ETF Sector Relative Strength Corner: Industrial Strength Breakout Into November

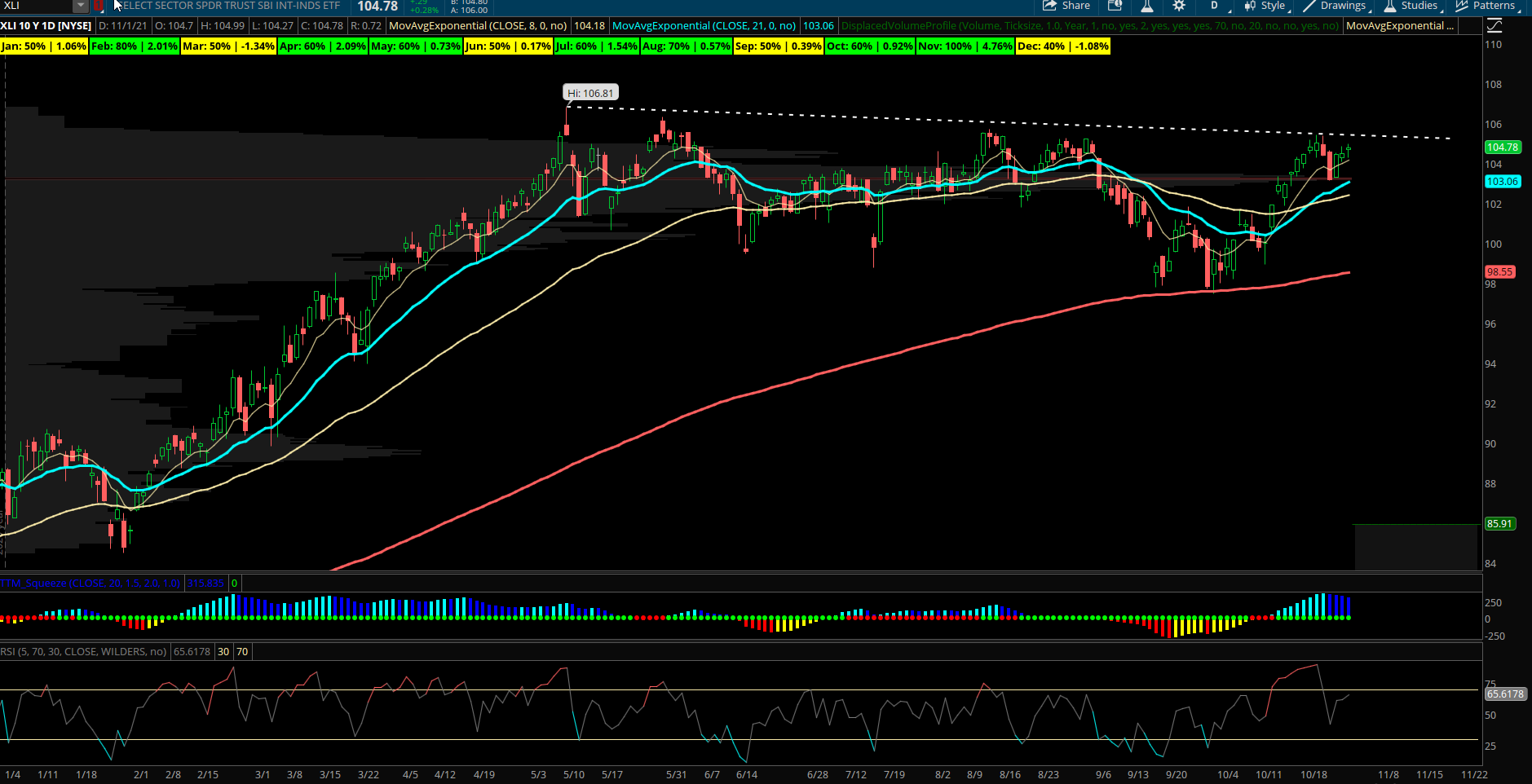

Industrials (XLI) The XLI is the Industrial ETF that gives exposure to a variety of offerings including stocks related to transportation, commercial and professional services, and manufacturers of capital goods. The group has shown relative strength of late after testing its 200 day EMA in late September and has rallied higher in October after the infrastructure bill likely creates multi month bullish tailwinds for the sector. Still a little bit underneath the old highs above 106 and can break out of this long weekly base pattern that is forming. The equal weighted Industrial ETF is RGI and it has already made fresh new recent highs. The XLI is up about 18% YTD and likely gets a push into November as it is seasonally a stronger month on the calendar for the Industrials. XLI has been up in November 100% of the time the last 10 years with an average return of +4.76%. This is good enough for the best monthly average return of any month. With the overall market likely to see sector rotation this month after the strong recent rally, getting into some strong trends in the Industrial group has promise.

The ETF’s top holdings are UNP, UPS, HON, RTX, GE, BA, CAT, MMM, DE, LMT with the first four names making up about 19% of the index. The best looking charts in the space include UPS, GE, DE, and RTX but also some less popular names that have yet to run to highs like ITW and ETN. The group has seasonality in its favor and a bullish chart with XLI recently retesting YTD VPOC and holding at 103, this level should show support as the 21 EMA is crossing back over the 55 EMA and a move to new highs seems likely into November. Looking to buy pullbacks into 100 level even if the group sells off to form a right shoulder of a bullish inverted pattern on the charts. XLI is likely well above 110 in the coming 3 months and perhaps sooner. XLI has several bullish multi million dollar options trades in open interest for November and December and recently on 10/7 saw a large $3.8M buyer for January $105 calls.