Insider Trades: Pool Corp (POOL)

Pool Corp (POOL) with a rare insider buy recently from President/CEO Peter Arvan of 500 shares at $316.03. This is just the second open market buy in the name in the last four years. POOL is a high-quality name that is down around 10% for the year but up over 100% in the last twelve months. Shares are forming a broader weekly bull wedge under $350 with a breakout targeting a run back at recent highs and then $430. Options flow is typically pretty quiet in the name but did see a buyer of 350 July $370 calls for $14.50 back on 2-25. The $13.4B company trades 32X earnings, 3.4X sales, and 47X FCF with a small yield. POOL is guiding to 35% revenue growth in FY21 with accelerating EPS growth.

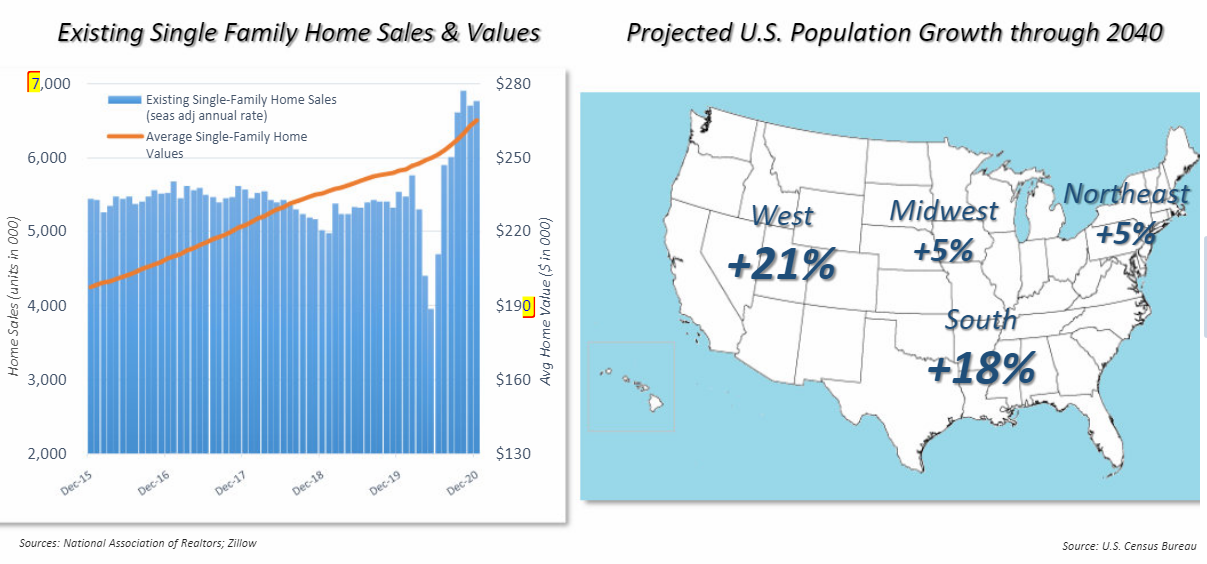

POOL is the largest wholesale distributor of pool and related backyard products throughout the world with sales centers in Europe, the US, and Australia. Their primary revenue driver is North American pool (86%). They have 200,000 brands and private label products which gives them margin leverage. They benefit from some positive industry dynamics including high recurring revenue from a big base of installed pools, a highly fragmented market, and recently trends towards outdoor living and investing in home luxuries. The pool channel is primarily maintenance and replacement/refurb with just 18% of all sales from new construction. For POOL, this drives a significant percentage of sales towards non-discretionary sales like minor repair. Longer-term, POOL benefits from growth in single-family housing and significant population shifts which are favoring areas like the South and West where the climate is more favorable for pools.

Further, they note:

“2020 is now in the rearview mirror, but the operating environment and market conditions are largely unchanged. As we turn the page to 2021, builders report large backlogs in virtually every market. That should carry us through the first half of the year and perhaps beyond. Strong housing market, with the continuation of the de-urbanization and southern migration trends and the public’s desire to find safe outdoor spaces for family recreation and entertainment, are helping position 2021 as another strong year. The work-from-home trend is likely to continue expanding, which bodes well for investments around the home, particularly in the backyard.”

Analysts have an average target for shares of $300 with a Street High $400 from Jefferies. Short interest is 2.2%. Hedge fund ownership rose 5.3% in Q4.