ETF Sector Relative Strength Corner: Alt Energy Group Shining

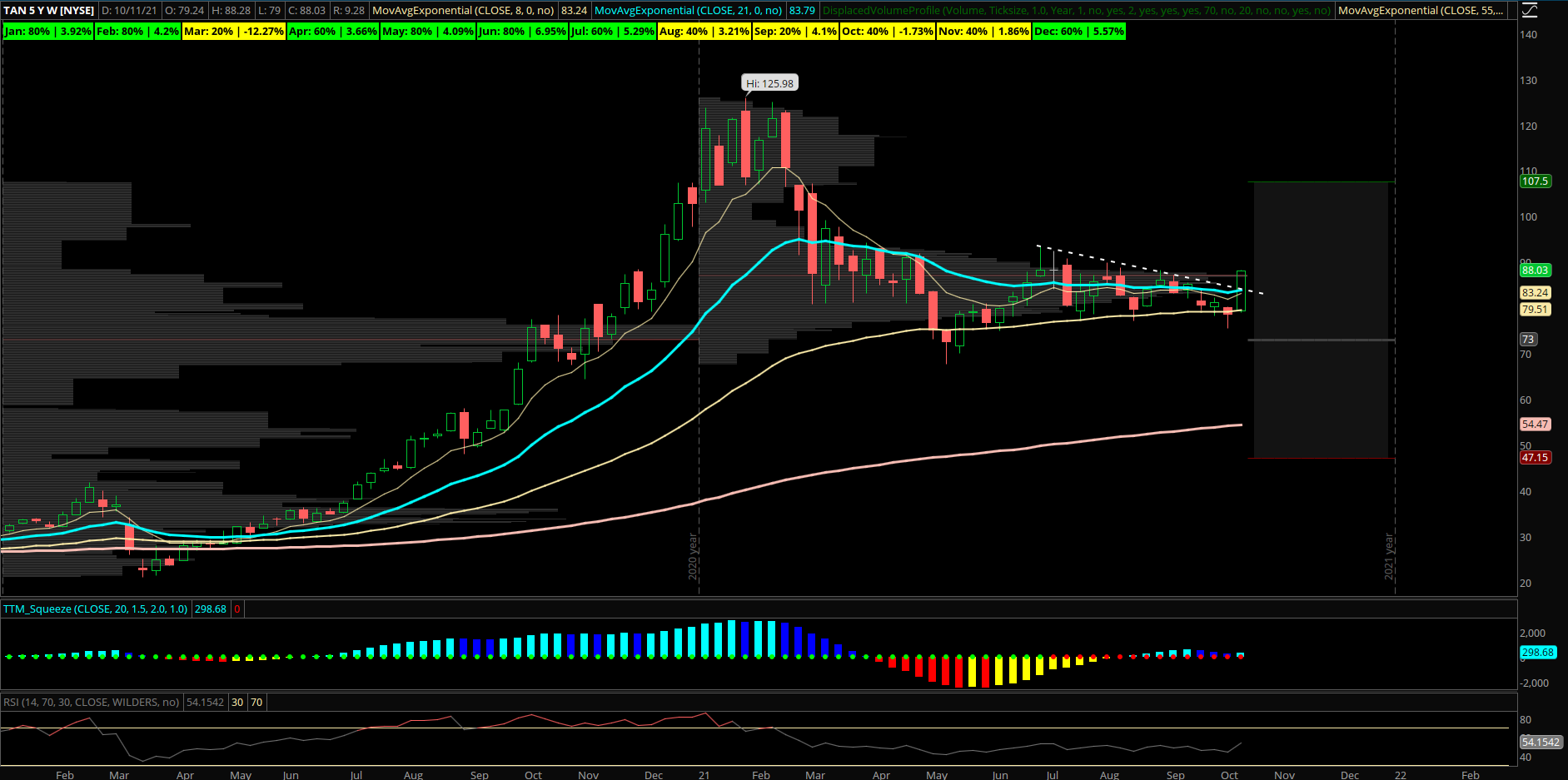

Solar (TAN) The Solar ETF has shown solid relative strength since the start of October and is up about 10% thus far. A bit extended short term so could pull back to its rising 8/21 EMA after they have seen a bullish cross up now. However, looking at the longer term weekly chart there is a lot of potential to regain higher after Solar took most of the year to correct its massive 2020 gains. About 30% off the highs from February and if TAN can get back over 92 there is a large volume pocket up to 110 longer term. This week’s candle is clearing a small downtrend since July and the recent consolidation based nicely at the 55 week EMA and value area from last year. RSI is back above the 50 level which indicates upside momentum bias. Seasonally the Solar group has tended to close the year strong with November and December higher. The latter month is showing an average return of +5.5% the last 5 years.

The ETF’s top 5 holdings are SEDG, ENPH, FSLR, RUN, DQ with the top two names SEDG and ENPH making up about 22% of the index. The best looking charts within the group include a few of the top names such as FSLR and SEDG but also a few more of the speculative names are breaking out including SPWR and NOVA. Looking to buy pullbacks in the Solar group as the weekly charts are starting to shift to more bullish patterns after a long healthy consolidation. FSLR is one name that has seen recent bullish options flow since the start of October including today on 10/13 a large buyer of Nov 5th $107 calls for more than $1.4M in premium. Also in mid-September an opening put sale of March 2022 ITM $120 puts for $1M. Confidence shares are higher by next Spring.