Understanding Options Bid/Ask Spreads and Liquidity

Bid/Ask Spreads

A bid/ask spread is the difference between where you can buy an option versus where you can sell an option. Sometimes called the offer, the ask price is the amount the market is willing to sell the option to you and the bid price is where the market is willing to buy an option from you. Naturally the tighter this difference in the spread is, the easier it is to facilitate trades which leads to more activity and volume. The reason a narrower bid ask spread is an advantage to a retail trader is because you are generally needing to buy closer to the ask and sell closer to the bid and if this is too wide then you are putting yourself in a hole right off the bat. If I buy an option on the ask that has a $1.00 wide bid ask spread then I am instantly down $100 based on this spread differential. I need the stock to move in my favor that much more and quicker to profit on this option I have purchased. Generally, the more popular actively traded stocks will have enough liquidity to offset this bid ask spread and the more narrow the spread, the easier it will be to get a fair price for your options trade.

The cool thing about markets is that there is always a two-sided market and participants or market makers are willing to take the other side of your trade. Market makers are in business to facilitate trade and just make money off the bid ask spreads without taking directional market risk. This allows retail traders to gain an advantage by having more liquidity than ever before in the history of trading markets. It truly is a great time to be a retail trader.

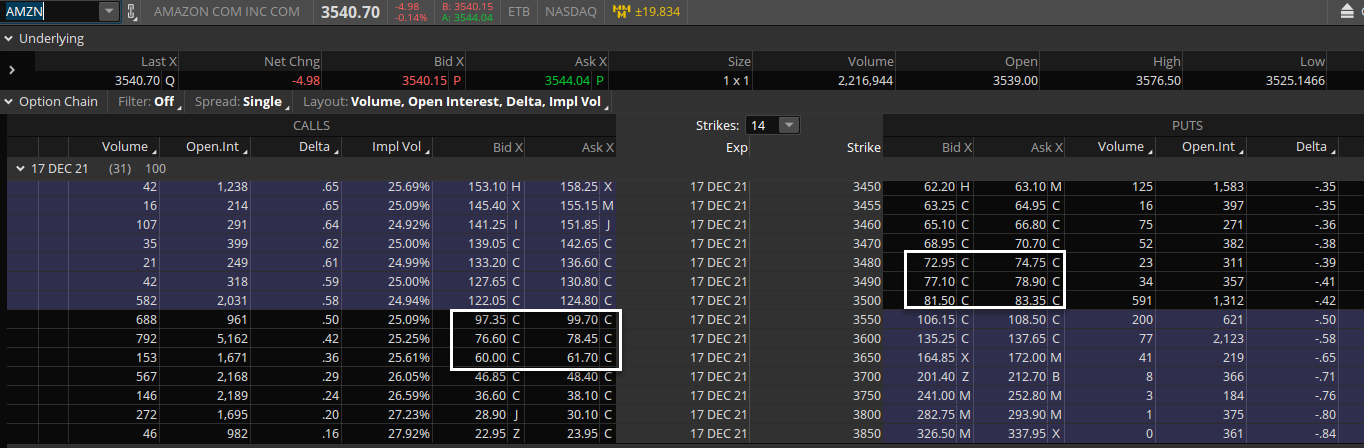

Options in the SPY or QQQ often have penny wide spreads which is as good as it gets. But just because an option might have a 50 cent or 1 dollar wide bid ask spread doesn’t mean it’s not liquid. If AMZN or TSLA, have spreads around $0.50 that actually is quite liquid and narrow based on the price of their underlying stocks which is over $1000 for TSLA and over $3000 for AMZN. The screenshots below show the bid/ask spreads for these high priced stocks TSLA and AMZN and even though the bid ask is $1-2 dollars wide at times, for a $3500 stock like AMZN, the liquidity is still good. A one dollar bid ask spread on a $50.00 option is just 2% of the price. If you apply that same 2% to a $5.00 option in a lower priced stock like SPY it comes to a 10 cent bid ask differential. It matters more about how wide the bid ask spread in relation to the total price of the option or stock. In general the more volume and open interest the better off the liquidity will be.

Liquidity of Options

The liquidity of a stock or option just comes down to how many people are willing to buy or sell that asset. Volume and open interest are important but there are plenty of times when there can still be a narrow bid ask spread in a stock that doesn’t trade a ton of volume. Ideally you are trading a stock that has a lot of daily volume and thus the options market of that stock is active and has enough open interest to encourage tighter bid ask spreads. In general, options that have less than 100 contracts in open interest are probably not that active and may have reduced liquidity and wider bid ask spreads. Stocks that trade thousands of contracts of volume per strike price are often the best to trade because it makes it effortless to enter and exit without much slippage between the bid and ask prices.The size of the bid/ask spread can also reflect the market maker’s perceived risk in trading the underlying stock. In large market volatility where the price swings are violent, liquidity can often decrease based on the width of the bid/ask spread widening due to uncertainty.

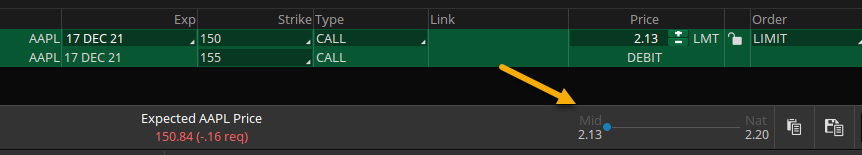

Mid-Price and Natural Bid

If I am buying to open an option, I can pay the natural asking price at the ask to be instantly filled but it’s often best to split the difference between the bid and ask and find the true market price at that moment, which is the mid price. The “mid” is the fair price of doing business because you are not buying from the market maker at the ask but you also are not bidding at the bid. Especially when trading multi-leg options spreads it’s beneficial to “price discover” where the true market is initially and then perhaps move your bid higher by a few pennies to get filled. You can see in the example below the call spread in AAPL is trading at a current mid price of 2.13 and a natural of 2.20. If I wanted to buy this spread and be filled immediately I can offer 2.20 to buy it. But instead I might try to put in my bid at 2.13 or 2.15 to “test the market” and get filled closer to fair market value. Saving a nickel on a call spread ($5 per spread) may not seem like much but if you are trading 10 contract spreads at a time that’s $50 per entry and exit for a total savings of $100 per round trip. Multiply that by 100 trades in a given year and that’s $10,000 in cost you saved by getting filled at a fair price.

Getting the Best Price

The simple solution to avoid getting a bad fill is to use limit orders. Even with tight bid ask spreads, there’s virtually no reason to use a market order for most traders. Paying the offer over time will decrease your profits and likely your patience. Similar to a sports bet, if you are constantly paying too much juice to the dealer, then you put yourself at a disadvantage at achieving long term profitability.

Takeaways:

- A bid/ask spread is the difference between the highest price that a buyer is willing to pay for an option and the lowest price that a seller is willing to accept.

- The spread is the transaction cost effectively. Market makers buy at the bid price and sell at the ask price.

- The bid is the level where demand is present and the ask is where supply is present.

- The spread between the bid and ask of any stock or option is the default measure of market liquidity for that instrument.