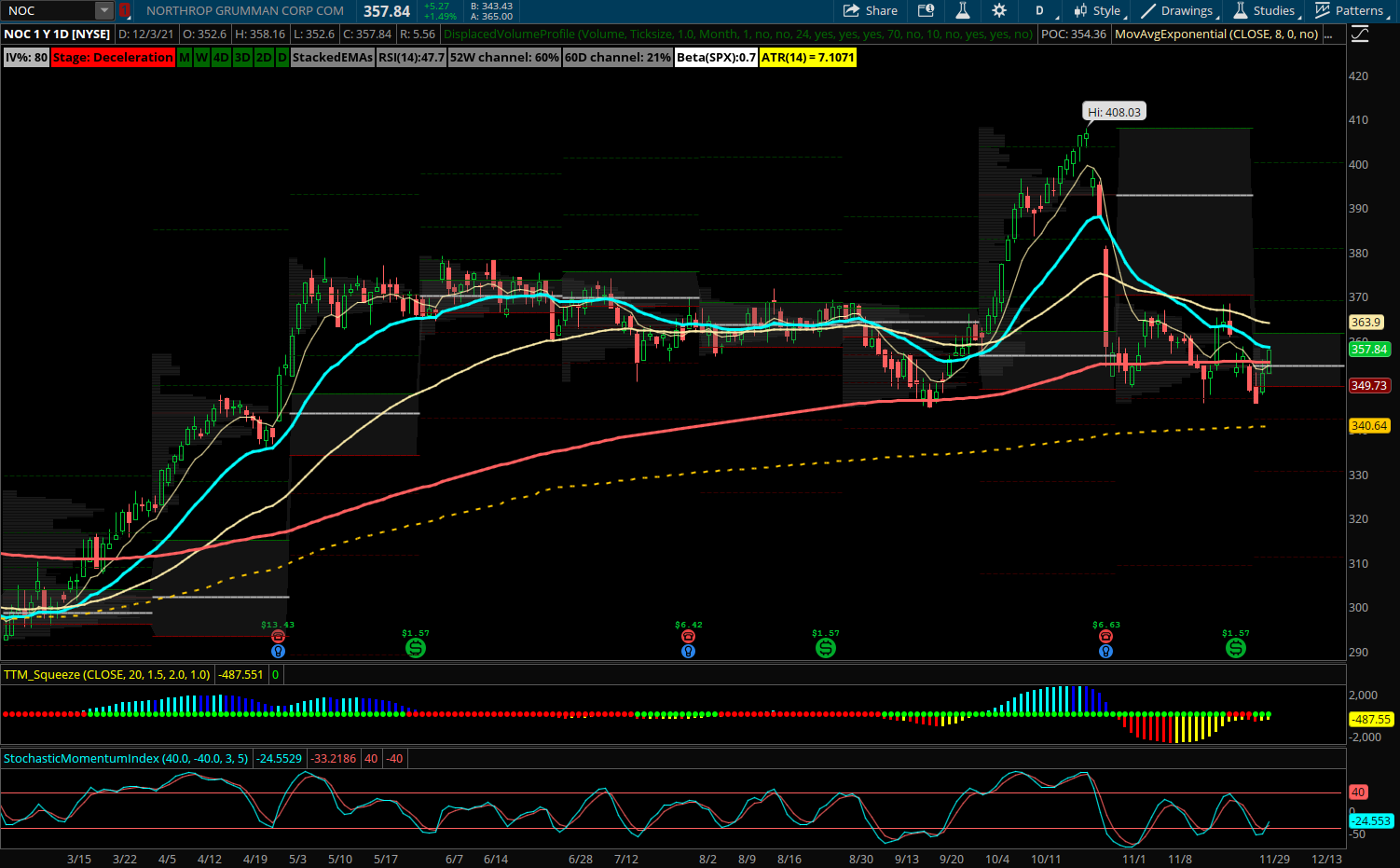

Credit Spread of the Week: Defense Name Basing at Long Term Support

Northrop Grumman (NOC) – NOC is a global Industrial defense stock that outperformed the market last week being up over 1% during a very turbulent time. The name has a lower beta so these more defensive stocks have held up or even rallied as of late during the market pullback. NOC rallied into the 400 area ahead of its prior earnings in October before dipping back to its long term support at the 200 day EMA and just ahead of YTD VWAP at 340. The stock stabilized and has started to base nicely above the 350 level with some bull divergences forming on indicators. RSI reset and now trying to regain the 50 zone as it churns in monthly value. An optimal spot to enter a bull put spread expecting the 350 level to hold into year end and January expiration. If the stock can clear its monthly value high at 361 it can rally up into the 370s and potentially fill that earnings gap near 385. NOC doesn’t see a lot of active options flow but has seen some opening put sales of note. On 11/18, the February $340 puts sold to open for $341k. Also back in early June, a large opening put seller sold over 1200 of the January $380 puts for over $3.5M in premium and most remains in open interest which benefits from a move back to 380.

Trade to consider: Sell NOC January 355/345 put spread for 3.50 credit or better