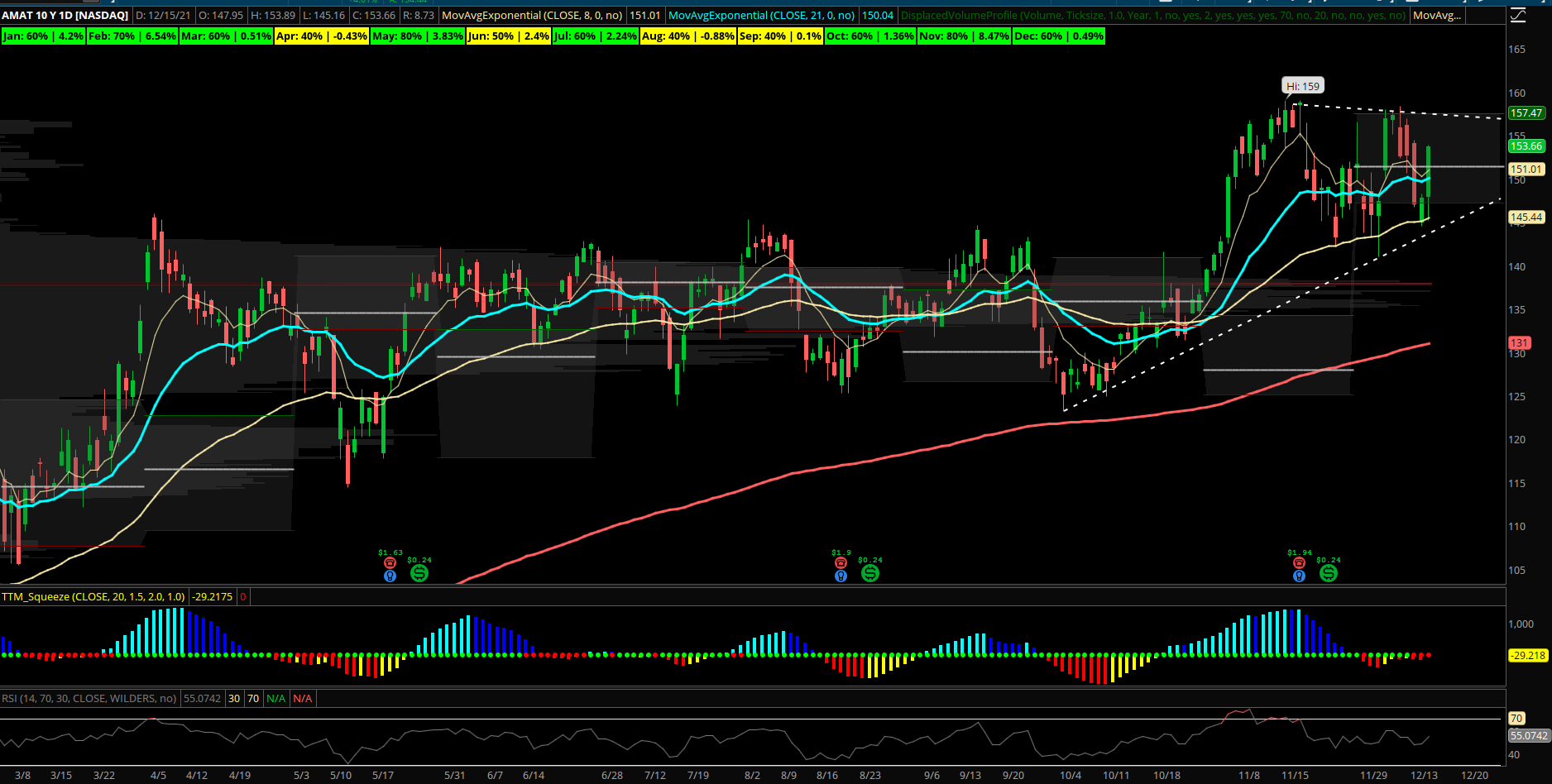

Seasonal Stock Setup: Tech Equipment Name Coiling in Squeeze Pattern

Applied Materials (AMAT) – AMAT has been a strong Semiconductor standout this year with the group leading the Tech rally. AMT spent most of Spring and Summer consolidating in a long base pattern which resulted in a breakout above YTD VPOC over 140 and a high nearly to 160 last month. The stock has since pulled back to test its rising 55 day EMA and bounced. Now closing today back above the 8 EMA after a strong reversal up with the market and looks poised to breakout into year end heading into its seasonally strong historical period. AMAT has been up 6 of the last 10 years in December but looking forward to January and February points to continuation as the stock has had an average gain in January of +4.2% and Feb +6.5% over the last 10 years. The stock has gained about 78% year to date in a strong trend and looks good above the 145 support level it has held this past month. Upside fib extension targets come in at 164 and 170 in the short term as the TTM squeeze could push it to new highs soon. Options flows have seen recent bullish opening put sales at the September $145 strike for $850k in premium and also on 11/23 a large buyer of June $155 calls at $13.75 for over $2M still in open interest.