Seasonal Stock Setup: Healthcare Leader Builds Bull Wedge into December

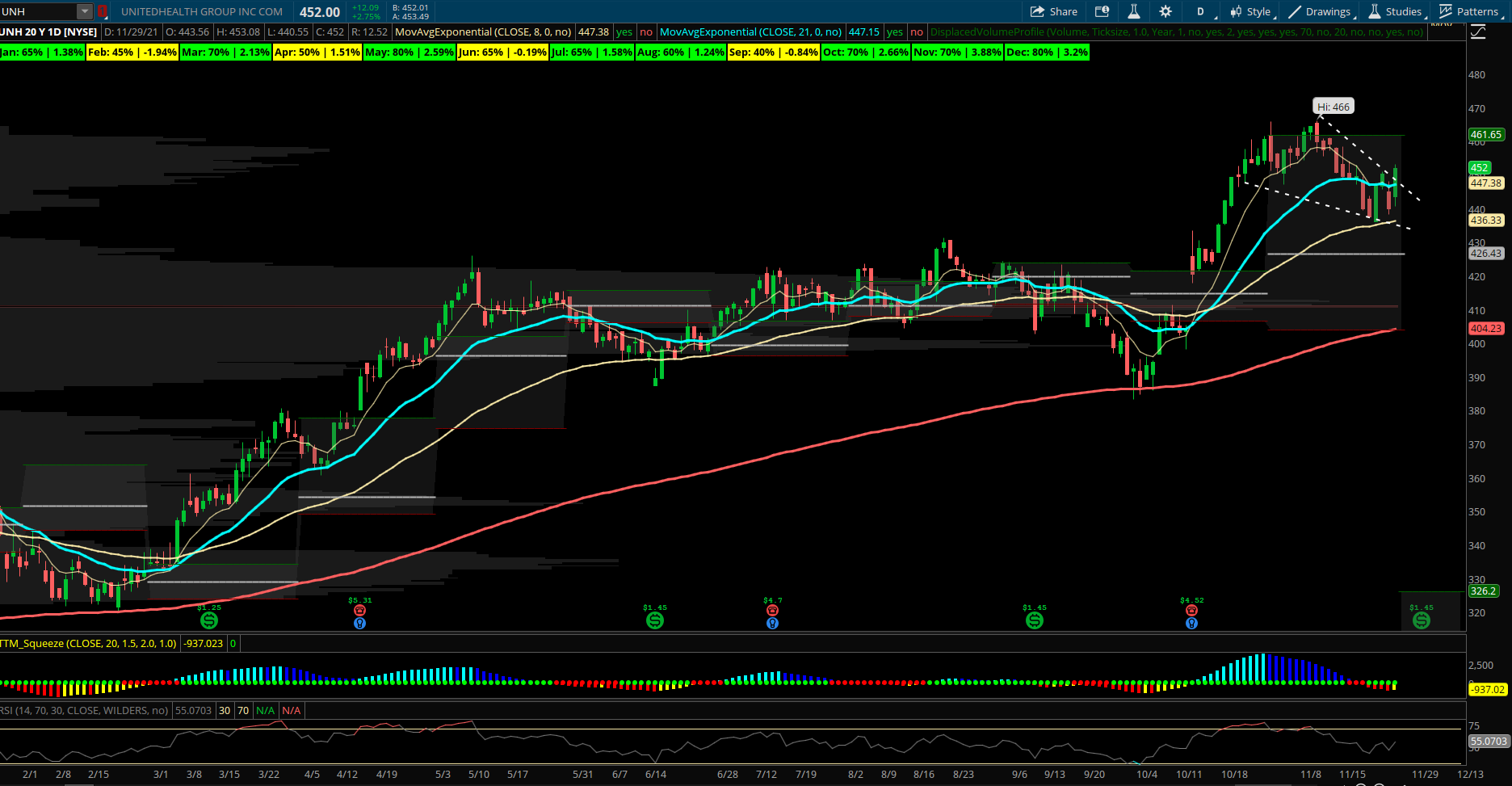

UnitedHealth (UNH) – UNH is part of the Healthcare sector that tends to offer defensiveness when the broad market turns sluggish. The XLV healthcare ETF has been up 14 of the last 20 years in December overall. UNH itself is up 16 of the last 20 Decembers for an average return of +3.2%. The stock is forming a bull wedge on top of its 21 and 55 EMA’s while it consolidates recent October gains. RSI has reset back near 55 as it attempts to bounce off that 440 support near term. UNH breaking above 461 monthly value area resistance can target the first Fibonacci extension at 474 and then 485. Above that and the 500 round number magnet starts to come into play as the stock boasts a strong weekly trend chart continuing to show positive momentum. UNH is up 29% YTD already headed into a more positive seasonal calendar month of December and looks set up technically to follow the trend higher. UNH has seen more bull options flows overall with last week on 11/23 a buyer opening January 2023 $440 calls for $1.76M in premium. Also on 10/11, a large $17.5M buyer of deep ITM June 2022 $250 calls at $158.35 which remain in OI and are up 25% thus far.