ETF Sector Relative Strength Corner: Online Security Group Setup to Continue Uptrend

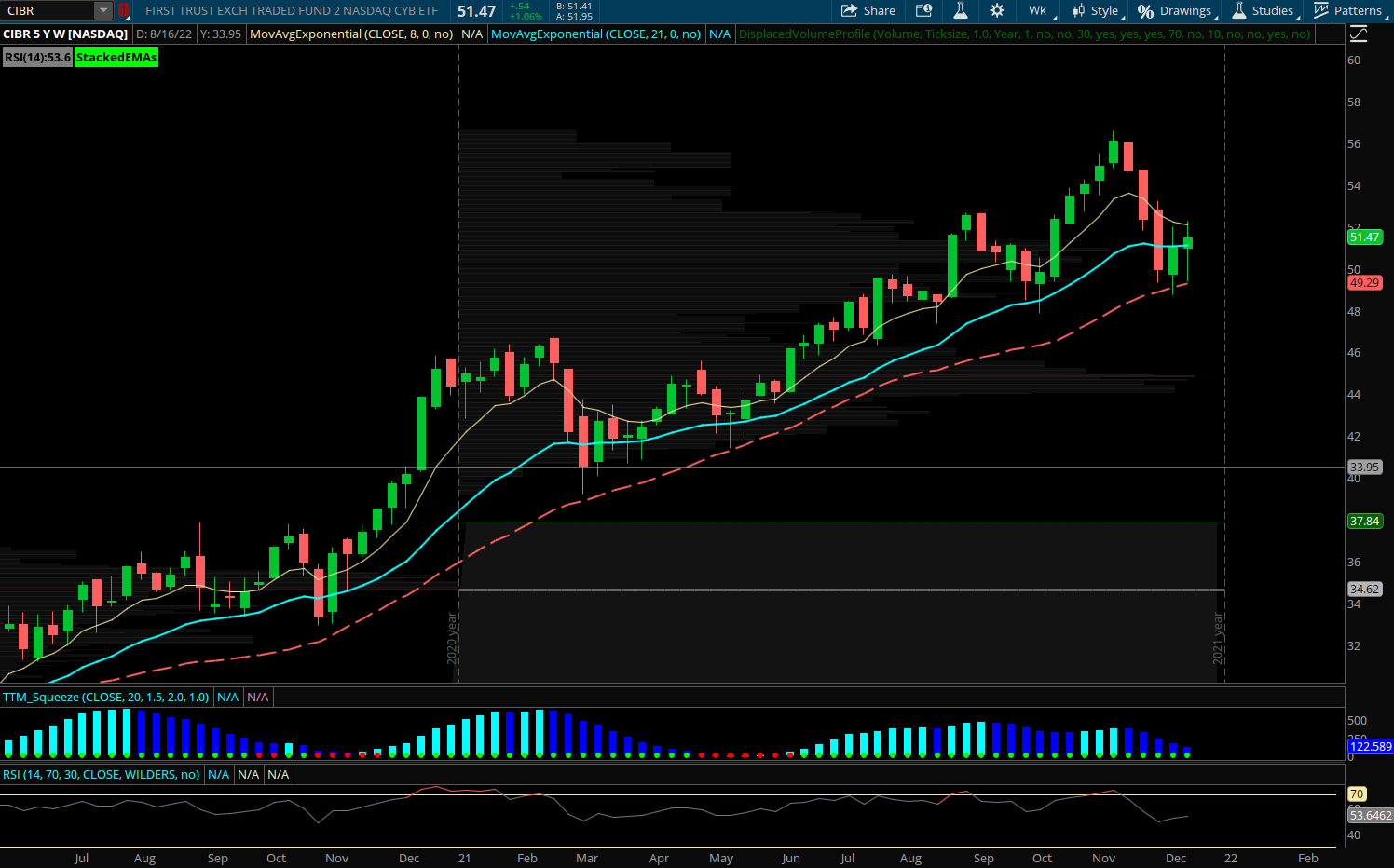

First Trust NASDAQ Cyber Security (CIBR) – The CIBR ETF is a relatively new offering the last 6 years as cyber security has become a big part of the internet sector with newer growth companies like NET, FTNT, and CRWD building a presence in the space along with old school names CSCO and JNPR. The ETF saw a rare large call option buyer last week as the January $51 calls were bought 2800x for $2.37, about a $691k purchase. Somewhat shorter term bet into January looking for a continuation higher in the sector. CIBR has shown a strong trend move off the weekly chart most of 2021 and recently had a pullback to the 34 week moving average which it found buyers at supporting prices similar to back in the spring time when it held that level. Stacked EMA’s are present on the weekly and the ETF is forming a nice volume node between 48-52 while a move above that can see new highs as the trend is intact.Weekly RSI has come back to 50 and reset with the pullback. CIBR is up about +16% YTD after being up 26% at its November peak.

The ETF’s top holdings are ACN, PANW, CSCO, OKTA, CRWD, JNPR, TENB, FFIV, MIME, VRSN, NET, ZS with the first 3 names making up about 20% of the index. The strongest charts in the space within bullish uptrends and strong RSI readings include several of the top weightings like ACN, PANW, CSCO, JNPR, FFIV. Many of the more volatile cyber stocks were large winners during the first 9 months of 2021 and have come back down to earth and near their 200 day MA support. The ETF offers several diversified names in the sector which gives exposure in a less volatile way than just investing in one stock alone as some names tend to have higher beta’s compared to the overall market. CIBR has just been around 6 years but has shown strength in January seasonally being up 4 of 6 years with an average gain of +2.3%.