ETF Sector Relative Strength Corner: Communications Sector Poised for Bullish Rotation

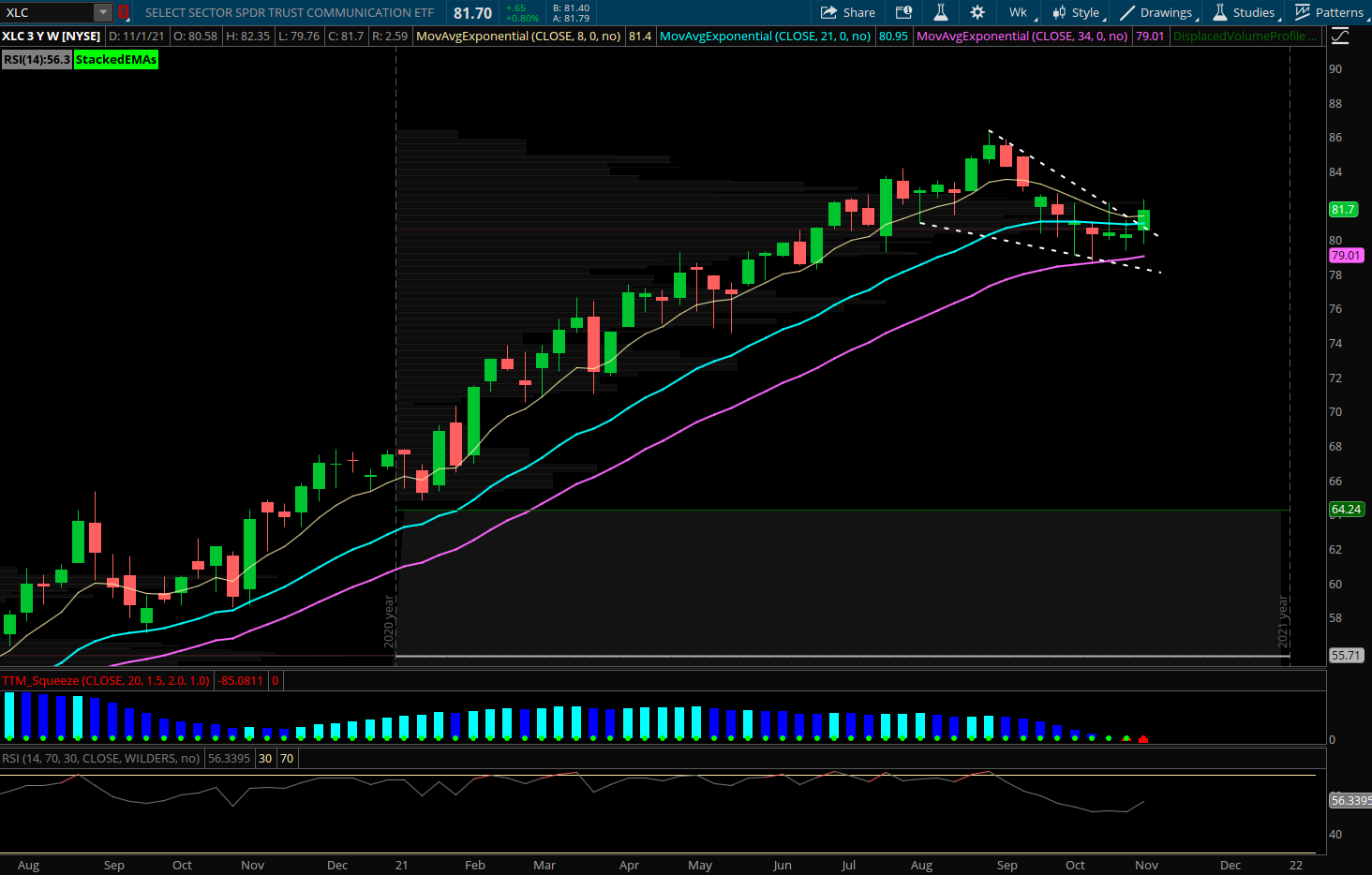

Communications (XLC) The XLC Communications ETF has been one of the few sectors to not yet make new highs recently. The group has shown relative strength the past week with a strong weekly candle regaining its 8/21 week EMA and back above YTD VPOC on the volume profile near 80. XLC is still up over 20% on the year to date basis but is strongly influenced by its top weighting FB, which has been in a downtrend the last few months. FB recently bottomed out and held its 200 day EMA zone of support after the company changed its name to Meta and this announcement seems to have helped the stock find some buyers. XLC has cleared back above its monthly value area this past week over 81 and looks ready to see money flow rotate back into this oversold sector as other groups seem rather extended. XLC also is a newer ETF in the last few years but in 3 years has been up in November twice with an average return of +3.5%. RSI has moved back above 50 and is leading the price of the ETF higher.

The ETF’s top holdings are FB, GOOGL, GOOG, NFLX, VZ, TMUS, T, DIS, CMCSA, CHTR, ATVI, TWTR with FB, GOOG and GOOGL making up about 45% of the index. The best looking charts in the space include GOOGL, NFLX, EA, and TTWO. The group has some laggards that could provide mean reversion in a market that is quite extended but this is more of a play on its top holdings being FB and GOOG and those being able to push the group higher. XLC doesn’t see a lot of options activity but if we look at its top weighted stock of FB its interesting to note the stock has seen a lot more bullish options flow since November began and the Meta name change was announced. On 11/5 the February $310 ITM calls were bought over 7000x for $31.4M in premium. Also on 10/22 a large opening put sale of March 2023 $280 puts for over $10.2M and on 10/5 the March 2023 $330 puts were sold to open for over $8.5M in premium collected showing confidence in a long term floor at these levels.