ETF Sector Relative Strength Corner: Pockets of Tech Strength

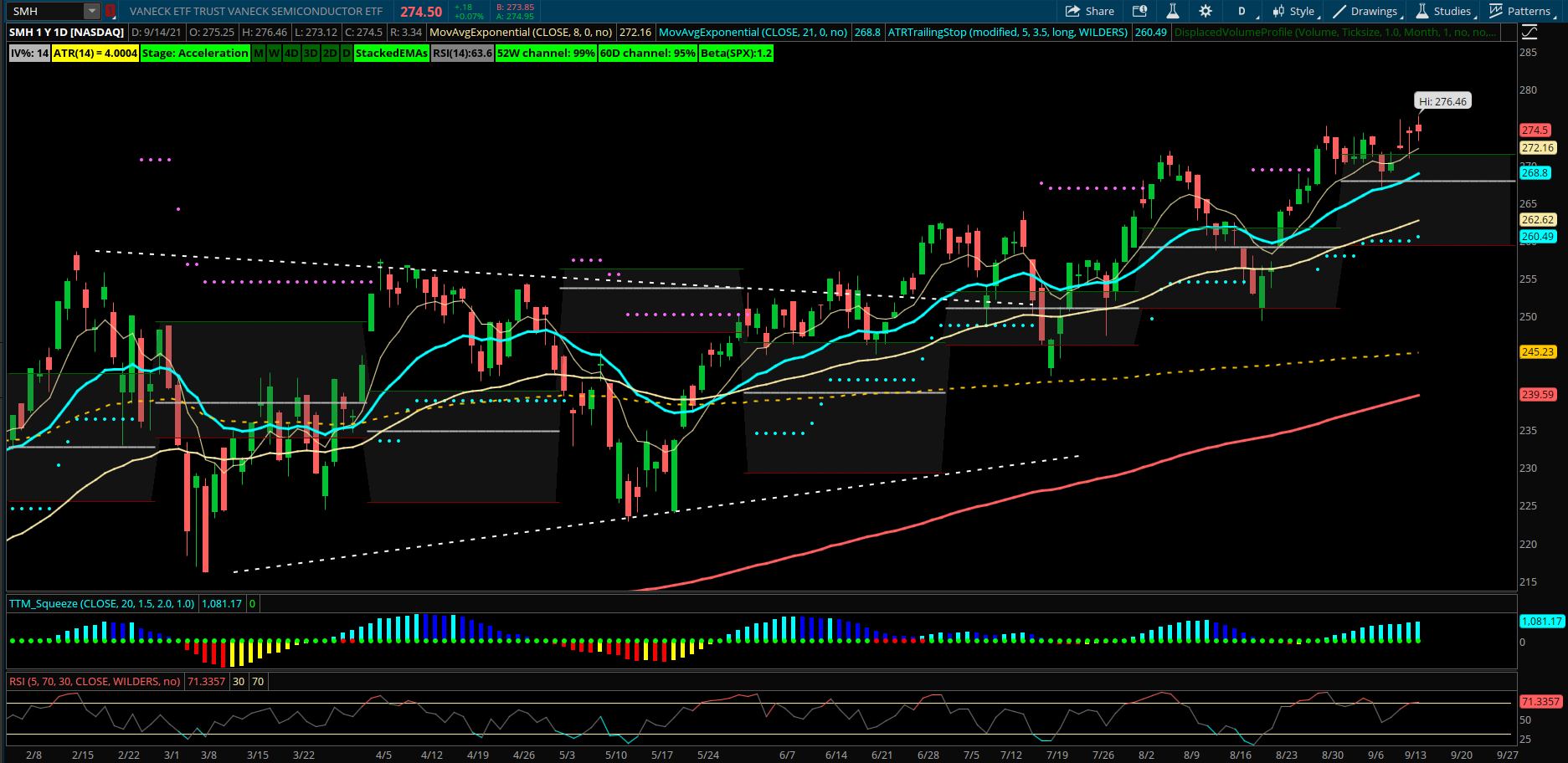

Semiconductors (SMH) have been showing relative strength as most other larger cap tech stocks pull back into September expiration week. Tuesday the group actually made a new 52 week high. Very impressive action with the trend persisting higher. The 21 day EMA and monthly VPOC were supportive on the most recent dip last week and should continue. If the market rebounds off the current pullback, Semi stocks should be able to lead higher in a stronger broad market. The top weightings in the group are TSM, NVDA, and ASML which are all at or near recent highs. NVDA being the most liquid stock in the group is forming a bull flag as it rests above its 21 EMA and formed an inside day today with potential for a breakout higher. NVDA also saw a buyer of June 275 calls and Dec 245 calls on Tuesday for a total of more than $3M bought. Other key stocks in the sector showing bullish patterns include AMD, INTC, ADI, TXN, AVGO.