Seasonal Stock Setup: Beaten Up Materials Ready to Recover

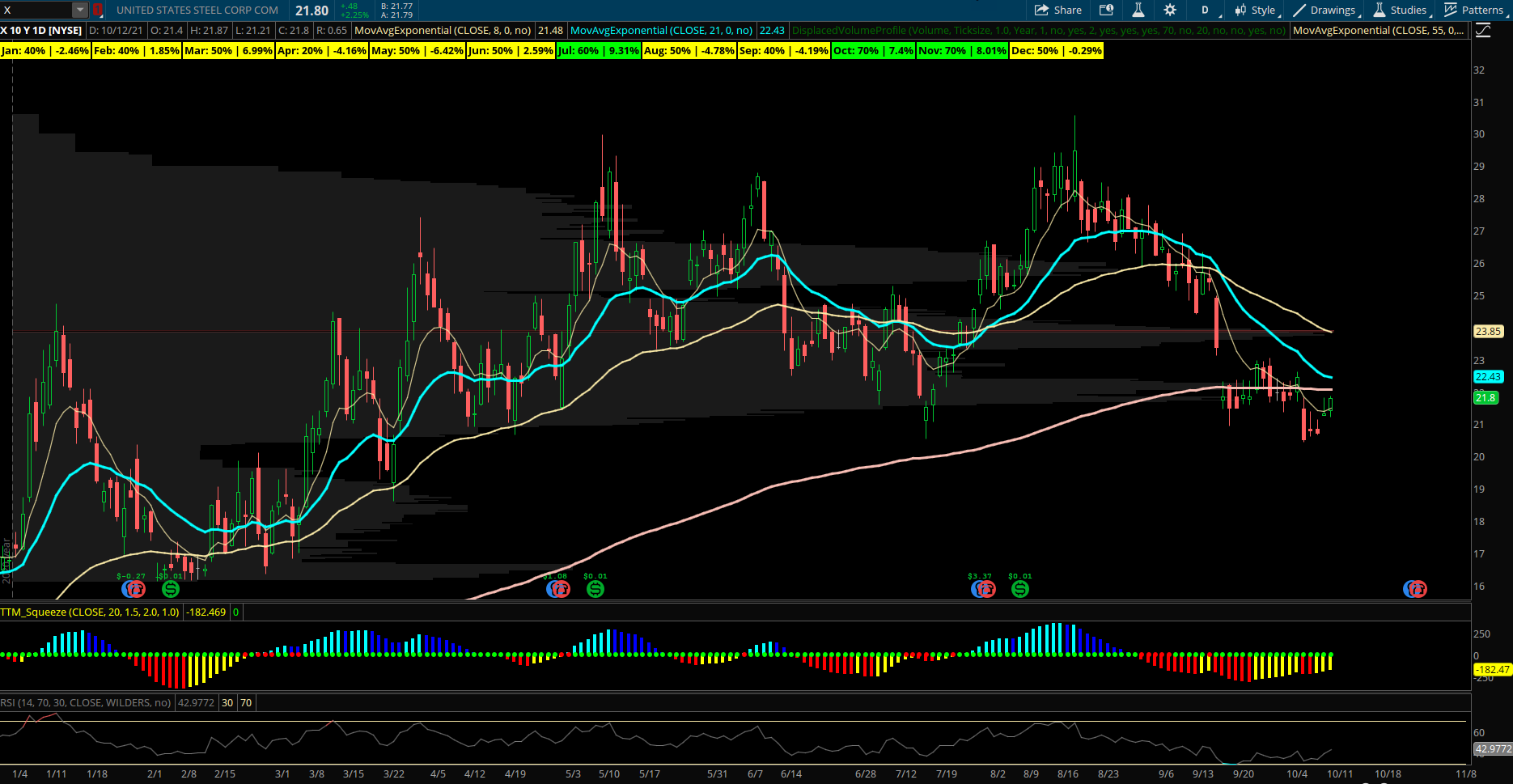

US Steel (X) – The steel stocks have been pulling back since late August and US Steel is now back at the lower edge of YTD value near the 200 day EMA. The low 20s should provide support into year end as the stock is starting to see large bullish options activity heading into a positive time of year for Steel and Materials names. X has some positive seasonality the last 10 years into the 4th quarter with Oct and Nov higher 70% of years. October has seen an average return of +7.4% and November even better at +8%. Overall the recent correction off the summertime highs near 30 offers a great risk/reward into year end in this beaten up sector that was largely due to China weakness and dollar strength. If that is to subside the rest of Q4 could see historical tendencies take over and allow X to trade back above its YTD VPOC near 24. RSI still below the 50 level but trying to break above the recent downtrend line before price clears the 21 EMA. The last few weeks X has seen massive amounts of bullish options flows including on 10/12 a buyer of June 2022 $18 calls bought for $1.2M in premium. Also several opening put sales since the start of October in various long term expirations such as April 14th $17 and $19 puts, and on 9/20 a June 2022 $18 put seller for $3M in premium showing confidence these levels hold.