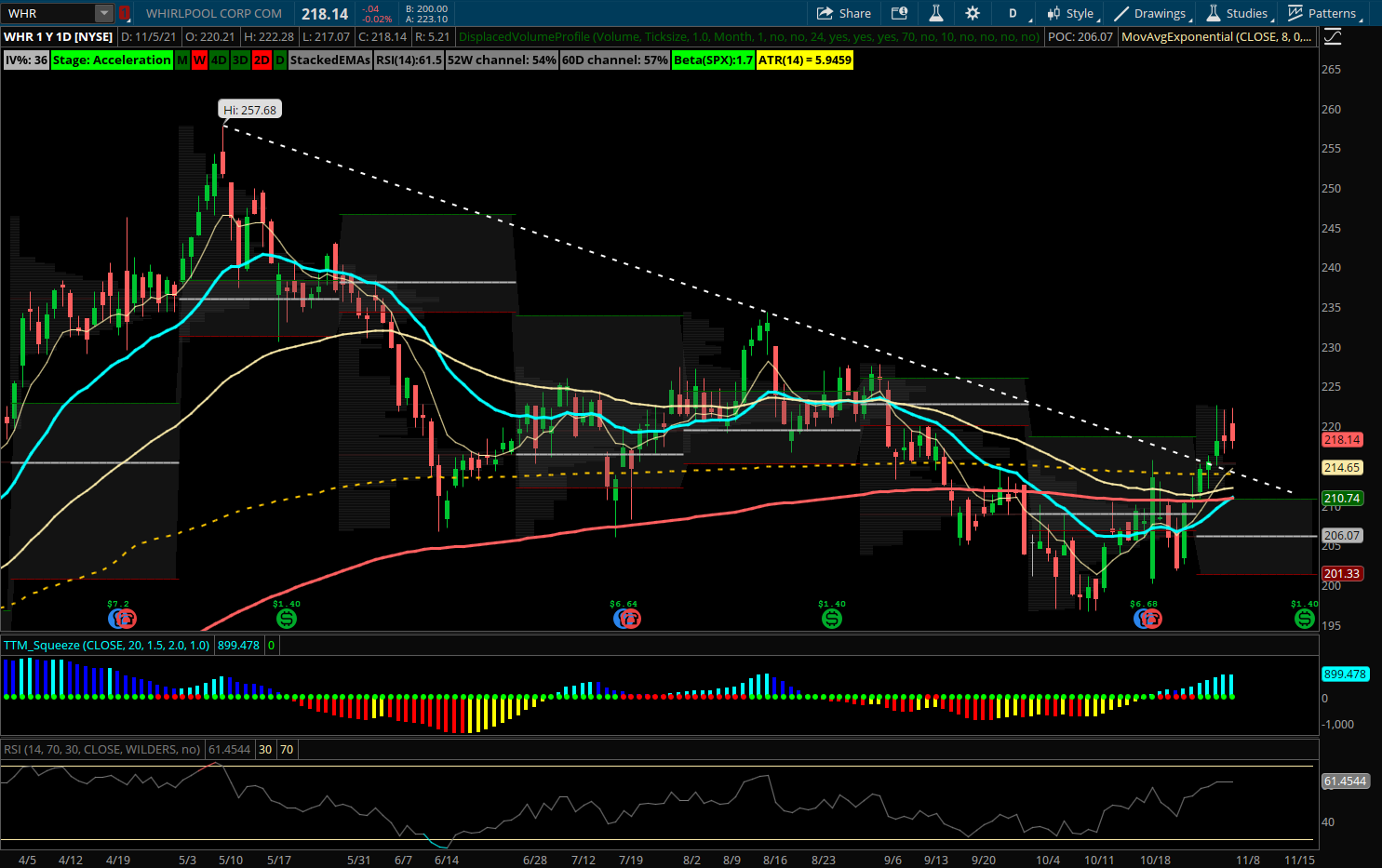

Credit Spread of the Week: Consumer Products Leader Basing at Key Support

Whirlpool (WHR) – Whirlpool is part of the Consumer Discretionary group that has been one of the strongest sectors in the market of late so it makes sense to be looking to play the catch up theme with WHR which has started to put in a bottoming base pattern. The stock is actually up +21% YTD even though it has pulled back off spring time highs from 257 after a strong early year runup. WHR came back to test its 200 EMA multiple times and formed a support zone between 200-210. Recently WHR had a strong move back over its 200 day after earnings and the 8/21 EMA bull cross is showing buyers back in control as the stock closed last week above its YTD VPOC of 216. Optimal time to sell a bull put spread into this zone of large support expecting the stock to hold these levels and gravitate higher into January. This is also near the 61.8% Fibonacci retracement of the 2021 range and could provide a floor for a new uptrend to start. WHR has seasonally been strong in November, up 8 of the last 10 years with an average return of +3.9% during the month. On 10/27 the June 2022 $200 puts were sold to open for $820k showing confidence in that level to hold.

Trade to consider: Sell WHR January 210/200 put spread for 3.30 credit or better