Sector ETF Relative Strength Corner: Bull Put Spreads in Payment Processor

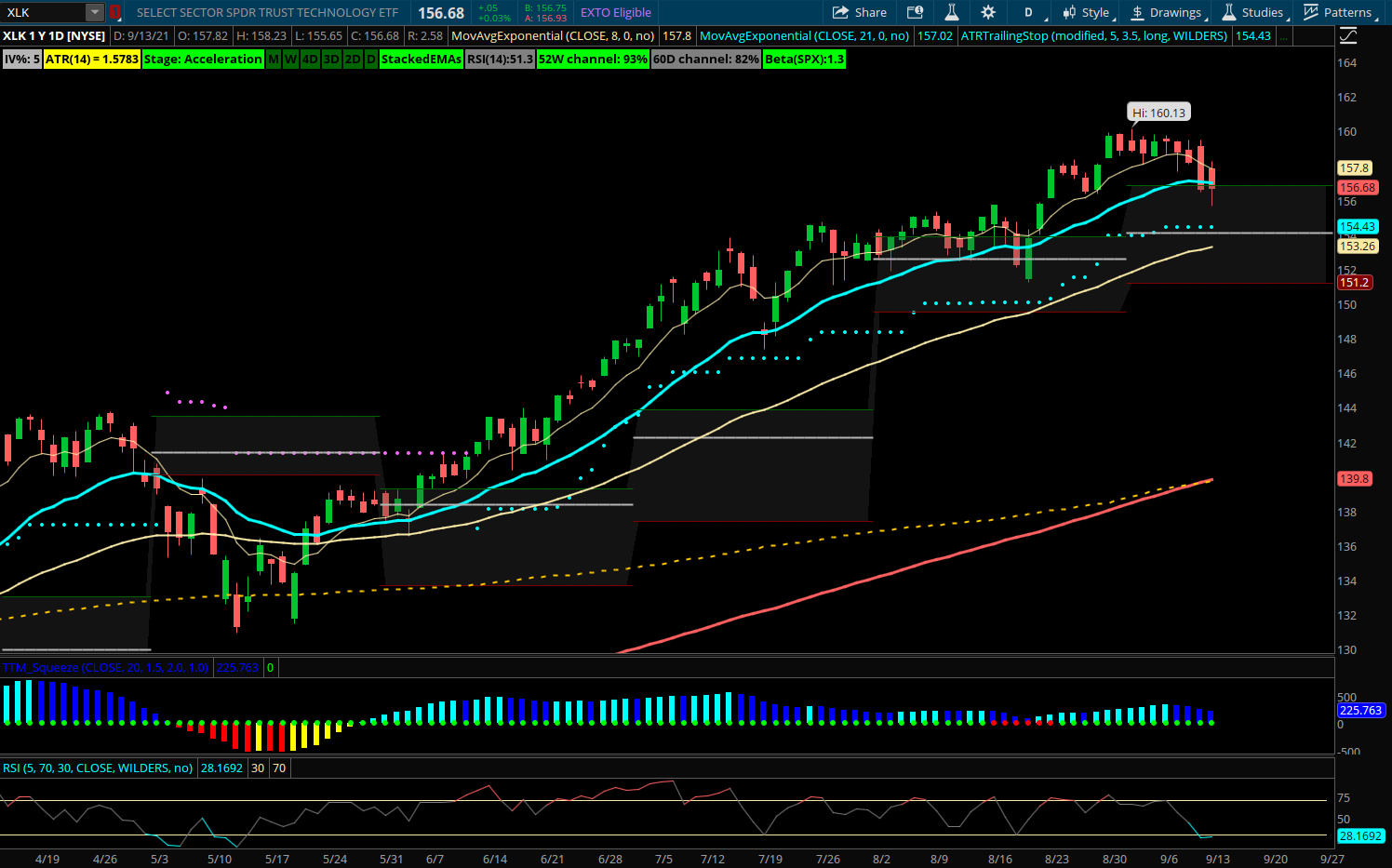

Technology (XLK) has been pulling back to the 21 day EMA and top of monthly value. So far just a normal dip within the uptrend that remains intact. The 55 EMA comes in just above 153 and is likely supportive as it rises up to the monthly VPOC. The XLK overall is heavily weighted to AAPL and MSFT which have had large runs this summer. However a few of the top weightings also include lower beta stocks like V and MA. These two credit card names are at or near their 200 day EMA after pulling back since early August.

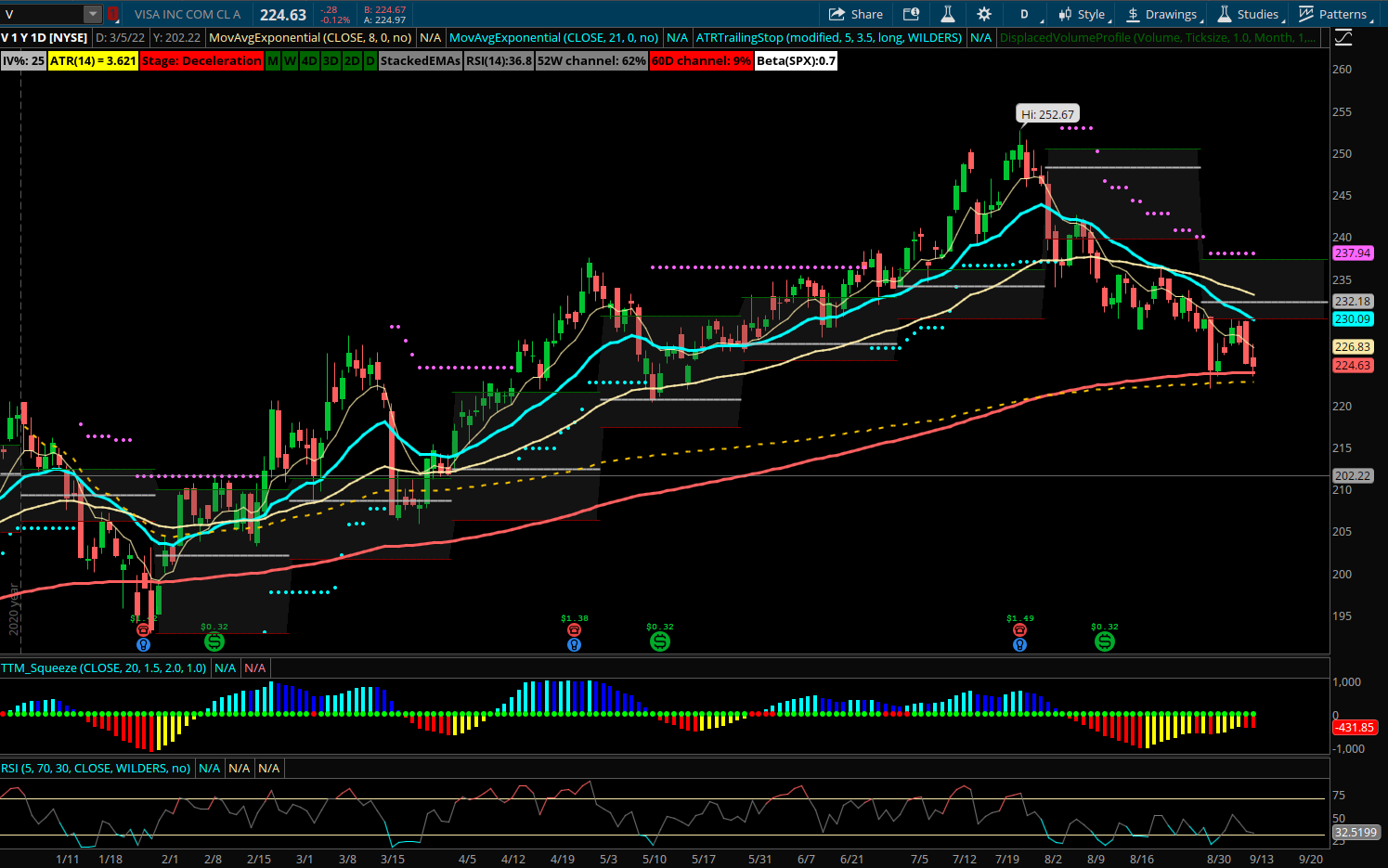

Visa (V) looks best of the two and is set up for a solid risk reward using a bull put spread in October expiration which is just before earnings are released. A move back up towards 235 likely can make 50% at least on this bull put spread and even if it churns around this 200 day EMA and YTD VWAP level of 225 the spread can still turn a profit. Visa has seen bullish options flows into the decline recently including a large buyer Monday 9/13 in the March 225 calls for over $2M.

Trade to Consider: Sell the V October 225/215 bull put spread at 3.10 or better.