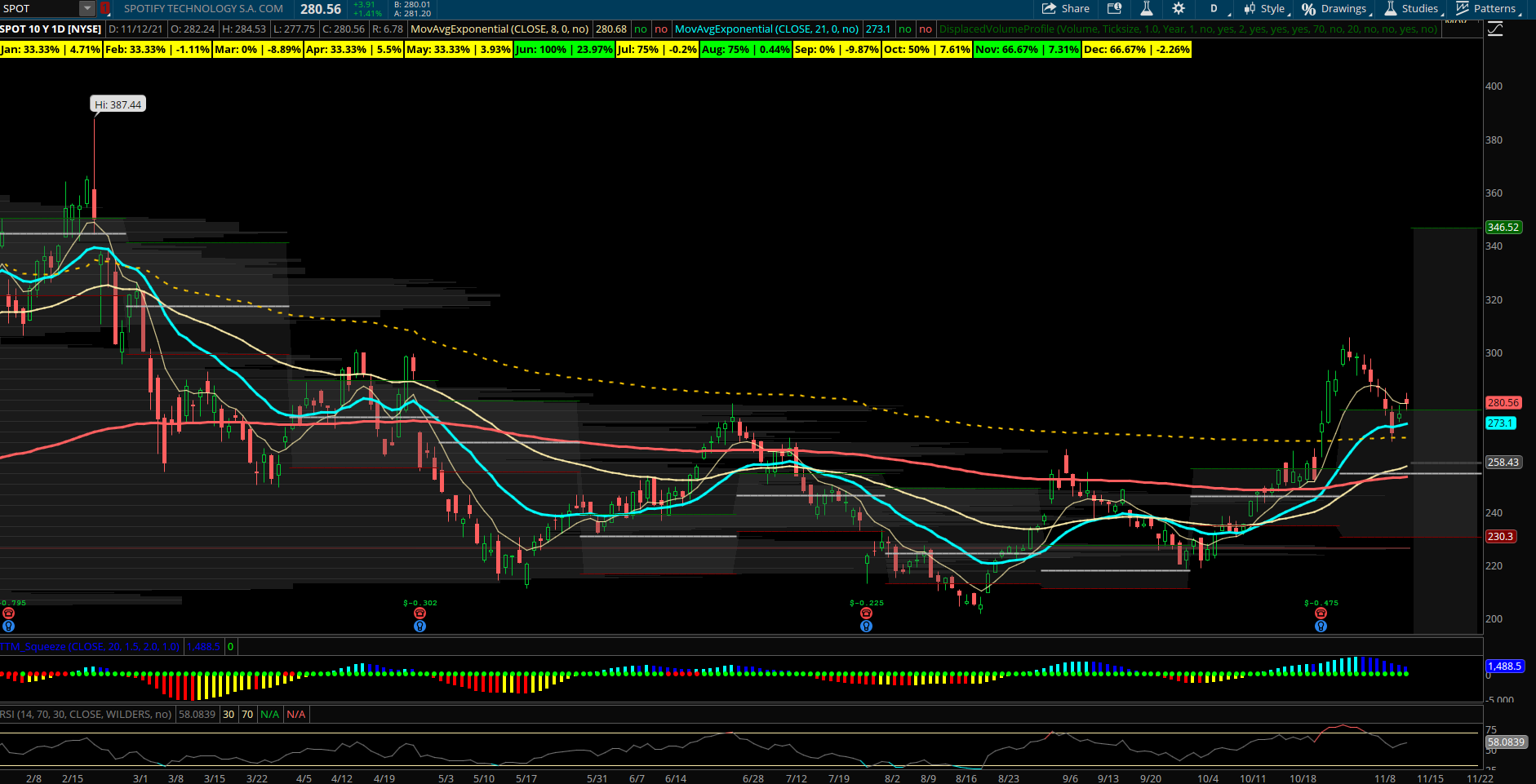

Credit Spread of the Week: Tech Innovator Ready to Stream Higher

Spotify (SPOT) – SPOT was one of the big gainers of 2020 and has taken most of the last 6 months to form a long base bottoming pattern around its YTD VPOC support zone near 250. Recently SPOT made a higher low to end September and rallied back over its 200 day EMA to show impressive momentum which led to a clearing of YTD VWAP at near 270. It has retested that level now on a minor pullback after making new 6 month highs. A new uptrend has emerged and with the stock still down -10% for the year it has plenty of room to catch up higher into year end with an upside volume node and VPOC near 320 and the top edge of yearly value at 346. SPOT has only been public since 2018 but seasonally in 3 years has been strong in November, up 2 of the 3 years for an average gain of +7.3%. With bullish options flows dominating the action since early October this appears to be a nice time to sell a bull put spread into this zone of large support expecting the stock to hold these levels higher into January. SPOT has been popular with opening put sellers lately, notably the December $270 puts sold to open and still partially in open interest. Also the January 2024 $240 and $210 puts sold for $5M each in mid October. On 10/29 a buyer of March $290 calls for over $2M.

Trade to consider: Sell SPOT January 270/260 put spread for 3.60 credit or better