Seasonal Stock Setup: Rails Riding Higher into the Holidays

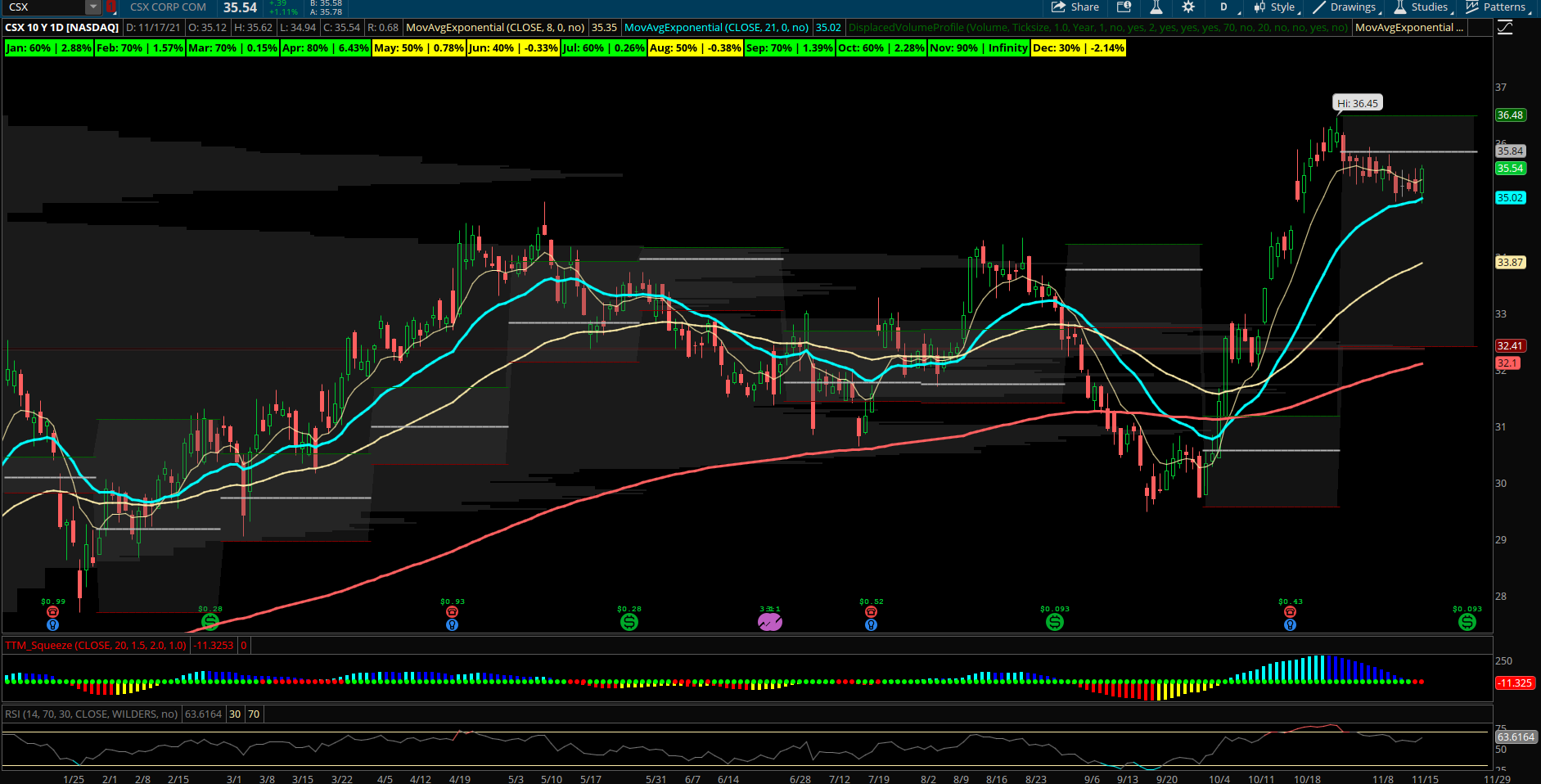

CSX Corp (CSX) – The transports have been rock solid since early in Q4 when they broke a downtrend and now overall continue to look strong into the second half of November. CSX is a railroad leader that has a bullish chart setup and positive seasonality in November the last 10 years. 8 of the last 10 years being higher this month for an average November return of +5.15%. That’s the 2nd strongest return for any calendar month, only behind April in the last 10 years of history. The stock has spent the first half of the month consolidating the October rally and tested the 21 EMA today with a bullish engulfing candle closing strong. CSX back over 36 can likely target 39-40 which is an extension from the monthly value area. A lower beta transport stock, CSX should be able to hold up even if the overall market sees a pullback into the next several weeks. As the Transportation index continues chugging higher, CSX should see new highs in due time as well. The stock has seen bullish flows the past month including December put sales at the 34 and 35 strikes and also on 11/9 a November 26th $36 call buyer for $731k.