Intro to Options vs. Stock

Options vs. Stock

A common beginner’s misconception with options is that they are “too risky” compared to just buying stock but this couldn’t be further from the truth once you fully grasp the flexibility and advantages that options have to offer. Being able to specify how bullish or bearish you are on a stock by using different option strategies and taking into account what timeframe you want to zero in on can save you capital to use on other trades and help the overall efficiency of a portfolio. Just about any opinion an investor has about a stock in the future can be replicated with options and almost always using a fraction of the capital required to buy stock.

Buying Stock

When you buy a stock you are making an investment in the future price going higher. Investors only buy shares of a company if they believe it will grow and thus the stock price will rise as it prices in the future potential of the company. When shares are bought, they can be held as long as desired and theoretically have unlimited upside with a max loss defined. This is the allure of owning stock as long term investors prefer to buy and hold in a company they believe in. However, owning stock is very black and white. You either profit on a rise in price or lose on a decline. The downside of buying stock is the cost. It can be expensive to even buy 100 shares of a normal sized company. Of course an investor can buy small amounts over time if in it for the long term but this is a big reason why options have become so much more popular as liquidity increases across the options market.

Example using long Apple (AAPL)

Assuming I was bullish AAPL stock I could buy 100 shares around the current price of 145 per share. This would cost me $14,500, I then get to participate if the stock rises in price for as long as I own the stock. There is no expiration date, and if the stock pays a quarterly dividend I receive that.

Shorting Stock

When you sell a stock short you are actually taking even more risk since you first have to borrow the shares from your broker if they are available and then there is unlimited upside risk if the stock goes higher after you sold short. Also there are often high borrowing costs on the most shorted stocks in the market. This creates another risk with the dreaded short squeeze that causes pain to a lot of short sellers that are forced to buy back shares at high prices. All this can be avoided by using simple option strategies to define your risk from the onset if wanting to construct a bearish position.

Example using short (AAPL)

Similarly, if I was bearish AAPL I could short 100 shares at 145 for a cost of $14,500. Since a stock can only go to zero there is a max profit and more realistically for a large cap blue chip stock the floor is much higher. Also if I am short a stock that pays a dividend I am on the hook for that and must pay out the dividend if I remain short the shares into its dividend date. Being responsible to pay out the dividend and also having unlimited upside risk is enough reason to avoid this and focus instead on an option trade that replicates the same short 100 shares but with defined risk.

Options Differences

Trading an option is not just a coin flip bet that depends on the stock’s direction in order to profit. A trader may choose to be bullish, bearish, or neutral on both price and implied volatility. Selecting a specific expiration cycle to trade can further reduce risk and enhance returns by not overpaying for premium and isolating a timeframe or catalyst that could cause a move in the stock. Trading stock is simply making a bet on where prices might go while trading options allows a trader to bet on where they think a stock might NOT go. Options allow traders to be much more flexible with strategies regardless of directional opinions and use implied moves and what the market is “pricing in” as a guide to use for future expected volatility. Being able to sell a cash secured put is a way to mirror a long stock purchase but with less capital upfront if trading in a margin account.

Trade Examples using AAPL

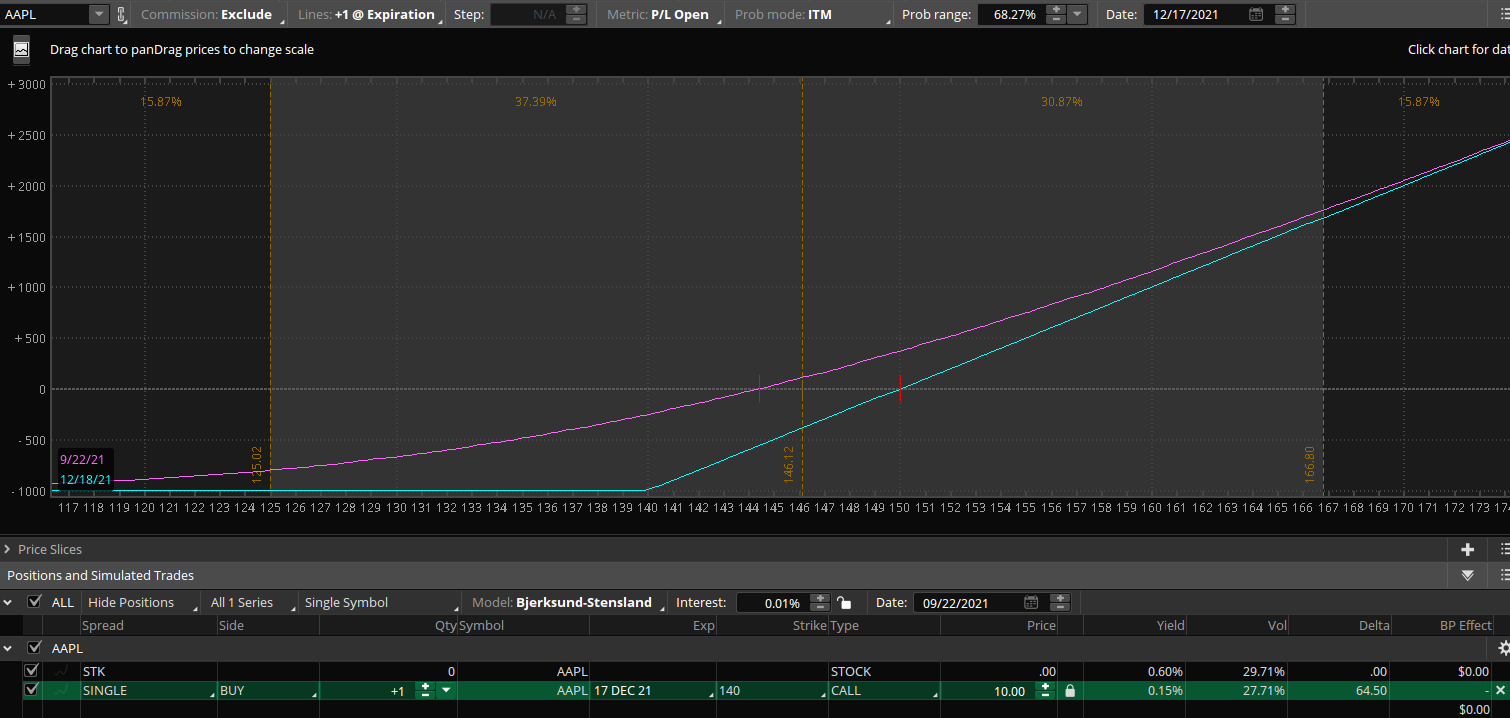

Bullish Bias- If I was bullish on AAPL, using options I could construct a trade buying a 3 month at-the-money call option for a fraction of the price of the stock. Instead of paying $14,500 for 100 shares I could pay about $10.00 per contract for a call option, and this is multiplied by 100 since each option represents 100 shares of stock notionally. The max risk on this call option would be $1000 or less than 10% of the cost of the stock purchase. The trade off for this discount in price is the expiration date. I am buying an option with 3 months of time so I need to be right within that timeframe or else I can roll to a future expiration date eventually as well to extend duration.

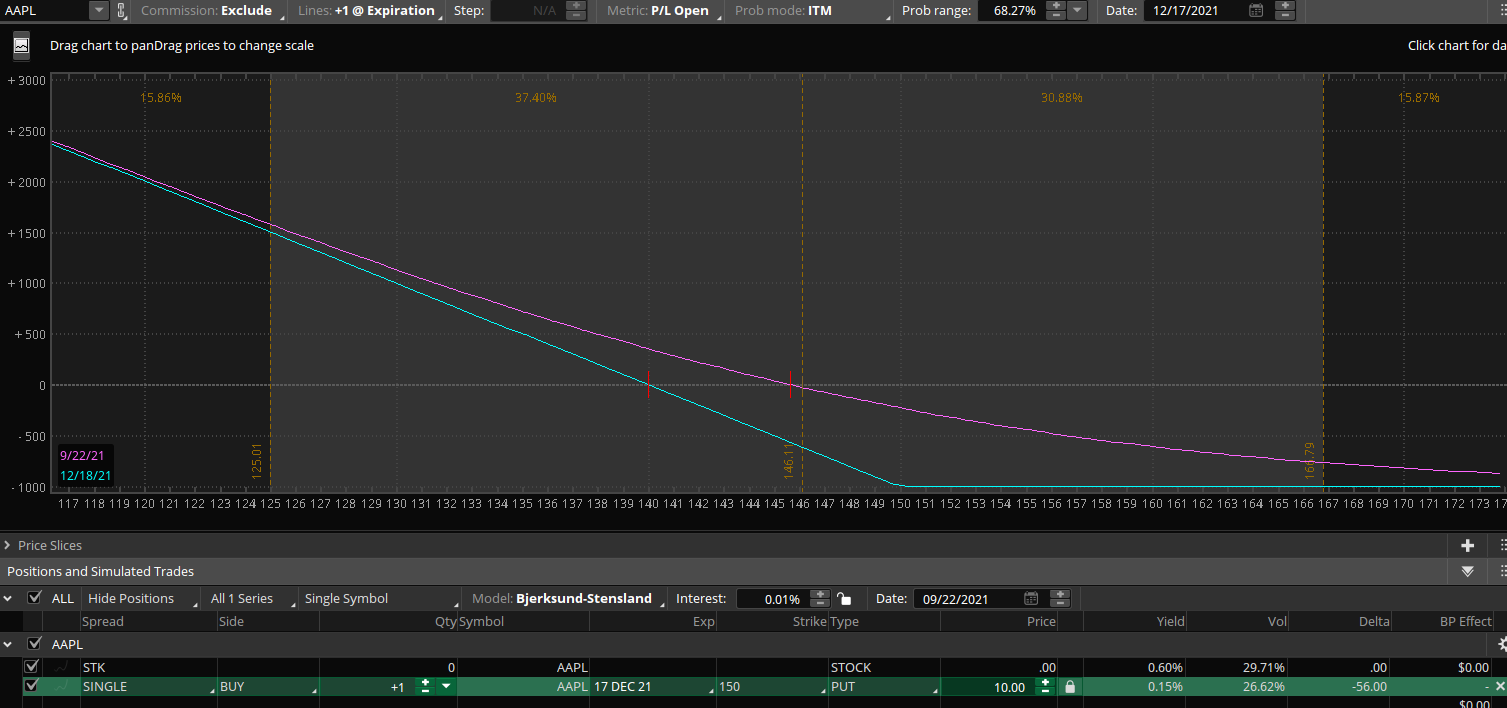

Bearish Bias- If I wanted to instead make a bearish trade on AAPL I could buy a put option using this same logic of going out several months in time and buying enough duration to give myself a chance to be right. Buying an AAPL 145 put for $10.00, or $1000 per contract allows you to define your max risk on the trade regardless of how high AAPL stock may go. You are protected this way versus just shorting shares of stock which carry unlimited risk.

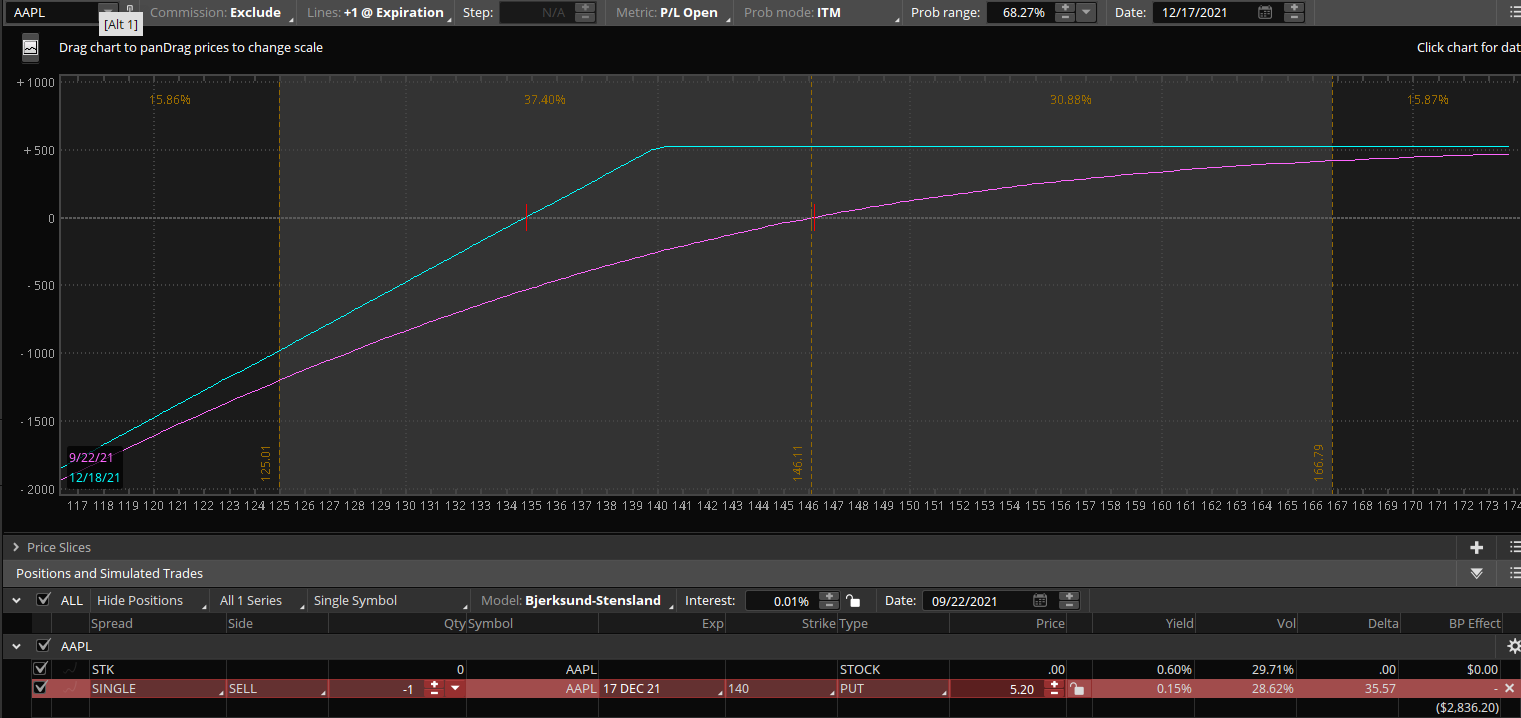

Neutral to bullish bias- If AAPL was showing signs of going higher from its current level of 145 and I wanted to make a bet it would go up or at least not go much lower I could sell an out of the money put at the 140 strike and collect a credit of 5.00. Assuming I was willing to own AAPL shares at 140 I could sell this option cash secured and have a theoretical breakeven at 135 (140 minus the 5 dollar credit). This 5.00 or $500 per contract is my max profit as long as AAPL shares stay above that 140 strike price by expiration. Utilizing this same idea using a spread cuts the risk and buying power down further. This strategy is called a “bull put spread” as I could sell the 140 put and buy the 135 put to create a spread. As long as the stock continues to close above my bull put spread strike prices the premium of the options decays each day and allows a trader to profit even in sideways neutral conditions.