Seasonal Stock Setup: Consumer Staple Basing Into Long Term Support

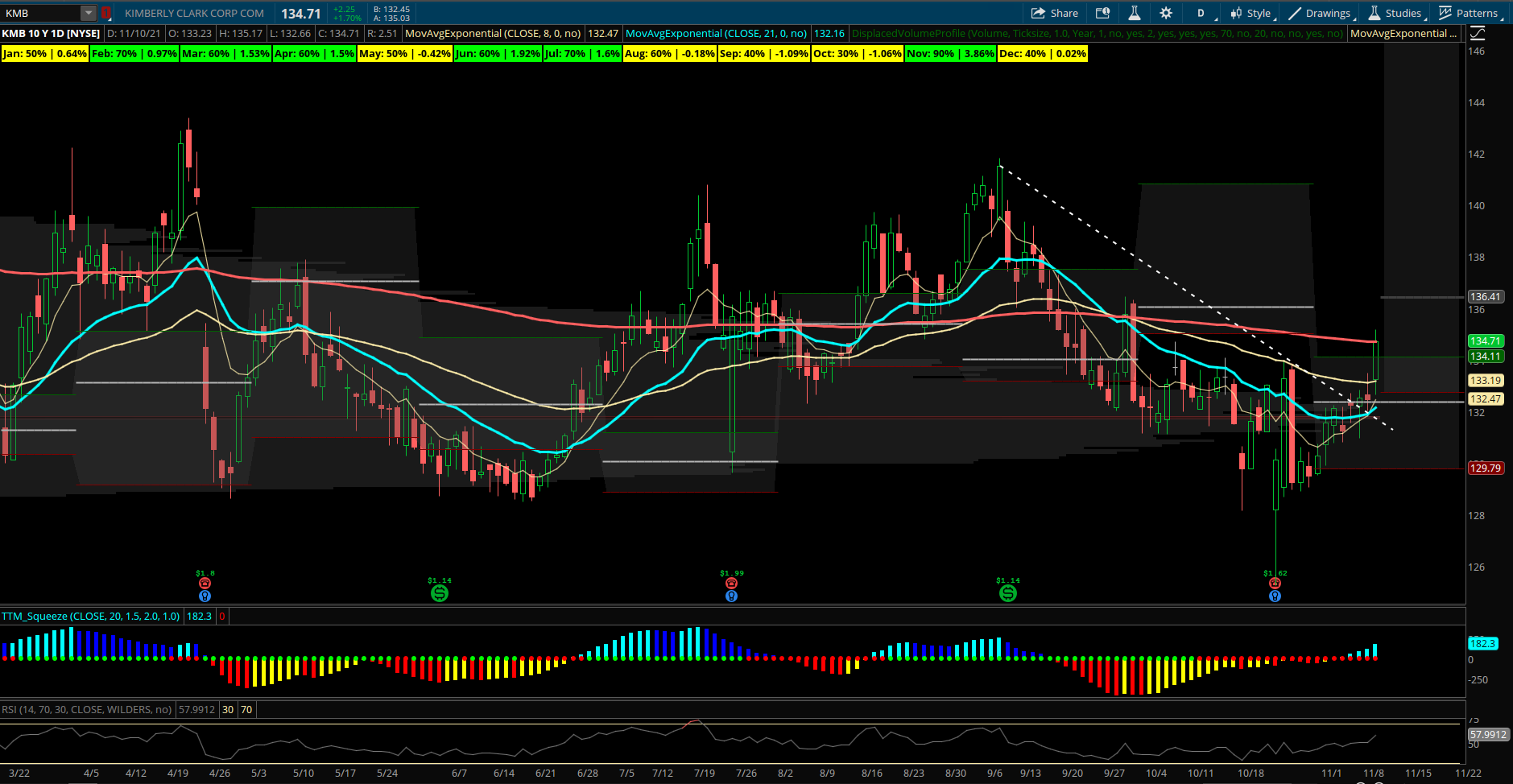

Kimberly Clark (KMB) – Consumer Staples held up well today while there was a risk off feel to the markets overall with bond yields, gold, and the dollar index stronger. If the market is to pullback into mid November, it makes sense to look at the Staples group for any potential seasonal patterns. XLP itself has tended to show strength in 8 of the last 10 November’s being higher for average gains of +2.25%. Within the group, KMB stands out best with 9 of the last 10 years being green in November for an average return of +3.9%. Not bad for a boring sector if the market is to cool off in the short term. On the chart KMB has been very sideways for most of the year but recently put in a bullish reversal candle after earnings and held the key 130 level. Today it broke out above monthly value and its 200 EMA. Potential for the stock to push up into the 140 zone from here with a squeeze forming on the daily after YTD VPOC held as support just under 132. KMB has a large trade still in open interest from a 8/13 buy of the January 2023 $125 calls for around $3.3M and also a recent November $130 risk reversal put on for a small debit of near $500k.