Option Expiration Dates and Strike Prices

Option Expirations

All options have an expiration date and that is partly how their values are derived. The time value till expiration is a large part of the equation and if you choose the wrong expiration for your trade horizon it can negatively impact your profit potential. Monthly options expiration is always the third Friday of every month and used to be the only expiration date of the month until weekly options came along. Now most actively traded liquid stocks have options expirations on a weekly basis, and some index options have 3 expirations per week plus quarterly expirations. There are a lot of choices these days with liquidity increasing every year based on the popularity of options markets.

Selecting Expirations

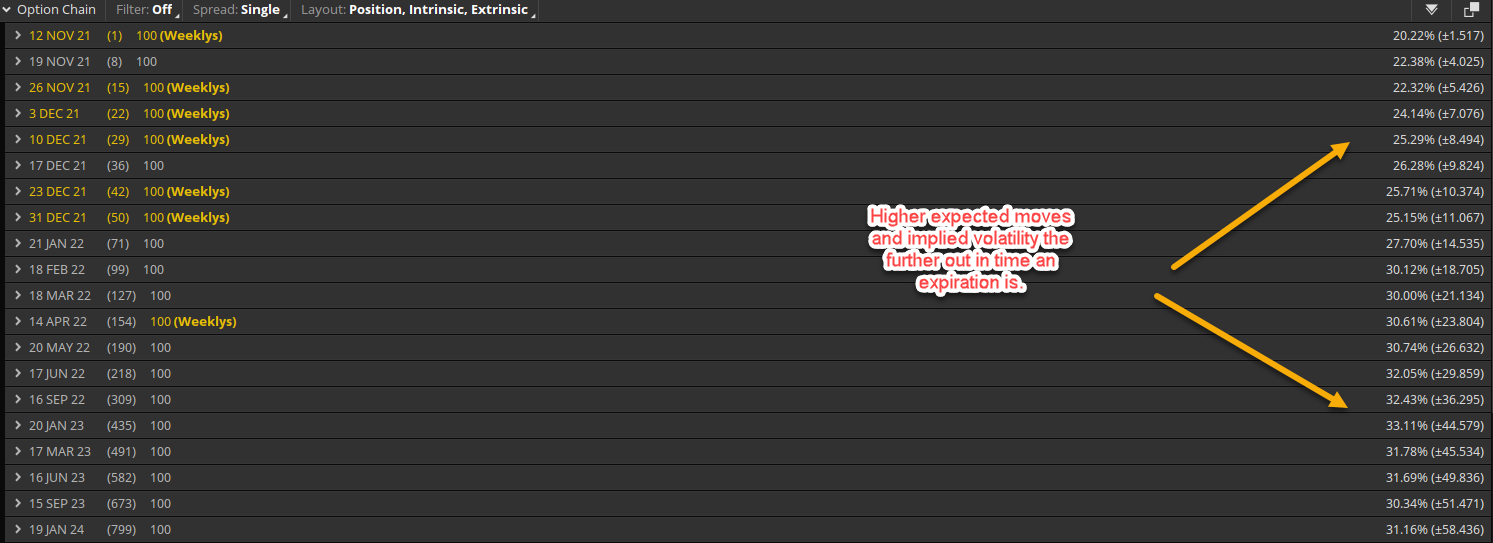

What expiration you trade is largely dependent on what your trade objective or assumption might be about the underlying stock or overall market. A simple rule of thumb I’ve always used is if I expect a move to happen in the next month and I’m buying options, I would prefer to trade the expiration cycle one further month out to allow for more duration and my idea to have enough time to play out. This is to say I would rather trade options expiring in 60 days versus 30 days if I plan to be in a swing trade for a month. There are generally expiration dates going out over 2 years in time but these will have lower interest and liquidity especially for retail traders. Usually in a normal market implied volatility will be priced higher the further out in time an expiration is because in theory, the further in the future presents more risks. As the screenshot below shows the AAPL options chain shows higher IV and larger expected moves priced into the options.

Options contracts are a lot like insurance contracts and it’s often best to pay for a little more time in order to be protected when buying insurance. So when you trade options, the comparison is very similar. Zeroing in on a certain expiration date to trade can depend on coming catalysts also where I might not want to pay for several months of time if I see or anticipate a move transpiring in less than a few weeks. Or if earnings are due out in a stock in the near term maybe I want to construct an options strategy around that expiration week. You can trade a calendar spread based on two different expirations, buying a further out dated option and selling the near dated option. There are plenty of reasons to use one expiration date over another but it all comes down to what your trade assumption or bias is.

Often when selling options, whether naked or a spread, it’s wise to avoid the short dated options expiring in less than a week or two because you are exposed to much more gamma risk. This just means that the delta of the option will move much faster for every point the stock moves, compared to that of an option expiring in 60 days for example. Selling a credit spread that expires in a week is pretty enticing because you can make money faster based on rapid theta decay but this is often a trade off not worth it because you are really playing the direction of the stock more than you imagine. If you compare the greeks and overall risk to selling a spread with 30 days of life versus just 7 days then you notice you have much more margin for error focusing on the option with one month of time value left. Your delta and gamma exposure is less and you have more wiggle room to wait for the move to unfold. If you are more of a scalper or short term swing trader, you are generally better off being long some of these short dated weekly options expiring in less than a few weeks. The long gamma component and cheaper implied volatility make short dated options more underpriced. Without getting too deep into a discussion on the greeks, you want to make sure you are avoiding taking unnecessary risks and when you sell options you want to try to collect as much credit as you can in an expiration cycle that avoids a catalyst which may keep premiums higher until that catalyst passes, for example an earnings report.

Strike Prices

Strike price selection is also a huge part of understanding options trading. Depending on the stock price, liquidity, and demand for options some stocks might have strike prices every dollar or every 5 to 10 dollars. What strike price you select comes down to how close to the money that strike is and what your goals are. Assuming you are trading a liquid stock there is likely tight bid ask spreads and plenty of open interest which is preferred. Each strike price has an associated delta and that equals how many shares of stock equivalent exposure you have if long or short that option. If I buy a 50 delta at the money strike price call option I am then long 50 deltas, or shares. The more in-the-money your strike price is the less extrinsic value you are paying to participate in a stock move. Avoiding paying too much time value and theta decay is a good rule of thumb if you are trading. Said in a different way, you can think of the strike price you select as the price level you choose to become long or short the stock you are trading. If I buy a $100 strike price call in an underlying stock, the higher the stock rallies above 100 the more long I become because the delta will increase.

The range of strike prices above or below the current stock price depends on what the options market is pricing into the stock, or how much the market expects it to move up or down before that expiration date. If AAPL stock is at 150 and has an expected move of 10 points in the next 30 days, the options market will price different strikes accordingly on a normal distribution curve above and below the current price. There might be strike prices up to 200 for example but there would be no reason to have strikes higher than that since it’s more than 5 times the expected move for that expiration. Using the implied move in your trading assumptions is a great way to get a realistic outlook for a stock in a given timeframe.

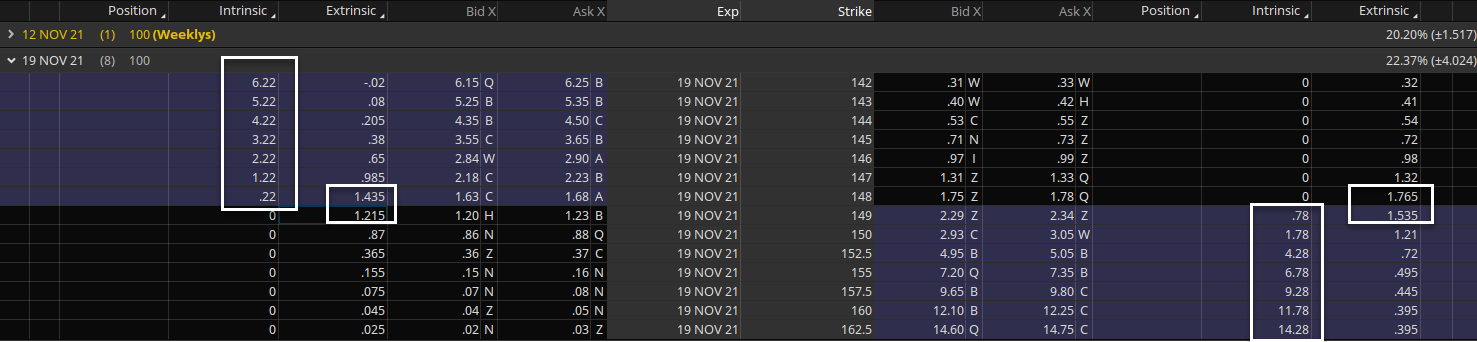

At-the-money options or strike prices near the current stock price have the highest extrinsic value because they have very little or no intrinsic value. Understanding the amount of intrinsic vs. extrinsic value an option has is a good way to see what your option would be worth if the stock stayed at current price levels into its expiration date. As the screenshot below shows the options chain of AAPL has higher extrinsic values for at-the-money options and the highest intrinsic values are the more in-the-money strike prices. This is because if an option expired today and the strike price was in-the-money then it is intrinsically worth something.

Alot goes into the pricing of options whether is implied volatility, the skew of that volatility, and the time till expiration but selecting the right strike price has a lot to do with where you see the underlying stock going (or not going) before expiration. Depending on the strategy I want to trade will determine what strike prices I trade. If I am just buying a call option I likely would stick to near the money strikes but if I want to trade a vertical spread or calendar spread I would explore going out-of-the-money to take advantage of different strike prices and their corresponding implied volatilities and risk/reward.

Takeaways:

- Options allow for selecting different expiration dates depending on our opinions on the underlying stock.

- Similar to insurance contracts, options can have short dated or longer dated expirations and that time value determines their premiums.

- Strike prices vary by stock and have numerous strikes above and below the current stock price which is determined by the expected move for that expiration cycle implied by the market.