Trading Diagonal Spreads

What is a Diagonal Spread?

If you read the recent post on Calendar Spreads, you will understand how Diagonal Spreads work fairly easily as they are simply a cousin or variation of the calendar. A Diagonal Spread is created by buying a call or put option further out in time, and selling a more near term call or put on a further out-of-the-money (OTM) strike to reduce the cost basis of the total spread. The diagonal spread has just two legs, similar to the calendar spread, but it provides a more directional lean somewhat mirroring a long Vertical Debit Spread, but also combining the effects of positive theta and vega exposure in which a calendar spread provides. Generally looking for a 25-50% target profit is best on standard diagonal spreads.

There are several ways to construct a diagonal spread which makes it a great flexible strategy depending on your outlook. Some traders might prefer the shorter term 20/50 days to expiration spread or 30/60 days to expiration. Then you can also construct the spread using longer term expirations such as buying an option with 120 days of life, and selling the expiration with 60 days. The further you go out in time the less sensitive to price movement the diagonal spread will be. Further, the strikes used can be varied based on how directionally aggressive a trader wants to be. A standard approach to the diagonal is buying the slightly in-the-money (ITM) option strike, perhaps a 50-55 delta, and then selling a slightly out-of-the-money strike, perhaps 35-40 delta. If you want to get more directional, you can opt for something like buying the 40 delta option (further out expiration) and selling the 20 delta (nearer date expiration). With that structure you are essentially getting long 20 delta’s or shares (40 minus 20 equals 20) of the underlying stock.

Diagonals are also excellent ideas to implement on stocks around earnings reports as the difference in implied volatility will be considerable between different expiration months. Since diagonal spreads are often best put on during lower implied volatility environments you have to expect vega to be a factor. Often if a slower moving stock is setting up for a directional move, a diagonal spread will be a nice way to exploit the move as the IV should rise on a larger than expected move. Similarly with earning reports, even though the IV will almost always get crushed after a report is released, you can still construct a diagonal spread similar to the calendar spread where the contraction in front month IV is much greater than the contraction in back month IV. This disparity is a good way to play a directional move in the stock going into an earnings report.

Call Diagonal Strategy Characteristics

Directional Lean: Bullish to neutral price action

Best Market Environment: You expect bullish action but don’t expect price beyond short strike.

Ideal Setup: Sell an OTM call with 30 days to expiration, buy an ATM call with 60 days to expiration.

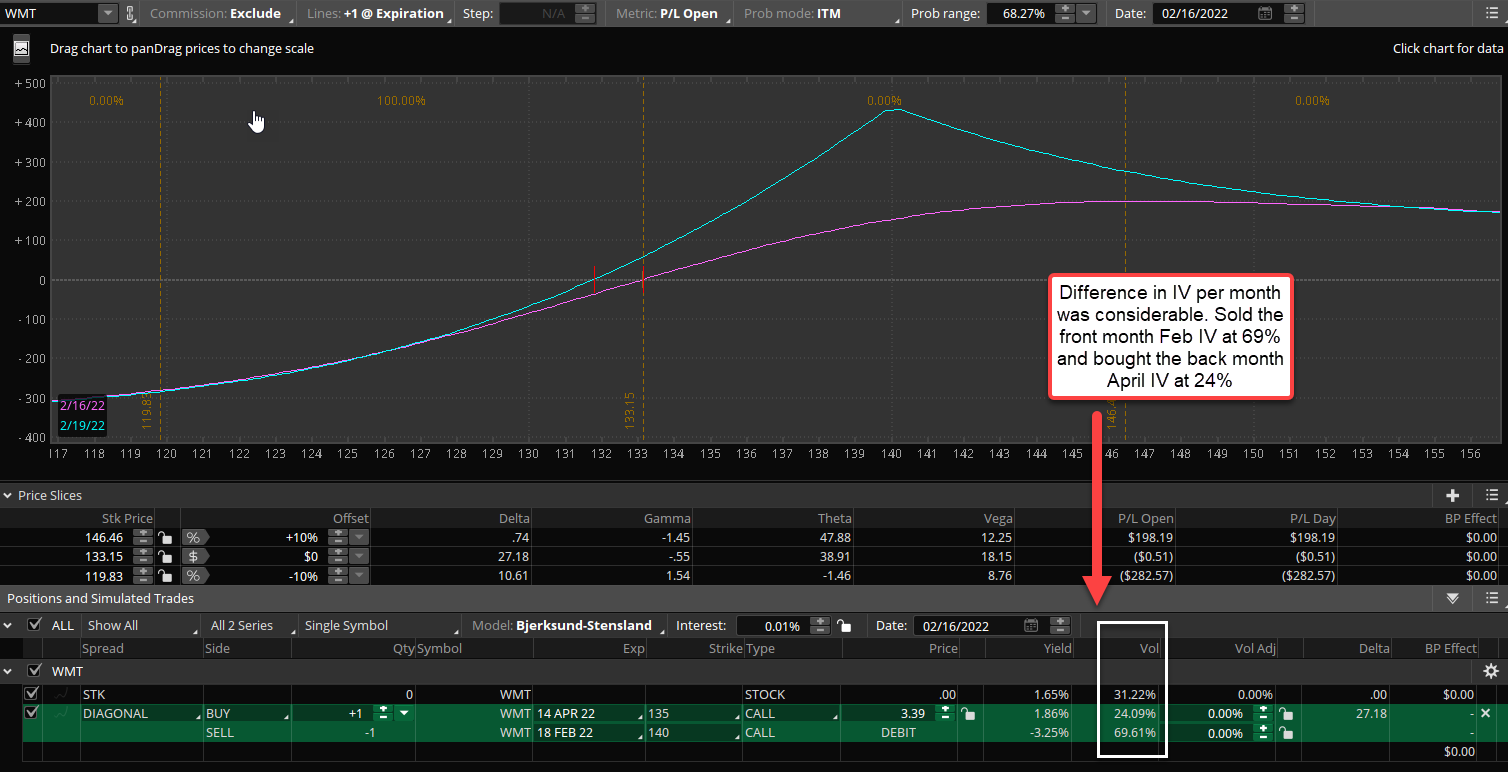

Using the below example on 2/16 on a lower volatility name like WMT heading into earnings I was interested in playing upside price movement after a recent decline in WMT stock. Noticing the big difference in the IV by month also was a nice opportunity to create a diagonal spread if directionally bullish. Buying the April 135 call strike with the stock just above 133 and selling the Feb 18th 140 call strike (expired in 2 days) gave a really nice structure to play an up move into earnings without getting hit with IV crush or theta decay. Since the trade risk graph below shows a positive theta and vega, the stock price going higher anywhere into the sweet spot near 140 (the short strike) would result in a great winning diagonal spread trade. Remember the Feb 140 call was expiring in 2 days since I entered the trade on Feb 16th. But since earnings were due the next day, there was a large amount of volatility premium still in the front week options based on an expected move in the stock of about 4 points.

The stock opened higher the next day and ran up by the end of the day to the 139 level. Just shy of the 140 strike I was short. This spread was going for a net debit price of 3.40 the day prior to earnings and the day after it shot up to over 6.00 per spread. It was nearly a perfect outcome for the structure implemented as choosing the 140 strike to sell the front month call was ideal and around the expected move implied by the options market. If holding a diagonal spread into the expiration of the front month then the perfect situation is to have the stock get to the short strike but not beyond as the sold strike will expire worthless and you will be left with a long call in the back month you can either sell for a profit also or convert to a new trade by rolling out to a new strike or selling a new front month call against it. Since we were long the April option here we could then go ahead and short the 145 or 150 call strike in March, assuming we wanted to stay in the trade. Often it’s best to just close the spread the way you opened it, as a two legged diagonal spread.

Put Diagonal Strategy Characteristics

Directional Lean: Bearish to neutral price action

Best Market Environment: You expect bearish action but don’t expect price beyond short strike.

Ideal Setup: Sell an OTM put with a month to expiration, buy an ATM put with 2 months to expiration.

The 40/20 Rule for Diagonal Spreads

An example using the SPY put diagonal below shows how this trade benefits from a move lower but does not get crushed too bad even with a move higher in the wrong direction. On March 4th, you can buy the SPY April 22nd 422 put (40 delta) and sell the March 31st 400 put (20 delta) for a net debit of 8.68 or $868 per spread. This is the aggressive style of a directional diagonal spread using the 40/20 delta but still going out far enough to allow the trade to play out. We are buying an option that has about 47 days till expiration and selling the options with about 25 days till expiration.

This also fits the 40/20 rule for days til expiration. I like this style of diagonal spreads where you are buying the 40 delta option with around 40 days of life and selling the 20 delta option with around 20 days of life remaining. These are just goal posts and of course using 25 versus 20 is not that big of a deal. The idea is to create a diagonal spread that you are able to have a directional leaning to a price level you expect the stock to move towards but not much beyond. But it’s fine if it surpasses the short strike as well since you see in the risk graph below, the profit flattens out similar to that of a vertical debit spread. The main idea is having a directional spread that also benefits from positive theta (time passing) and positive vega (IV increasing). The important factor to point out also is that as the trade goes in your favor directionally, the exposure to positive theta RISES and exposure to positive vega DECLINES. This is what you want overall.

Takeaways:

- A diagonal spread consists of two options, buying the further out expiration but closer to the money option, while selling the nearer term expiration but further OTM strike.

- Diagonals are also excellent ideas to implement on stocks around earnings reports.

- Generally looking for a 25-50% target profit is best on these diagonal spreads.

- Diagonals enable a trader to have a directional option trade without suffering from theta decay.

- Positive vega or IV expansion is another trait that benefits a long diagonal spread.