ETF Sector Relative Strength Corner: Healthcare High Tight Flag Points to New Highs

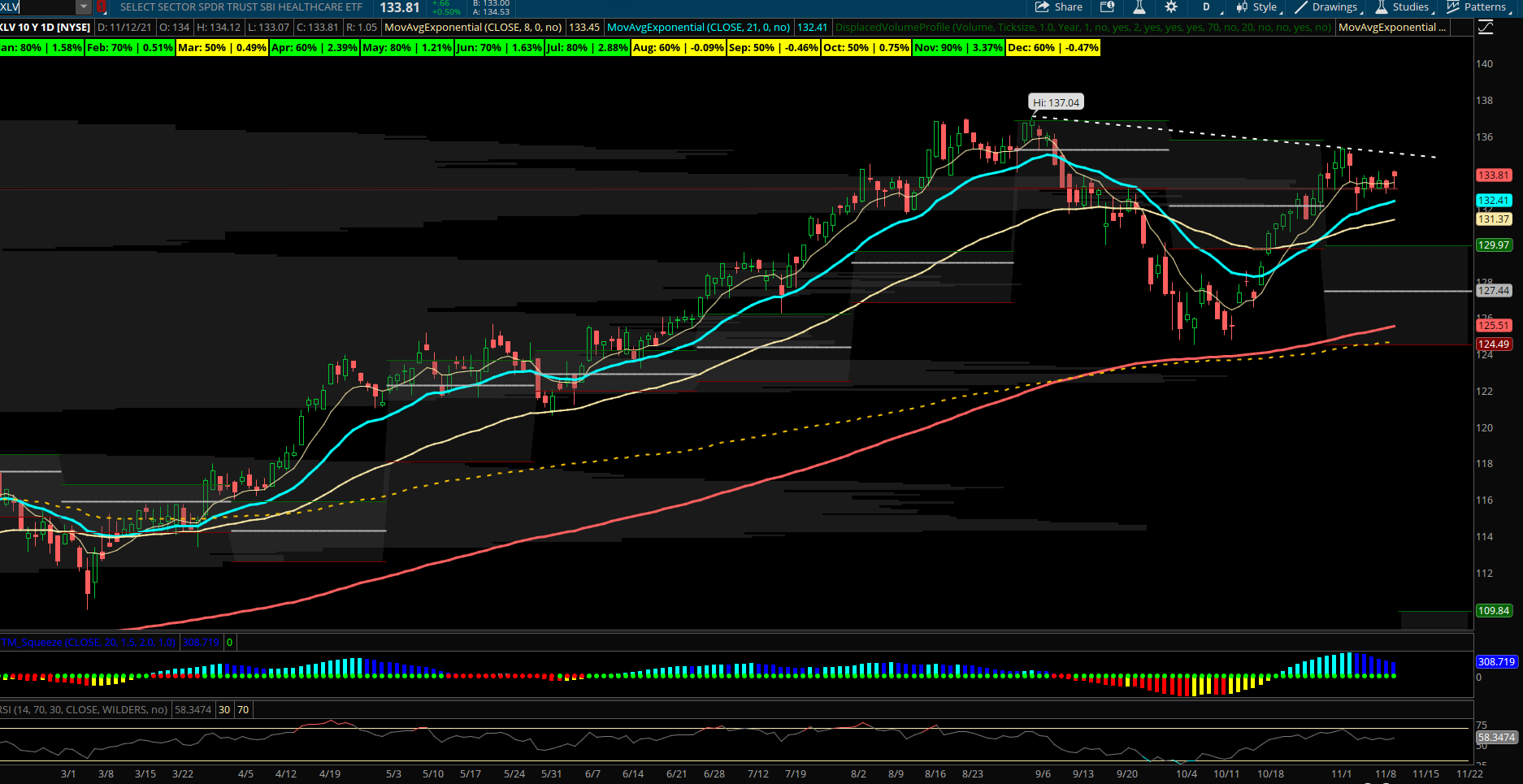

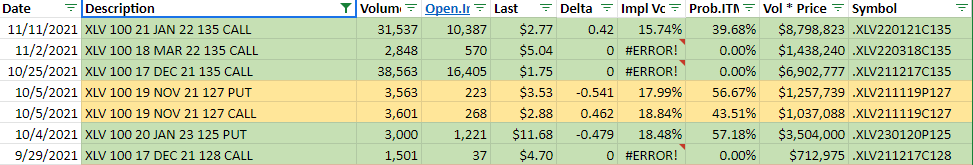

Healthcare (XLV) The XLV Healthcare ETF is the 2nd biggest sector in the S&P at about a 13.4% weighting in SPY. The sector is up 18% YTD and has consolidated recently to start November at YTD VPOC support near 133. The Healthcare group is flat this month but has a seasonal bullish tendency to close positive in November. 9 of the last 10 years being higher with an average gain of +3.4%. XLV pulled back in September to retest its upward trending 200 day EMA and bounced to resume its trend. The ETF can see some sector rotation into year end with money flow perhaps coming back in from other overextended groups like Tech. RSI is also staying above 50 on this current flag pattern. XLV is building a high tight bull flag and can breakout to new highs over 137 on an upside push into its stronger seasonal period. Also, bullish options flows are heating up in XLV and supporting a rally with a recent large buyer on 11/11 of 31,000 of the January $135 calls for over $8.7M in premium and on 10/25 a buyer of December $135 calls for $6.9M.

The ETF’s top holdings are UNH, JNJ, PFE, TMO, ABT, MRK, LLY, ABBV, DHR, MDT with the top 3 names UNH, JNJ, PFE making up about 22% of the index. The best looking charts in the space that are within 10% of 52 week highs include TMO, UNH, ABT, CVS, and ISRG . The group’s primary laggards that could provide mean reversion back higher to play catch up are MDT, BMY, and AMGN. As the overall stock market stays extended, watch for new sectors to try to carry the torch by making new highs. Healthcare is one of the groups that has room to run after a quiet start to November.