Sector ETF Relative Strength Corner: A Trade Set-Up in the Communications Group

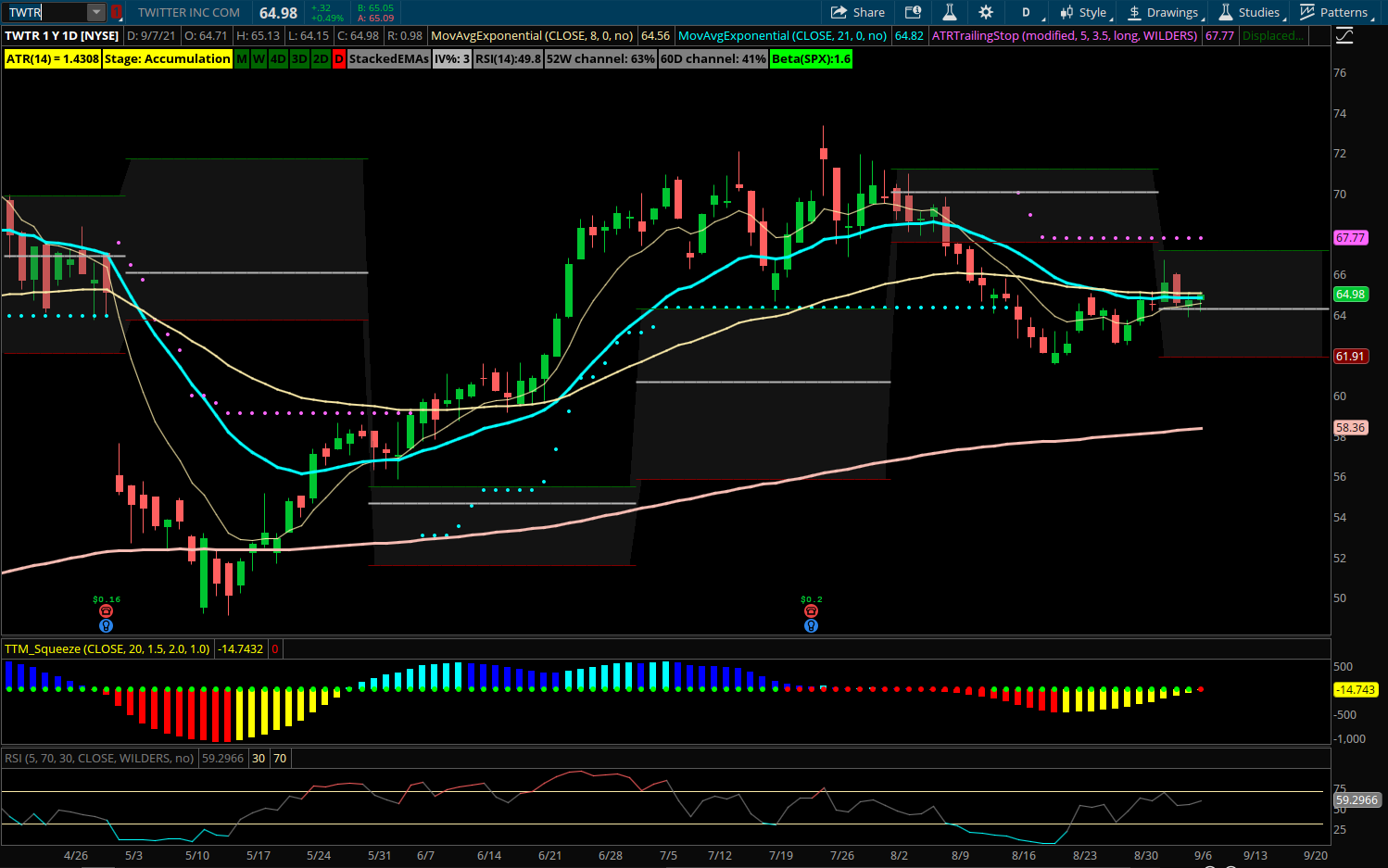

Communications (XLC) has shown relative strength as a sector to start September after a recent TTM squeeze consolidation resulted in a breakout to highs. Some of the leaders like FB, GOOGL, and NFLX have run to new highs already but you can often drill down into a strong sector to find the next potential mover. TWTR is trying to curl back up over the 8/21/55 cluster of EMA’s as it finds support around this 63-65 zone. Recent buyers in the Nov 67.5 calls with over 10k sitting in Open Interest. A move back to 70 could be setting up for TWTR with the Communications sector continuing relative strength.

Trade to Consider: TWTR November 67.50 calls at 3.95 or better