Open Interest Reports

The OptionsHawk Open Interest Report is a detailed report on 50 stocks that have notable Institutional positions in Open Interest for July 2019 to June 2020 option expiration. The report is a must-own for anyone looking to know where the Smart Money is positioned in the market as we have have 6 months left to 2019 trading. At the low price of $99 if you find just 1 trade idea in this report it will likely pay for the cost 25-fold, and all 50 stocks are actionable based on the analysis provided.

To order a copy, hit Add to Cart, and sign out. Reports will be available for download after payment. Please then save the file to your computer as the download limit is set. No Registration Required!

Purchase Open Interest Report

$99

A must-own for anyone looking to know where the Smart Money is positioned in the market

Stay tuned for the next report issue

What’s Included?

50 Stocks with Large Institutional Smart Money Option Trades in Open Interest

1-3 Pages Dedicated to Each Stock with Fundamental, Technical, Ownership Trends and Potential Catalyst Notes with a Chart

Visual of the Options Flow from the OptionsHawk Open Interest Database

Skew Watch – Going month by month to identify names exhibiting bullish and bearish skews

Notable Put Sales – A database of notable puts sold to open in open interest, giving an optimal level that shares are likely to defend and provide optimal entry into positions

Notable Put Buys – A database of notable puts purchased in names with downtrends and weak fundamentals

Notable Call Buys by Industry Groups – A database of notable calls bought still in open interest broken into industry groups, focused on large institutional size and in names not presented in the Top 50

Volatility & Skew Notes – A look at the Implied Volatility and Skew of each stock presented versus historical levels and identifying opportunities

Visualization – Each stock is presented along with some visuals regarding its business (growth, market share, etc.)

Seasonality – Identifying seasonal tendencies of each stock discussed

Optimal Strategy – Each stock profile is also now presented with an optimal trading strategy to position based on technical analysis and the open interest positioning

Reports Examples

Please See the Links Below for the Prior OI Reports as Examples!

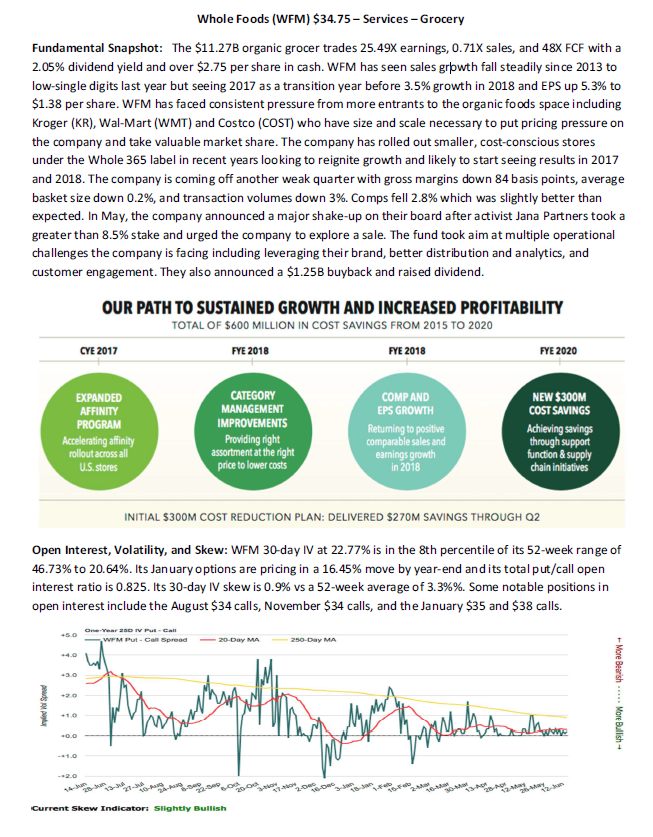

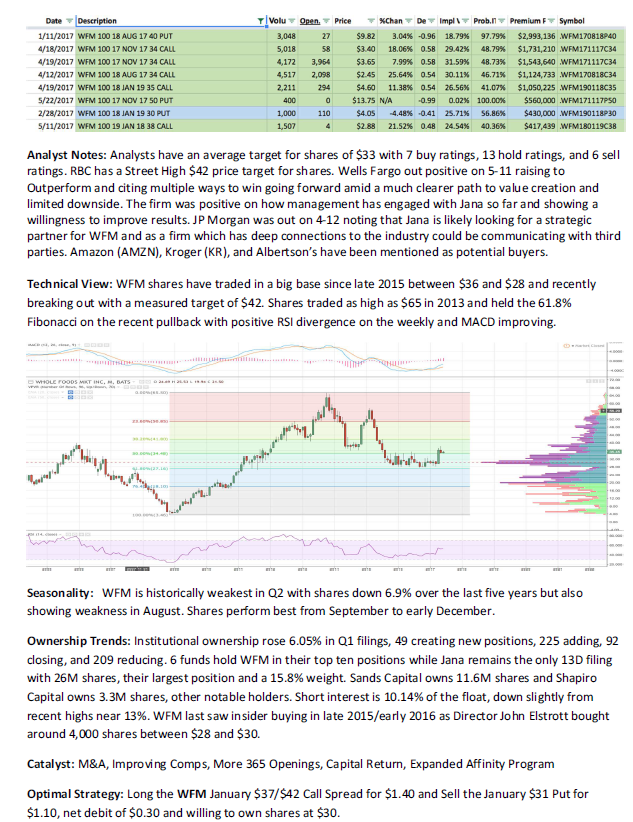

6/16/17 Update: Whole Foods (WFM) an example from the report (shown below) was just bought by Amazon (AMZN) at $42/share, the optimal strategy returning 1,500%