Seasonal Stock Setup: Entertainment Leader Oversold Into Strong Year End Setup

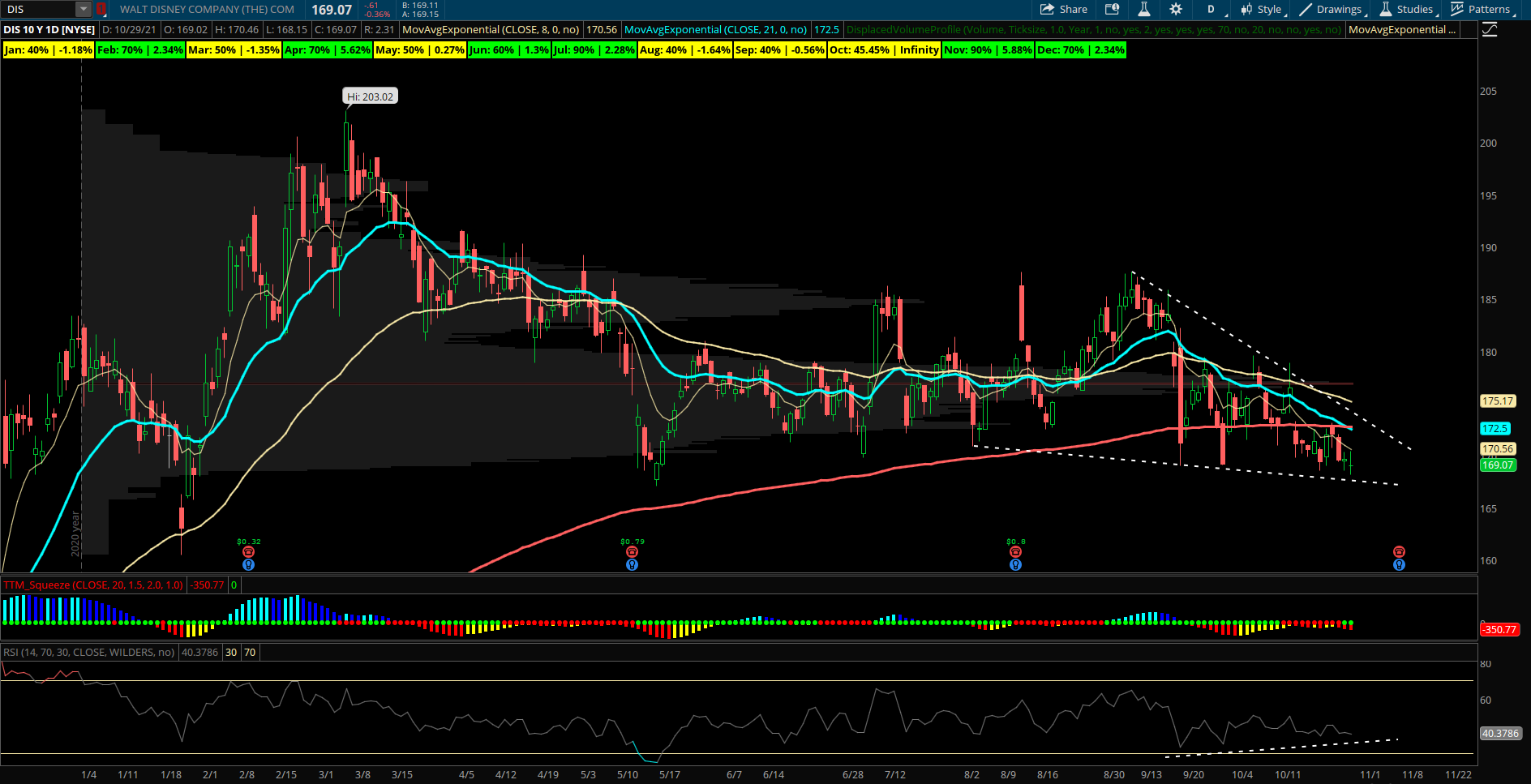

Disney (DIS) – Disney has underperformed the market as of late pulling back to under its 200 day EMA since August when it put in a swing high near 187. The end of summer is seasonally a weaker time period for DIS going back the prior 10 years showing slightly negative returns for Aug-Oct. However starting in November is when we look for stronger returns into the year-end for the Mouse House. November has been positive 9 out of the last 10 years for an average return of +5.88%. As shown in the chart labels below, December has also seen continuation of the bullish bias with 70% of years positive as well. DIS will report earnings on 11/10 during this month of November and enters the month oversold after retesting the 168-170 level of support many times recently and holding. This has been a strong zone of lower value area support since the Spring. DIS is forming a bit of a falling wedge pattern which it may look to pop out from with any relative strength that turns the tide during November. YTD VPOC is up at 177 and a first level to target resistance. Above that DIS has a volume pocket up to about 185. RSI has formed some bullish divergence on these recent lows and it appears sellers are drying up and unable to push much below current levels. DIS started to see some more bullish flows this past week with some large call buys on 10/25 in the January $180 calls for $4.8M and also the June $175 calls for $2.1M. A large buyer from 9/30 for $26M of the March $160 calls remains in open interest as well.