Iron Condors Explained

What is an Iron Condor?

An iron condor is simply two credit spreads combined into a four legged spread trade. The iron condor is made up of a short put credit spread below the current stock price and a short call credit spread above the current stock price and ideally look for the stock to stay in between both short strikes you sold. An iron condor is a directionally neutral but risk defined strategy. The four options combined in one spread can be traded as one single transaction. The wide width of profitability resembles the wide wingspan of a condor bird which is how it got its name.

Essentially an iron condor is very similar to a short strangle where you sell an out-of-the-money put and call but with an iron condor you will also buy further out cheaper options or “wings” or cap off the risk and create a risk defined spread version of the short strangle. Either way, it benefits from neutral price action in a range and a contracting implied volatility as time passes.

The benefit of selling an iron condor or any credit spread for that matter is that risk is defined at entry. The max profit is the credit received for the trade and that is realized if the stock is between both short strikes at expiration. The max risk will always be the biggest width of the strikes in the iron condor minus the credit received.

Strategy Characteristics

Directional Lean: Neutral

Best Market Environment: Higher Implied Volatility Market in a Range

Ideal Setup: When Expecting a stock to stay between a defined support/resistance zone

Iron condors are neutral because we are selling purely extrinsic value options out-of-the-money on each side of the current stock price. The goal is for all options to expire worthless or drop enough in price to buy back the iron condor for an amount much lower than where it was sold. From the post I wrote about Vertical Credit Spreads you might remember that by selling a put credit spread (bull put spread) you are getting long the stock and if selling a call credit spread (bear call spread) you are getting short the stock. But when combined then we have an iron condor which offsets most if not all the directional bias.

Just like most trades where you are a net seller of premium, the iron condor makes money from theta decay or also known as the passing of time and it benefits from a decrease in implied volatility or IV. Ideally, you can sell an iron condor with higher implied volatility and see a decline which drops the prices of out-of-the-money options, aka IV crush. All while the stock stays in a wide range between your short strikes. Since theta decay is a big factor working in your favor with an iron condor it makes the most sense to enter these trades when the rate of time decay is at its highest. From my post about What is Theta, we know that options decay accelerates within the 60 days to expiration (DTE) timeframe. So while options decay even faster in the 0-21 DTE timeframe, the gamma risk is also substantial in the final weeks as well. This makes the timeframe of 30 to 45 days till expiration an ideal sweet spot for selling iron condors or options in general. Of course there will always be other factors involved when deciding the expiration to sell, such as earnings or other catalysts that might be influencing a stock and its option prices. Using iron condors on the indexes eliminates single stock concerns and often is a safer way to use the strategy since indexes often do stay more sideways overall.

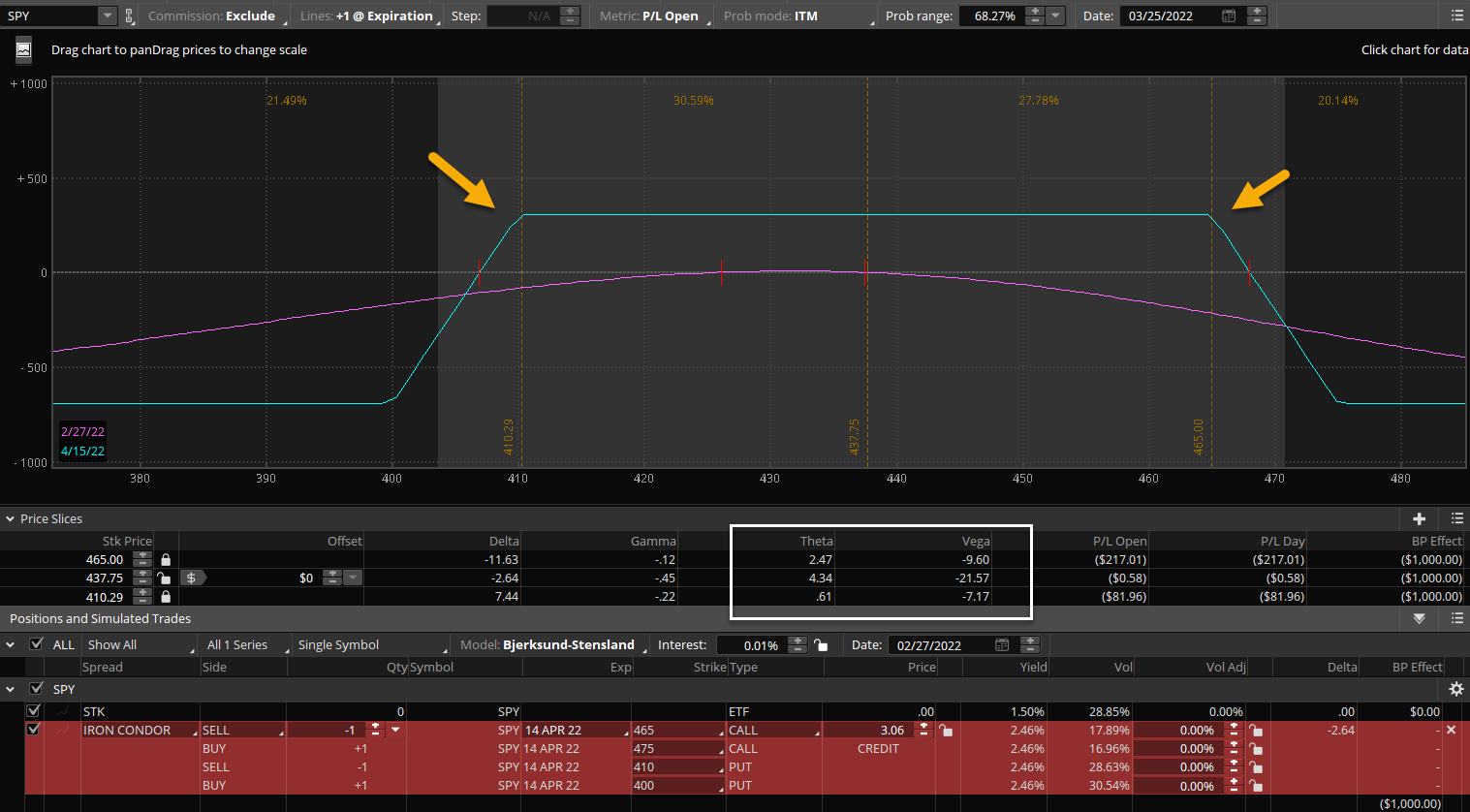

The example below shows a SPY April iron condor with short strikes at 410 and 465, both roughly the same amount of points from current prices near 438. But since the delta of the 410 put is closer to 25 and the delta of the 465 call is around 17 this creates a slightly negative delta bias. But with theta of 4.3 and vega around -21 this means each day that passes the iron condor decays by $4 and for each point of IV decline, the iron condor makes $21, all else being equal. This is a simple example of collecting a credit of roughly one third the width of the strikes as the credit is 3.06 on a 10 point wide IC. This is our max profit if SPY stays between that 410-465 range by April expiration. However there is no reason to wait that long to realize a profit, if the spreads decline in value and the iron condor goes from 3.00 to 1.50 that would show a 50% profit of the credit received and is often a great rule of thumb to exit the trade.

The Benefit of Higher IV

If we believe that implied volatility is mean reverting and generally will come back into its long term average then using it to our advantage when it is higher makes sense. The main benefit to selling iron condors when implied volatility is higher is that you can sell spreads further outside of the current stock price and still collect a decent credit for the trade. Of course prices are higher for a reason in volatile markets as the implied or expected range for a stock is higher because it is moving more per day. Realized volatility is a factor that is important to watch as well and shows how much the stock is actually moving. Implied volatility is just the options market pricing in the future movement which is often overstated and thus a great opportunity to sell. But if realized or historical volatility in the stock is actually higher than implied volatility then it’s a yellow flag that perhaps IV is not as high as it should be. As with anything related to options trading, there is no certainty but only probability. But over time I have learned that selling iron condors in higher volatility avoids being hit with outlier events that blow through your range of the iron condor. Outlier moves tend to occur when the options market is not anticipating them, and thus implied volatility is too low.

This high IV is often best seen on stocks approaching their earnings reports every 3 months. If several factors line up and the ideal setup is for continued range bound trading then selling an iron condor into earnings can be a fantastic strategy and one I use often. Generally I have learned that selling a weekly iron condor for earnings that expires that same week is not as beneficial as going out a few weeks or even one month. This is because the gamma risk is high and you are basically making a binary bet that earnings will keep the stock between your short strikes the next day. Stocks will often have wild moves after their earnings report and that is why giving yourself a little extra time to be right is best. A recent example I traded using TSLA iron condors ahead of its January earnings report. With the stock trading about 940 on 1/26, the day of earnings I sold a February iron condor with short strikes at 800 and 1100 expecting price to be contained in that range. I sold the 10 dollar wide IC for roughly $4.25. Ideally the stock behaves and I could buy back the iron condor for around $2.00.

The stock actually opened the next day unchanged but quickly got rocked lower with market wide volatility still in control overall. The trade was profitable right at the open but of course I did not exit quickly enough (I was actually in Hawaii on vacation so not as active). TSLA went lower for a few days and touched the 800 area where my short strike was before it bounced sharply back higher. This is why it is important to give yourself some time to be correct on these types of premium selling strategies. If I had sold a weekly iron condor that expired in two days then I would likely have taken a loss. But by selling the February monthly expiration I had several weeks to wait and see. As the stock bounced back to above 900 in the following week I was able to buy back the iron condor at 2.70 a few days later on 1/31 for a profit of $155 per spread or about 36% return of the credit received. If I had waited til expiration on 2/18 a few weeks later the whole iron condor actually did expire worthless as TSLA closed between 800-1100 so I would have been able to keep the full premium collected of $425 but as I mentioned I am usually not interested in waiting til the final week of expiration if I am already in a good profit. Close the winner and move onto the next trade.

Skewed Iron Condors

Typically iron condors are traded with an equal width on each the put and call side but it doesn’t have to be that way. If you sell a put spread that is $10 wide and a call spread that is $5 wide then you are more long the stock since there is more risk to the downside with the put spread a wider width. But if you wanted to sell an iron condor that exposes you to less risk on one side then it might look like this example below.

Using the SPY example from earlier we have essentially the same strikes and trade setup but on the call side I made the spread 5 points wide while the put spread side is 10 points wide. This lowers our credit received for the trade to $2.50 roughly. Which is one half of the width on the call spread side. This results in a more delta neutral to bullish bias iron condor as the risk graph shows. Also if more bullish on the stock then this variation contains your risk more on the upside in case the stock runs away higher a bit faster than expected. Overall the goal is still the same, collect enough credit to make the odds reasonably in your favor (selling at least beyond the 25-30 delta strikes) and try to capture around 50% of the credit as a target profit as the price action stays range bound and theta decay works in your favor.

Takeaways:

- An iron condor is a neutral trade which sees max profit at expiration if the stock settles between the two short strikes.

- Iron condors are similar to short strangles, except they are risk defined.

- Max loss happens if the stock moves beyond one side of the iron condor at expiration.

- If trading skewed iron condors, the risk can be more on one side if the spreads are different widths. Whichever spread side has more width, the more risk there is.

- Iron condors are best entered during high implied volatility range bound markets.