The Art of Nailing Market Bottoms

On Monday 1/24 when markets started the week in panic I sat there cool as a cucumber seeing exactly the kinds of signals I wanted to in order to put some cash to work and get back long markets that triggered a bear signal back on 1/4. The rest of the week was choppy and Friday morning I noted that the VIX was only at 32 compared to 38 earlier in the week which provided another strong clue as we rallied sharply the rest of the session and QQQ 338 level once again held as it needed to along with SPY maintaining above the key 421 level. All week since Monday we kept seeing big high TICK prints off the 4300 level in S&P futures, someone with a lot of firepower was defending that level and DIX prints were insanely strong all week as well. The 2021 theme was Retail money came back into the markets at a record pace and what we saw to start 2022 may have been that retail money dumping stock back into the hands of the willing hedge fund buyers.

The formula is one that repeats itself repeatedly but is hard for many to actually capitalize on because emotions play a big role when money is on the line. I outline all the key indicators and the levels we look for extensively in our annual market outlook which is a great resource. The hardest part is not being early and waiting for a combination of all the ingredients needed for a market bottom to materialize and exercise patience until that occurs. There needs to be despair and “blood in the streets” for a true meaningful bottom to occur.

It is certainly feasible that this is not the bottom and just the start of a longer bear trend with lower lows but catching it ahead of these historic rebounds leaves no excuse for not coming away with a boatload of profits whether or not the bottom holds or fails from here. I am going to operate under the assumption this was a major bottom and the rest of the week was a bottoming process until proven otherwise. We have become too accustomed to those violent rally and never look back bottoms when historically bottoming has been a process, so this new environment and investment cycle may be shifting back to the old structure as well.

The ingredients to a market bottom are as follows:

Sentiment: VIX calls > 1M, VIX Backwardation, QQQ Puts Hit Record, NAAIM and AAII Extreme Lows – These were a few of the signals hit on Monday along with the sheer despair seen across by Financial Twitter (FinTwit) stream which is always a great contra indicator.

Breadth: NYMO Extreme Oversold, % of Stocks Above 50/200 MAs Extreme Lows – These signals all triggered near historic levels on Monday.

Technical: The key is having a plan pre-market and executing, ideally like in this situation find a level with a convergence of key supports which 421 for SPY was a 38.2% Fibonacci, major volume node and retest level, VWAP from the Election breakout and the potential new lower support of an 18 month rising channel pattern. The QQQ 338 level was similar as a retest of the June 2021 resistance that saw a major breakout run, a 50% retrace of the October 2020 lows to 2021 highs, and a major volume node. We were also hitting the typical 10-15% correction thresholds and I find it handy to always have an outline of market levels at %-correction based targets.

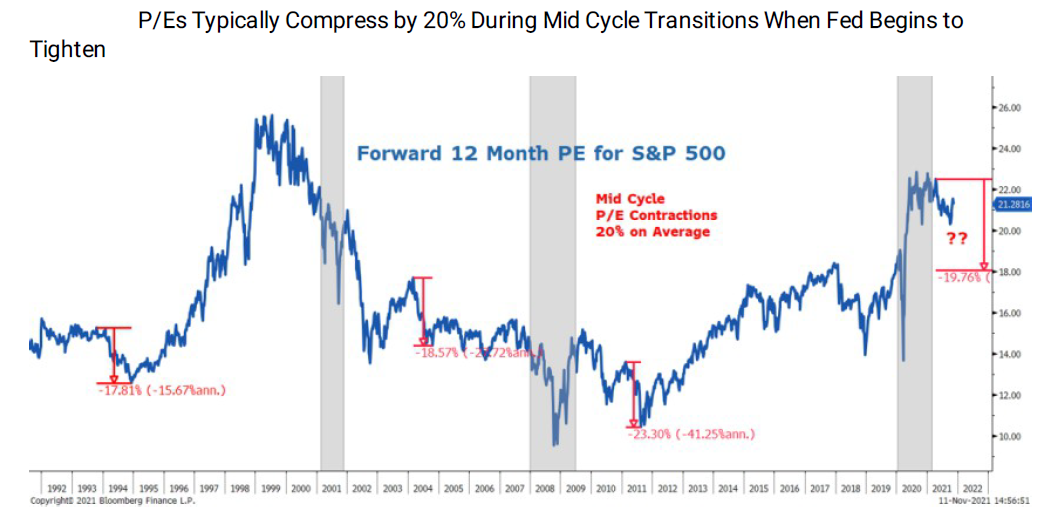

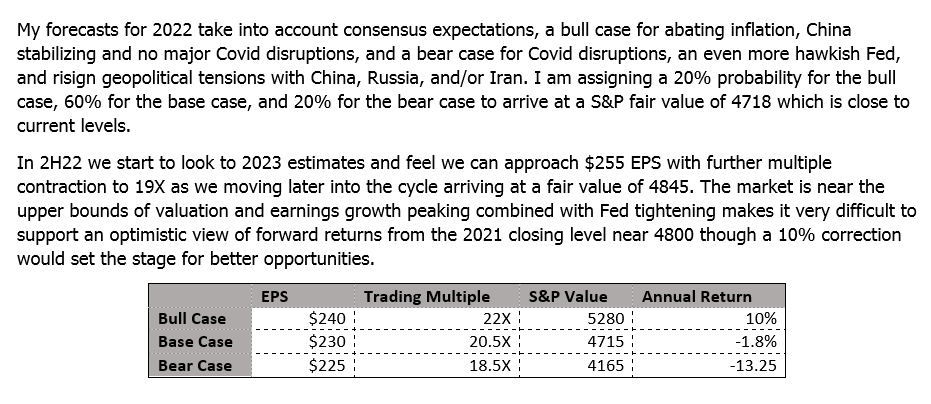

Fundamental: Coming into 2022 in our Annual Outlook report I outlined that where markets closed 2021 left virtually no rational room for upside considering the current valuation and the fact we were entering a multiple contraction phase. Interestingly the low in the S&P on 1/24 came right near our bear-case scenario for 2022 on valuation. Obviously this does not mean the market can not trade below some nobody like me’s bear scenario target, but it does give us a very strong positive reward/risk bias on valuation/fundamentals. When we are moving to the upside people throw out wild targets with no regard for valuation, and the same when we are moving lower as people were telling me we were headed below 3000 which would be insane from a valuation perspective. Below are some excerpts from our Annual Outlook 2022:

Why are we selling off?: Once again this was just a typical correction and not some kind of structural issue. There are a lot of reasons this is happening and none of them are really sustainable. The economy is humming along strongly, Omicron is peaking and burning out, inflation is peaking and set to roll over, and the market has quickly repriced growth stocks for the Fed’s new hawkish outlook. I do not see Ukraine/Russia being meaningful to the global economy and likely ends without any major financial impact to US companies.

During the downtrend: Hoard cash, pick your spots and carry very little overnight exposure. During 2022 I have taken 9 weekly trades in long call options and profitable on 8, the one fail was ROKU which if I held another few hours would have been a double, and a 100% win rate on put trades. There is no sense stepping in front of a liquidity price, technical levels are useless, you need real extremes to put in real bottoms so I tend to just pick spots and take quick profits with the main philosophy in a downtrend being the opposite of a bull trend, fade strong opens with puts and buy weak opens with calls for snapback rallies.

How to trade the bottom: There are a lot of fancy & smart ways to maximize returns but I keep it simple and during volatile markets tend to utilize QQQ/SPY and wait to return to stock-picking when things calm. This allows me to take larger positions knowing the value-at-risk is lower in these less volatile instruments, and in the case of 1/24 I took a position 10X larger than any I had previously taken due to everything lining up so perfectly. I am also going to start firing up my fundamental screeners looking for names of high quality that have come down to attractive valuation levels and received the “baby with the bathwater” treatment as history has shown many great stocks suffer massive drawdowns with the markets and present excellent opportunities to accumulate shares.

Confirmation of the bottom: NYSI/NASI > 8-MA, MA upward slopes (5,8), crosses w/ , (13, 21), VIX back under 25 (and preferably 20)

Historically, the S&P 500 fell by an average of 15% peak-to-trough during the 21 non-recession corrections since 1950, which in the current market would place S&P 500 at 4100. But market corrections are typically good buying opportunities if the economy is not entering into recession. Buying the S&P 500 10% below its high, regardless of whether that was the trough, would have generated a median return of +15% during the next 12 months, or 4975 today.

The adage is cited often but none is more true, be fearful when others are greedy and be greedy when others are fearful, from the GOAT. Bear markets create opportunities unlike any other and allow for much fatter pitches to take swings at as reward/risk profiles become much more favorably skewed. Options also become over-priced allowing for optimal longer-dated put selling strategies in quality names willing to own.

And for a laugh, told my wife I was going to write this article, her response “You certainly do know how to nail bottoms”

And if you have not yet purchased our 2022 Annual Outlook, it is more useful than ever to identify the best-in-class names to be buying as well as a resource for being prepared for these corrections in the future. Check it out here

Enjoy the weekend!