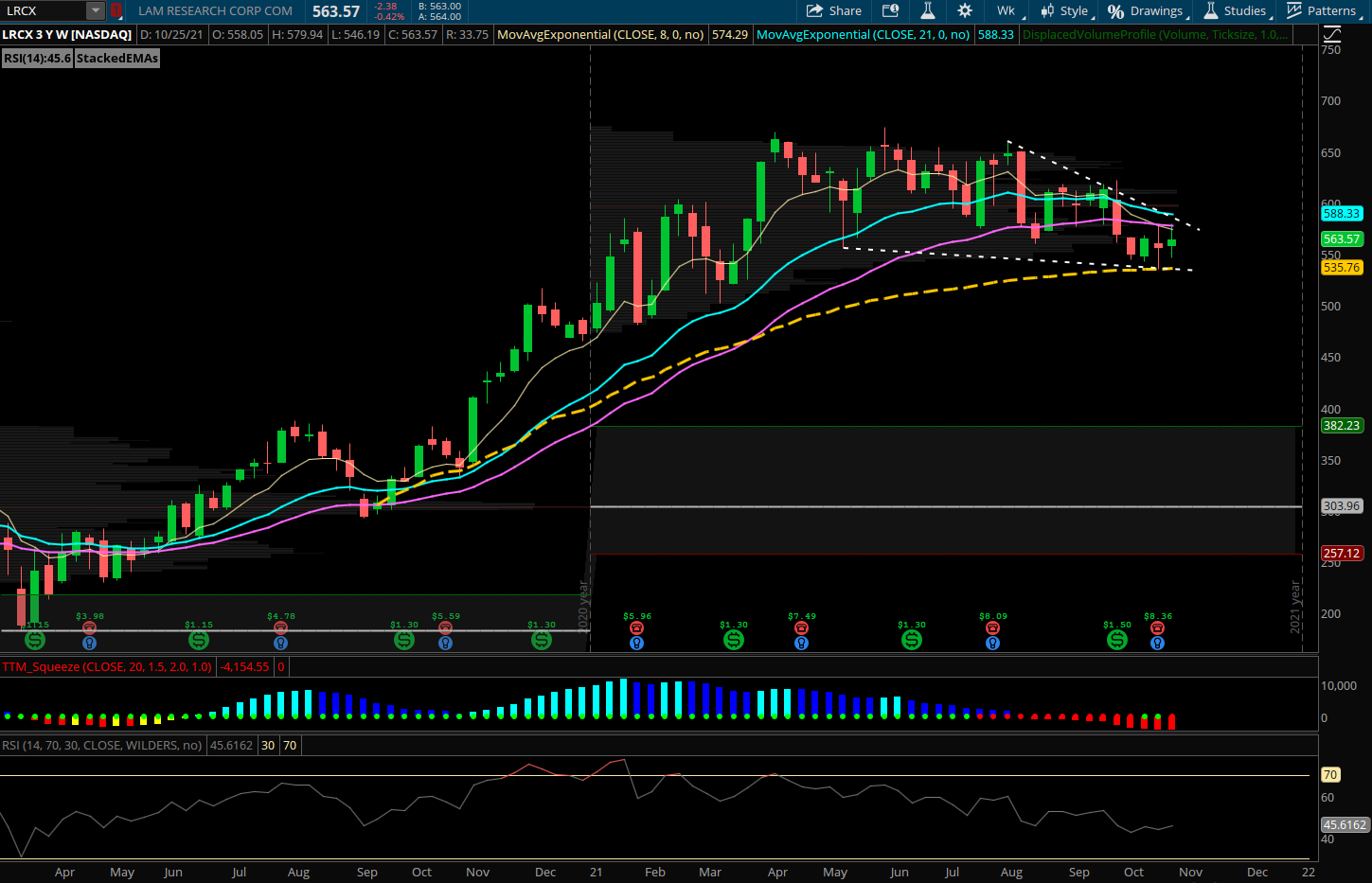

Credit Spread of the Week: Semi Stock Catching Support in Bull Wedge

Lam Research (LRCX) – Lam Research has consolidated in a wide range for most of the last 6 months after a very strong rally late 2020 into early 2021 peaking near 660. Since August LRCX has pulled back into its 200 EMA and formed a base near 550 with a falling wedge developing on its chart. The chip stocks overall are still in a strong uptrend as SMH has regained almost all of its September selloff and is likely to make new highs. LRCX is a top 15 holding in the SMH ETF and looks to follow the other chip names higher into year end. The anchored VWAP (dashed line) from the lows of Sept 2020 held perfect recently at 535 showing the stock is catching strong support at a key volume level. This is also near the 61.8% of the 2021 range and likely provides a multi month bounce back with potential here to start a fresh uptrend higher. LRCX has seasonally been strong into November up 3 of the last 5 years with an average return of +7.6% during the month. Looking further ahead to January is when the stock has had its strongest performance up 5 of the last 5 years for an average return of +8%. LRCX has recently seen some large put spread sales to open around this 550 level. On 10/20 the December 545/540 bull put spread was sold over 1200 times looking for a floor. Also on 10/4 there was a large bull put spread sold in the longer term Jan 2024 expiration using the 460/380 put strikes for about an $8M credit.

Trade to consider: Sell LRCX December 550/540 put spread for 3.75 credit or better