Trading Vertical Debit Spreads

Vertical debit spreads are a great way to lower initial cost on higher dollar stocks that still offer a directional bias on a trade. They are a defined risk trade where the debit paid is the most that one can lose. The long option that is purchased is more expensive than the short option strike that is sold, this creates a net debit transaction for the spread. The spread is “vertical” when the two options are in the same expiration cycle. These can be done as vertical call spreads or vertical put spreads depending on the directional assumption being made. They will always be directional delta similar to a long call or long put but you are simply lowering the cost by selling the further out of the money option. By lowering your cost for the trade, the trade off is a limited risk but limited profit. This should not be a big concern for most traders that understand the probability of the trade increases by reducing the cost from the short option.

Debit Spread Benefits

Some of the main benefits to using debit spreads is that risk is defined at the start so even when trading a high dollar stock like AMZN or TSLA, a trader can create a spread with a width small enough to be appropriate based on risk parameters for any sized account. The debit paid to buy the spread is the max loss, regardless of where the stock goes. This makes vertical spreads a great trade strategy for smaller accounts that may not be able to risk buying stock or a long option which would require more capital. Since a trader can construct the vertical spread based on where they think a stock might go it becomes a good way to get long stock with minimizing risk in the trade. Simply buying the at the money strike and selling the nearest out of the money strike whether it’s 5, or 10 points further is one of my favorite ways to quickly participate in a directional move without risking a lot. Depending on the strikes selected a vertical debit spread is usually more of a risk one to make one kind of trade, this makes it more of a 50/50 probability based on direction but much easier to manage than simply buying a long call.

Long Call Vertical Spread

Directional bias: Bullish

Max profit: Difference between call strikes minus debit paid

Max loss: Debit paid

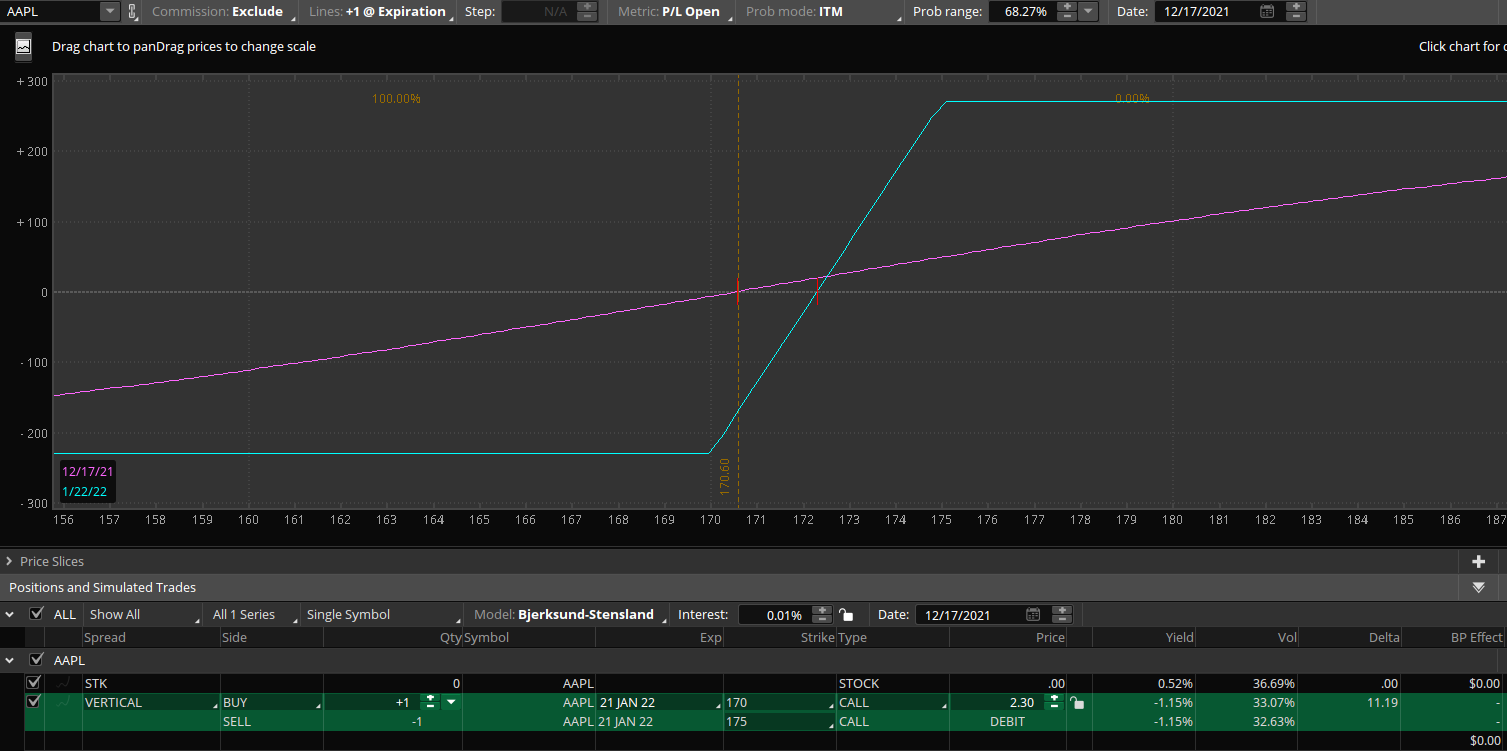

The example below shows a AAPL vertical debit spread using the 170/175 strikes in January. Buying the 170 strike which is at the money and selling the 175 strike creates that spread which is priced at about $2.30 per spread. With the max potential value being $5.00 since that is the width between the two strikes. Risking $230 to possibly make as much as $270 if the stock closed above 175 on expiration day in January. By purchasing the slightly in the money option strike we are buying the option that has some intrinsic value and the out of the money option being sold has nothing but extrinsic value. This just means we are selling the option that would have no value at expiration if the stock stays where it is now.

This spread in AAPL is an example of an “at the money” vertical spread but if a trader was more bullish and wanted to lower upfront cost they could buy the 175 strike and sell the 180 strike. This spread cost would be closer to $1.70 based on current prices and roughly one third the width of the $5.00 wide vertical spread. By paying about 35% of the width that creates more of a 2 to 1 reward to risk ratio but also gives you a lower probability of seeing that profit materialize since you are buying purely out of the money premium. This is where days till expiration come in and it makes sense to buy enough time for your assumption to play out in the stock.

Max Profit: Distance between Call Strikes minus Net Debit Paid

Our max profit is capped above the short call strike we sold to reduce the cost basis on the overall trade. The maximum value the spread can be worth is the width of the spread but you need to subtract what you paid for the spread from that to calculate the max profit. As the example below shows in AMZN, the January 3500/3510 call spread can be bought for just under 4.00 or $400. With a 10 point distance between strike prices, the max the spread can be worth is $10.00 and since we paid $4.00 then the max profit is $6.00. However, since options have time value, the full potential would not be realized until expiration day. You can see the blue line shows the profit and loss graph at expiration in January but the pink line shows today’s PnL graph and is very similar to being long stock. But for a fraction of the price of shares you can create a vertical spread to participate in a move higher. If AMZN rallied well ahead of expiration and our spread became fully in the money it would likely benefit a trader to take the profit if the vertical spread rose in value from 4.00 to 6.00 or beyond. That would be a 50% profit which is a good target to shoot for in these generally.

Long Put Vertical Spread

Directional bias: Bearish

Max profit: Difference between put strikes minus debit paid

Max loss: Debit paid

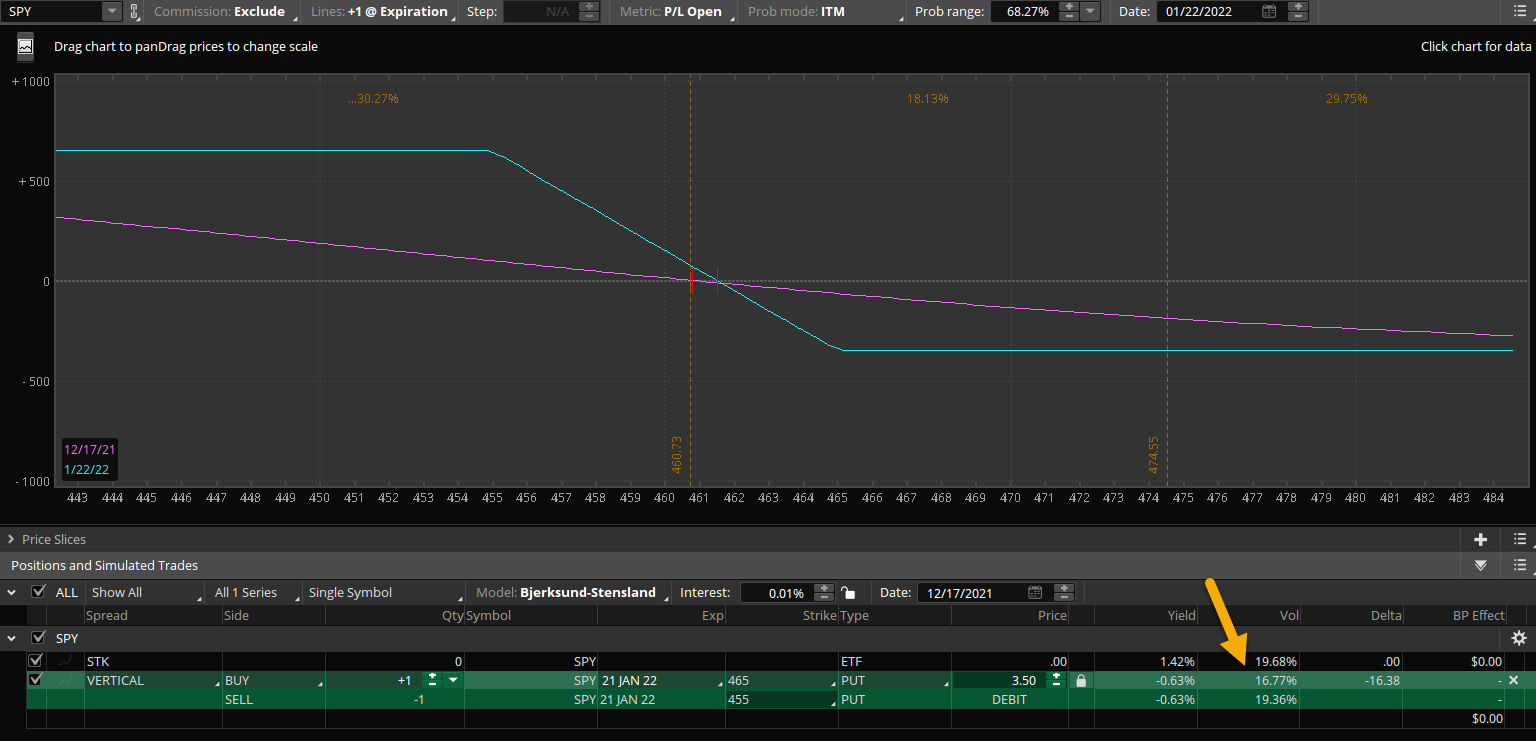

Just like a long call vertical, a put vertical is a directional trade looking for lower prices. It’s constructed the same way and has the same risk versus reward parameters. The closer to the money strike is the long strike that is bought and the lower priced further out of the money strike is sold, creating the put vertical. The example below shows a SPY put vertical debit spread using the 465/455 strikes in January when the stock is just under 461. Buying the 465 strike which is in the money and selling the 455 strike creates that spread which is priced at about $3.50 per spread. With the max potential value being $10.00 since that is the width between the two strikes. Risking $350 to possibly make as much as $650 if the stock closed below 455 on expiration day in January. The other thing you might notice on this vertical put spread in SPY is that it’s cheaper than the similar spread in AAPL was. This is an example of volatility skew in put options on the indexes. Normally you have to pay closer to half the width of a spread when you buy an in the money vertical spread but here the spread is priced at $3.50 or close to one third the width.

The arrow in the image for SPY shows the implied volatility between strikes. Since you are selling the out of the money 455 strike with higher IV that makes the spread trade cheaper based on volatility skew. This is common for index options that price in more risk to the downside and that is why puts are always more expensive than calls with ETF’s like SPY and QQQ. Similarly with volatile stocks that have upside risk the call skew makes vertical call spreads trade cheaper but that is a more advanced topic for another time.

Takeaways:

- When trading vertical debit spreads you are always buying one option strike closer to the current stock price and selling another strike further away, creating a debit.

- Vertical debit spreads are directional trades that require the stock to move up for a call spread or down for a put spread.

- The short strike option reduces the cost of the long option.

- Max profit is the width of the spread, minus the debit paid.

- Max loss is the debit paid for the spread.

- A trader can choose any strikes for a vertical spread but the closer to the money the option strikes the more favorable the odds become while reducing most extrinsic value paid.