Credit Spread of the Week: Oversold Networking Leader

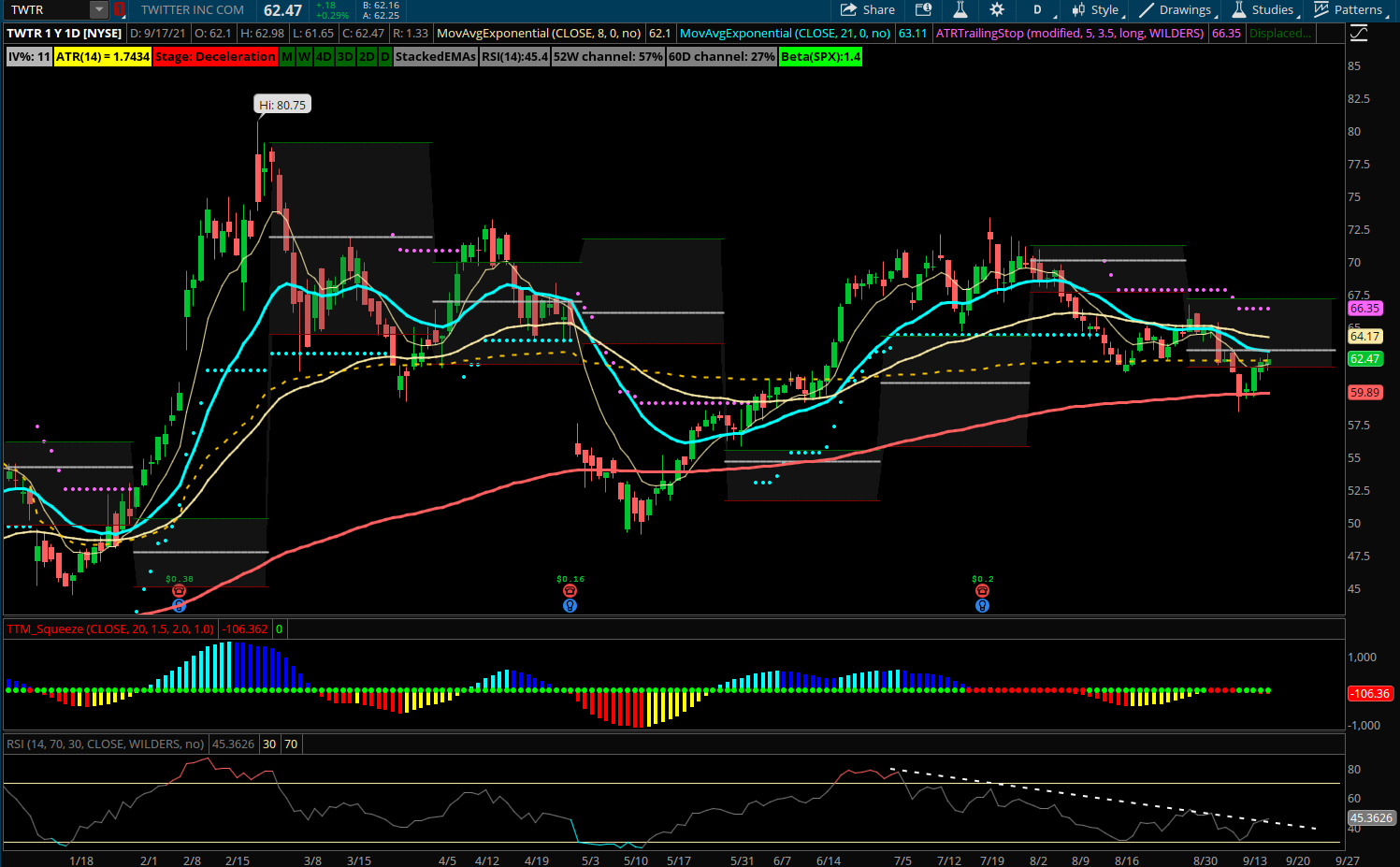

Twitter (TWTR) – Twitter has been pulling in to its 200 day EMA and near YTD VWAP since reporting earnings in late July. It bounced back above 62 last week and closed strong in a weaker market so a good risk/reward to look for the 60 price level to hold as RSI tries to push back above 50 and resume the uptrend. Selling a bull put spread while the stock forms a base at the 200 day support zone can work well if it continues to grind sideways to up or even start a new rally to highs. TWTR has seen numerous recent bullish flows since the start of September including opening put sales in June and Sept 2022 $50 puts. Also last week a large buyer of October 60 calls for $6.4M.

Trade to consider: Sell TWTR November 62.5/57.5 put spreads for 2.10 or better