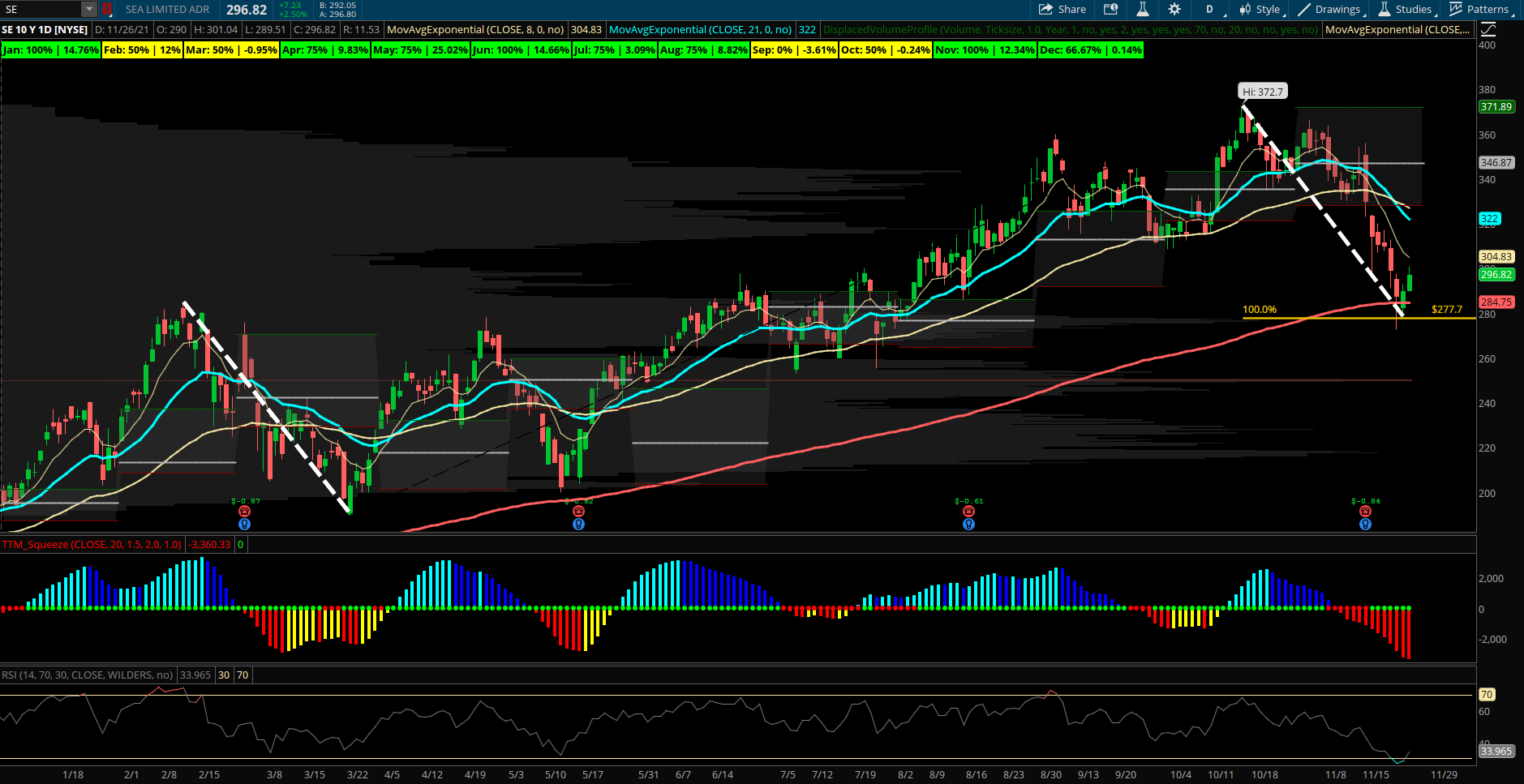

Credit Spread of the Week: E-commerce Growth Name Back to Long Term Support

Sea Limited (SE) – SE has corrected back to its 200 day EMA the past few weeks since its earnings report was sold. The stock saw some rotation with many of the other high growth tech names seeing pressure into mid November. SE closed green during Friday’s heavy selling in the markets and benefited from the online e-commerce spending theme that pandemic winners tend to outperform in. The stock peaked at 372 last month and has since pulled back just about exactly 100 points and bounced off the 275 level which was an untested VPOC level of volume support. Also interestingly, this 100 point dip was almost the same point move in the correction it had in February of this year. The Fibonacci projection tool compares the prior pullback to the current one projected support at 277. All this points to a large cluster of strong support in the 270-280 zone. Looking for the 280 level to hold into year end sets up a nice bull put spread opportunity. Options flows have stayed fairly bullish even during the pullback. On Friday 11/26, a large buyer of September $320 calls for $3M. SE is also a name that has seen many longer term opening put sales the last few months in expirations throughout 2022 and beyond. On 9/9, the Jan 2023 $320 puts were sold to open at $66.20 for over $5.2M and remain in open interest.

Trade to consider: Sell SE January 280/270 put spread for 3.60 credit or better