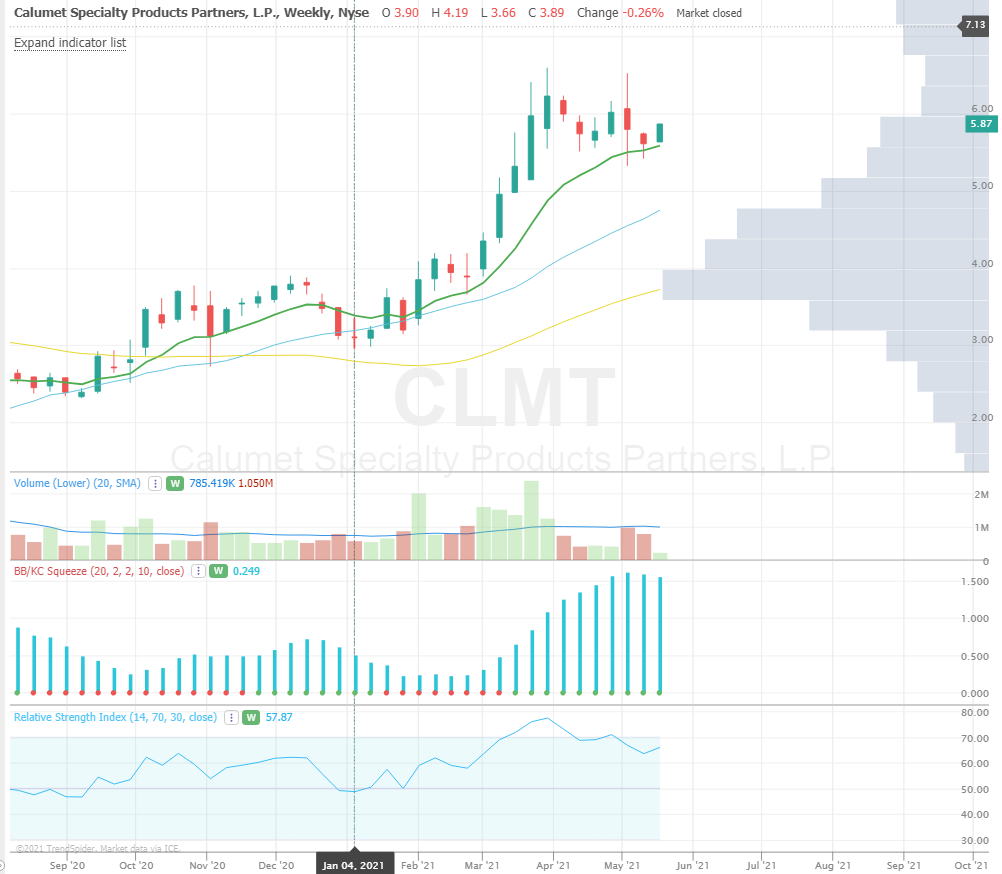

Calumet (CLMT) Call Buyers See Further Upside Ahead of Renewable Diesel Transition

Calumet (CLMT) strong small-cap not far from recent 52-week highs seeing bullish positioning this week with buyers on 5/18 in the August $7 calls 5000X and on 5/6 the June $7 calls bought over 8,500X. CLMT produces and sells specialty hydrocarbon products such as waxes, naphthenic oils, and solvents. Their products are used as a raw material for industrial, consumer, and automotive goods. Some of the key brands and companies they work with include P&G, Sherwin Williams, Bath & Body Works, Dow, Lubrizol, Avon, Estee Lauder, and Unilever. They have a dominant #2 position in synthetic lubricants with brand recognition in racing. CLMT has been working on ‘self-help’ moves like deleveraging and divesting non-core assets while narrowing their product focus and implementing cost-cutting. CLMT is benefitting from a stronger specialty industrials market and consumer market while fuels remain challenged. CLMT sees long-term potential for their engineered fuels products business with several non-automotive applications including small outboard motors, motorcross, and emergency vehicles. They also announced plans in March to transition their Great Falls refinery to renewable diesel. CLMT believes they can process 10,000 barrels per day of renewable feedstock. The process is on track, according their May call, and they are looking for a partner as well which will be beneficial for them:

“We see 3 very compelling reasons for admitting a partner. First, the renewable diesel project depends on government-regulated markets and therefore, carries a higher uncertainty than other projects available to the company. A strategic partner who is already pursuing renewable diesel supply would be prepared to manage that risk. We, on the other hand, want to focus our capital investment on specialties businesses. Second, a partner who is already pursuing renewable diesel supply will see our Montana project the same way we do. It’s the lowest capital cost per barrel of any industry announcement to date in our opinion. And third, the renewable diesel business is in an up-cycle, while refining in 2020 is arguably bottom of cycle. It’s the right time for the pivot. Especially because we can straddle the energy transition with our dual train moving faster given the infrastructure in place.”

Wells Fargo upgraded to Overweight in March citing its proposed renewable diesel transition. The transition, if executed adroitly, should allow Calumet to accelerate debt reduction, shift the company into high-growth/high-margin renewable fuels and shrink its conventional fuels ops. Hedge fund ownership rose 15% in Q1, Caption Management a buyer of stock and Evermore Global a buyer of call options. In October, Bloomberg reported that the company was exploring a sale of their finished lubricants business which could fetch $500M.