ETF Sector Relative Strength Corner: Constructing a Squeeze Higher

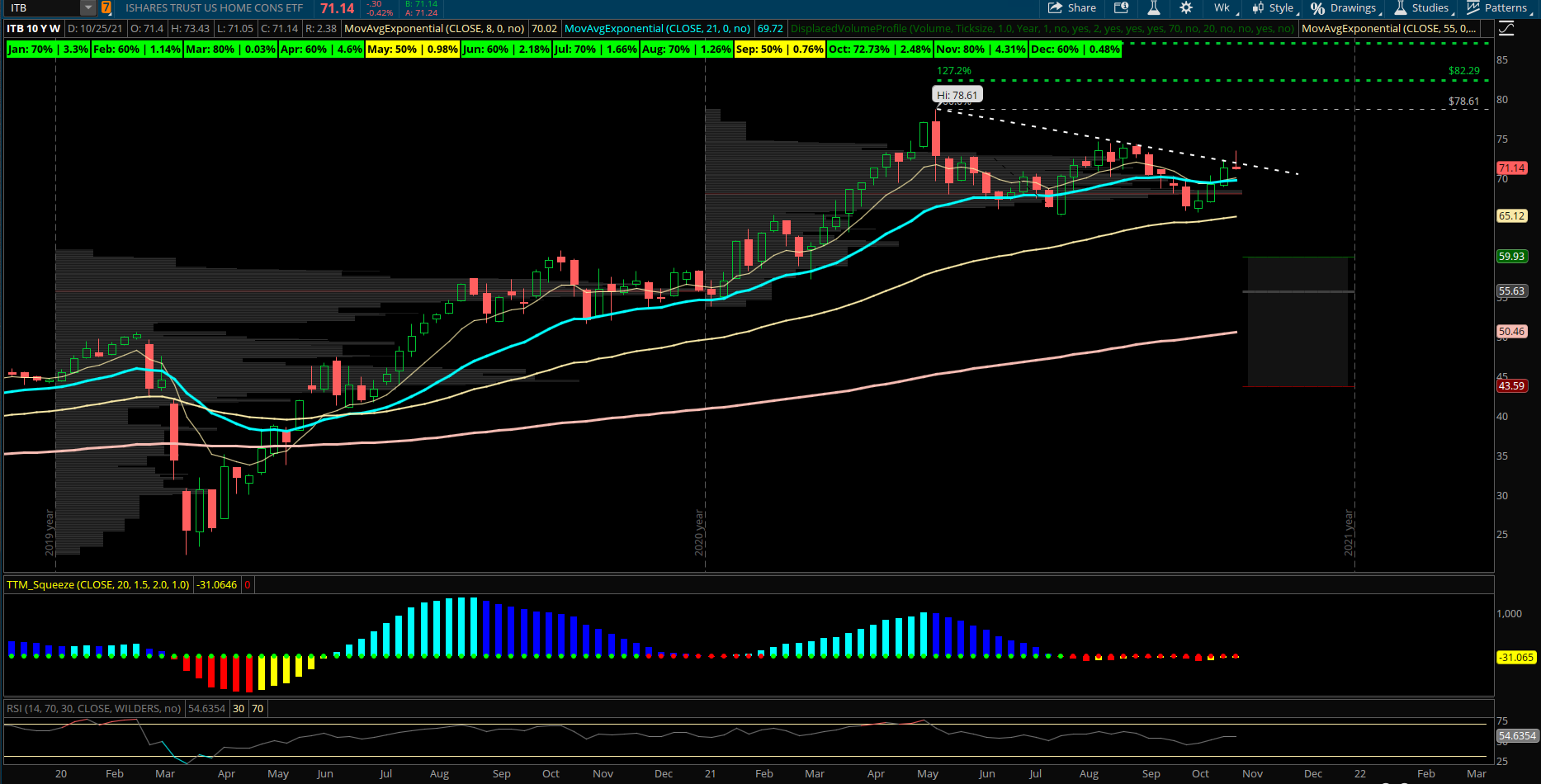

Home Construction (ITB) The Homebuilder and Construction sector has been forming a large weekly bull flag as it coils for a push to new highs. The group has shown solid relative strength this year still being up nearly 30% YTD and held its recent pullback to the 200 EMA in September. The highs from early May up at 78 are a logical level to see retested on a breakout and likely higher to the first fibonacci extension at 82 if it can gain momentum into year end out of this weekly pattern that consolidated the early 2021 gains. With the market a little stretched short term, ITB could also pull in to lower 21 EMA support near 70 but that level represents a lot of volume profile support and offers a good buy level. Weekly RSI is back above the 50 level which indicates upside momentum bias. Seasonally the Home Construction group has tended to close the year strong with November one of the strongest calendar months over the last 10 years. November has been positive 80% of years with an average return of +4.3%.

The ETF’s top holdings are DHI, LEN, NVR, PHM, LOW, HD with the top two names DHI and LEN making up about 26% of the index. The best looking charts in the space include SHW, HD, LOW, FND, TOL but also some less popular names that have yet to run to highs like TREX and TOL. Looking to buy pullbacks in the Homebuilder group as the weekly charts are starting to shift to more bullish patterns after a long healthy consolidation since spring time. It may take some additional time for upside momentum but for multi month moves that are setting up it often is best to build positions in anticipation of what’s to come. If we look forward 3-6 months, ITB is likely much higher with the sector in the middle of a big boom. DHI being the highest weighting in the ETF and has seen several recent bullish opening trades in longer term expirations including on 10/26 a buyer of Jan 2023 $87.5 calls for $1.3M. Also last month saw a large bullish risk reversal in May 2022 options, buying the 90 calls and selling the 80 puts over 1800x each.