Unusual Surge in Call Buying, Implied Volatility in Hyper-Growth Small Cap AutoTech

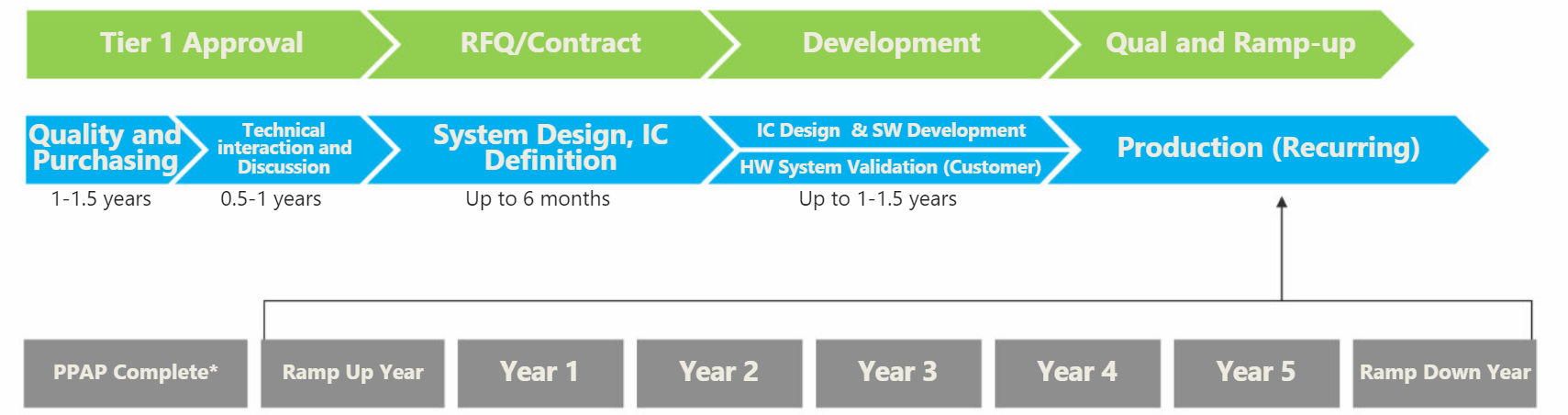

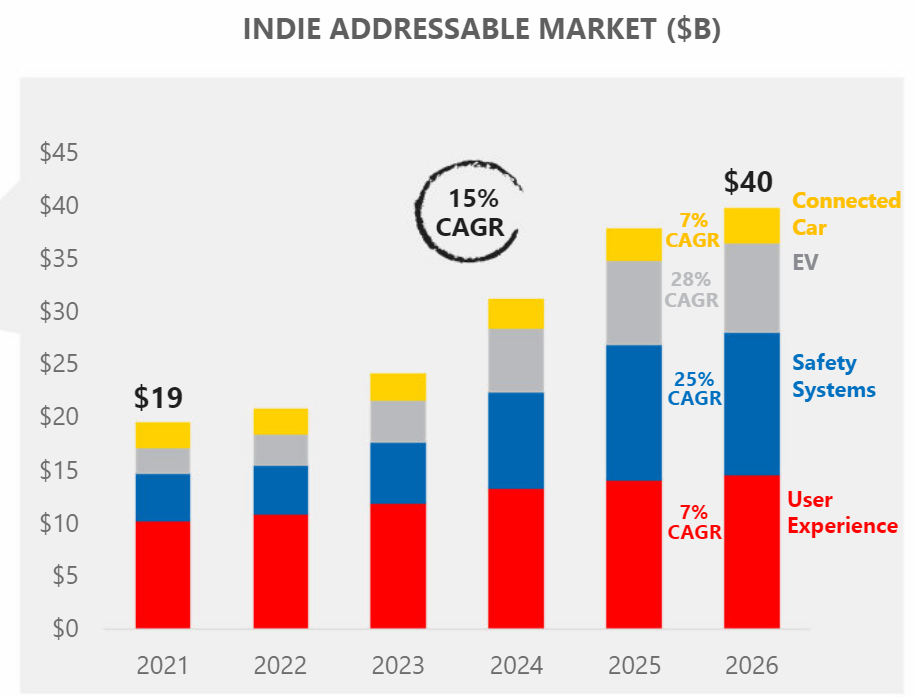

Indie Semi (INDI) on 9/21 traded more than 87,000 calls which is 60X average and IV30 surged 85% higher, a lot of attention in October $12.50 and $15 calls which traded 60,000 combined but also interesting size lot buys of 3000 February $15 calls. INDI shares climbed 14% on 6X relative stock volume on the day as well breaking to multi-month highs. INDI offers highly innovative automotive semiconductors and software solutions for Advanced Driver Assistance Systems including LiDAR, connected car, user experience and electrification applications. These functions represent the core underpinnings of both electric and autonomous vehicles, while the advanced user interfaces are transforming the in-cabin experience to mirror and seamlessly connect to the mobile platforms we rely on every day. INDI has 12 Tier 1 engagements and AVLs and sees a $40B market opportunity driven by automotive megatrends.

INDI posted revenues of $9.2M in Q2 growing 148% Y/Y while navigating supply chain dynamics. INDI also announced a $159M deal for TeraXion, a designer and manufacturer of innovative photonic components. INDI currently has a market cap of $1.36B so it trades 12X FY22 expected sales with the revenue growth trajectory seen as 107% in 2022, 122% in 2023 and 70% in 2024. B. Riley started coverage on 8/24 at Buy noting that with 100M+ units shipped over 10+ years, we believe INDI has established a strong foundation with 20+ tier 1 customers, $2.5B in strategic backlog across ~30 blue-chip customers, and now $335M in cash to extend organic and inorganic growth. It sees INDI’s advantage as high functional integration with world-class building blocks for a more powerful and efficient total solution versus much larger traditional discrete suppliers and sees major upside potential to ASPs. It sees new product engagements and backlog growth as stock catalysts. Deutsche Bank started at Buy with a $14 target in July citing INDI’s compelling growth potential in AutoTech and significant traction with customers.