Seasonal Stock Setup: Streaming Leader Back at Ideal Entry Into Strong Seasonal Period

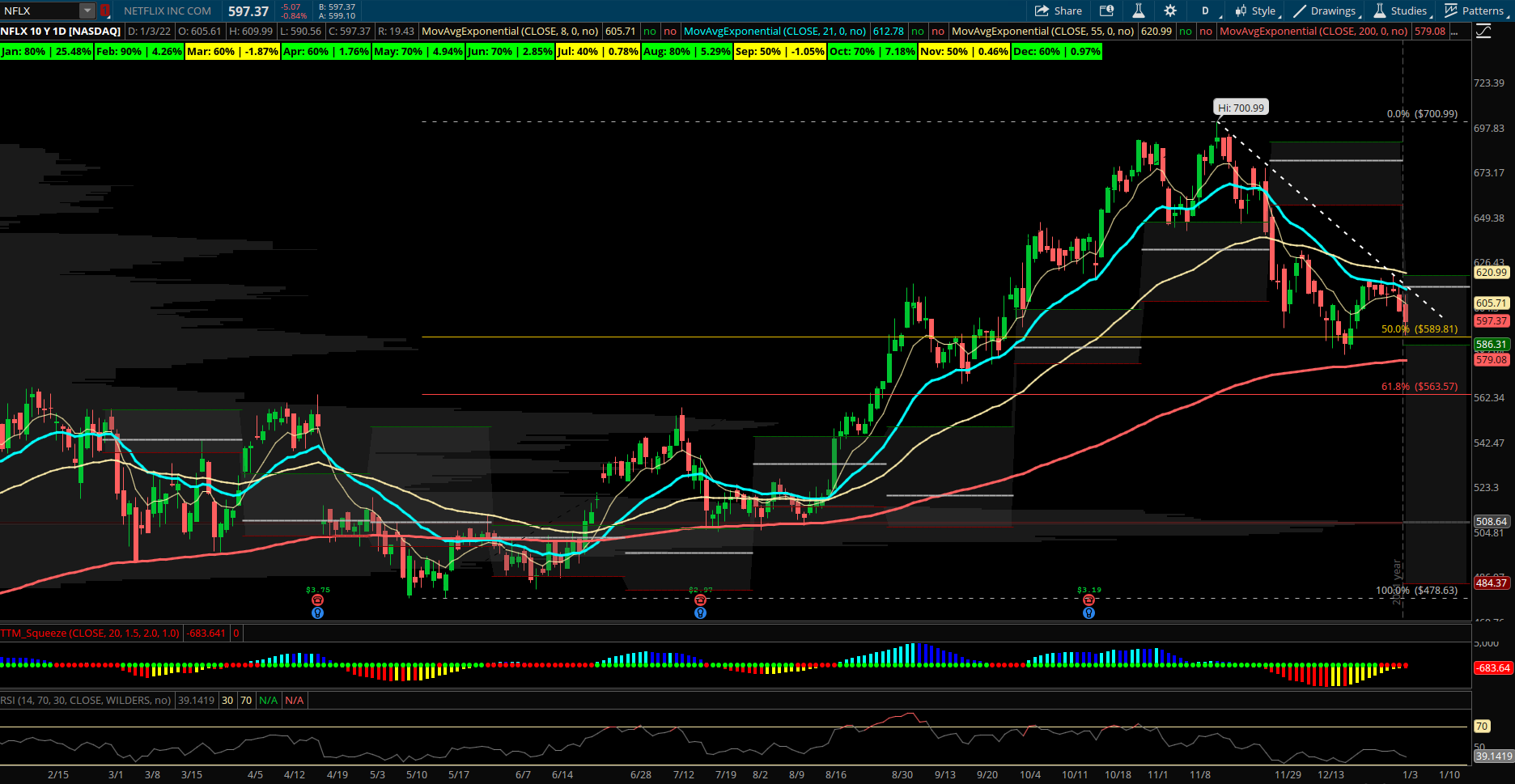

Netflix (NFLX) – Netflix has pulled back since its mid November high at 700 to retrace into the 50% fibonacci support from its 2021 low to high range. This level around 600 lines up with the 200 EMA and top of yearly value area as a small inverted bottom pattern shapes up. January is also historically the strongest calendar month for NFLX going back 10 years with 8 of the last 10 January’s higher for an average gain of +25.5%. Partly skewed by a few monster January earnings beats in 2013 and 2018 but impressively the stock has had at least 5 other Januarys in the last 10 years with gains of at least 10%. It seems this is the month to be long NFLX shares. As the seasonal chart below also shows February has had strength higher in 9 of 10 years for an average gain of +4.3%. NFLX has several big series hits being released soon with Ozark set to stream in late January, as well as Stranger Things scheduled for later this year. The stock overall had a moderate gain in 2021 of about +11% after being up as high as +29% in November. On the upside there is a potential breakout above 620 if it can clear its 21 EMA short term. Above that and momentum can see 675 monthly VPOC as a target. Options flows have started to see a few bullish trades as of late with opening put sellers active last week for the March $715 deep ITM puts sold to open at $106.75 for $1.6M in premium. Also the February $515 puts sold to open for $615k and on 12/15 a buyer of the January $580 calls at $40.14 for over $4.5M.