Seasonal Stock Setup: Consumer E-commerce Leader Ready to Catch Up

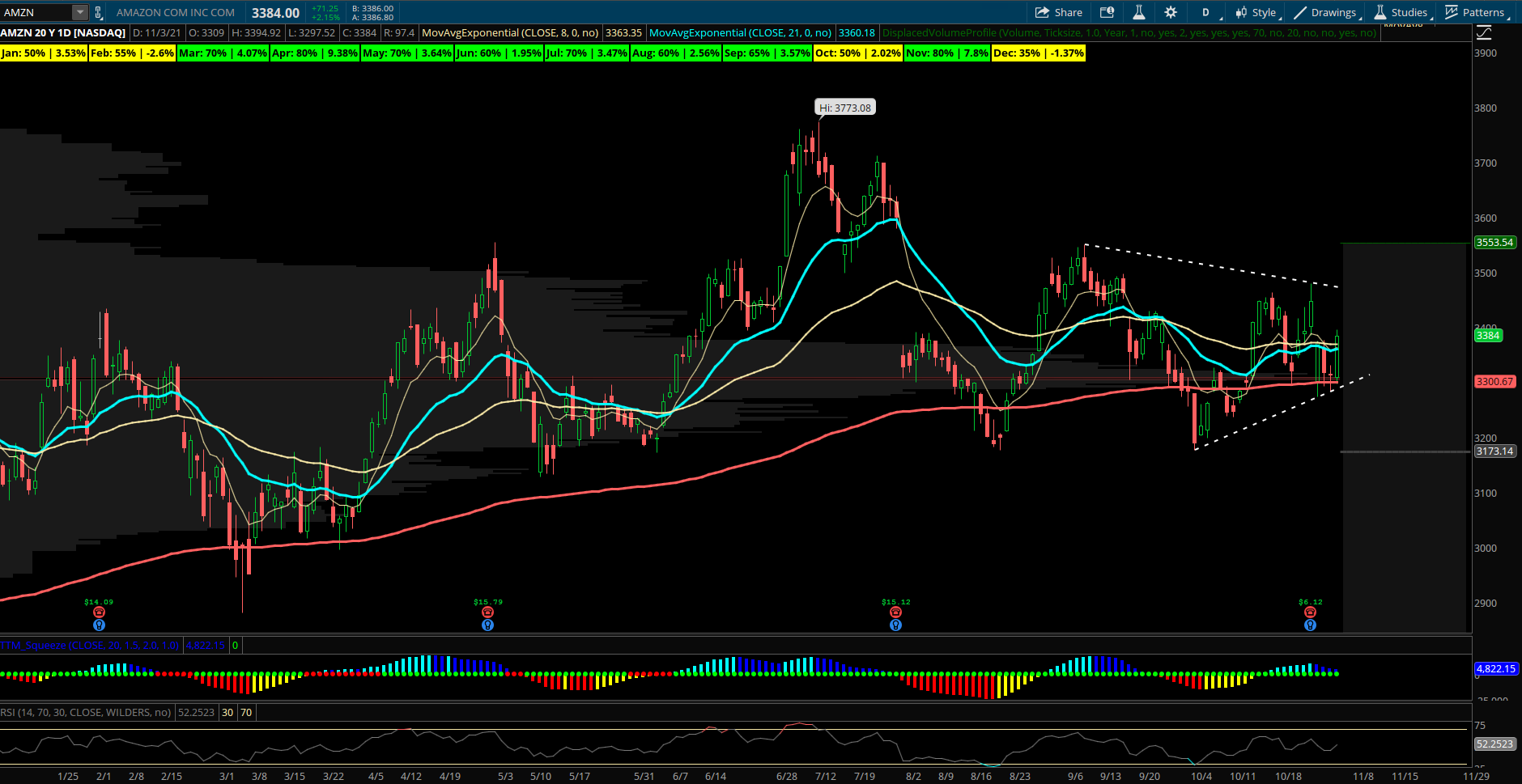

Amazon (AMZN) – Amazon has been mostly range bound this year between 3100-3500 and is primed to play catch up into the busy holiday shopping season as seasonality favors an upside advance in November ahead of Black Friday. AMZN is also potentially where money may flow as it is one of the large cap names that hasn’t participated in the market runup of late. AMZN is up just 4% YTD and recently reported earnings that were a bit soft. The stock has shook that off and bounced back to nearly fill the gap. AMZN found support at a key level showing a cluster of support at 3300 in the form of the YTD VPOC and also the 200 day EMA. If AMZN can continue to push above 3400 in the near term it can clear value area resistance and get back up into the 3600s.

Seasonally the XLY Consumer Discretionary ETF, of which AMZN is the top weighting, performs well in November. XLY has been up 9 of the last 10 years in November with an average return of +3.3%. Drilling down into the sector we see AMZN is yet to make the moves some of the others in the group have so if the sector stays strong, look for AMZN to play catch up. AMZN has seen positive November returns in 8 of the last 10 years for an average gain of +3.3% and over a larger sample size of the last 20 years, AMZN has been up 80% of those Novembers for an average return of +7.8%. The stock has potential to see a longer term breakout above 3550 if it can see a weekly close above and looks alot like NFLX did before its recent multi month breakout from a long weekly range. The stock also has the stock split rumored catalyst as something that could trigger a larger breakout as well. AMZN has seen some recent bullish flows including today’s Nov 12th 3300/3400/3500 call butterfly opened as well as Nov 3250/3450 call spreads opening this week over 1000x. Not usually a ton of large frequent trades with the high dollar contracts but April $3300 puts have been sold to open 3000X and has proven to be a key support level on recent tests of 3300.