Unusual Call Accumulation in Small Aerospace Supplier

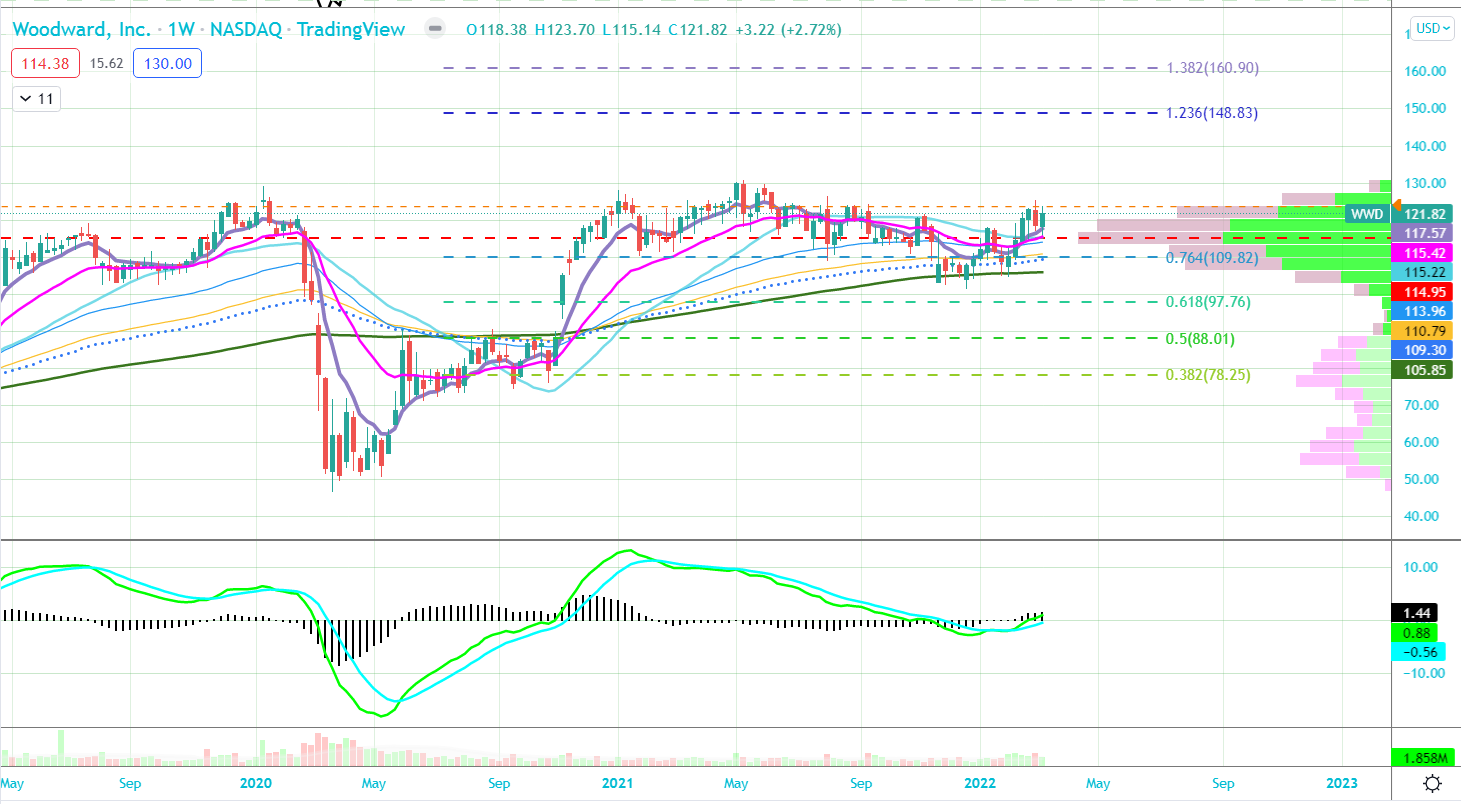

Woodward (WWD) with a buyer of 1000 April $125 calls on 3/11 for $5 and still as 1200 of the April $120 calls in open interest from buyers. WWD has a very strong chart considering the weak market with shares consolidating just under the 2021 highs with a Fibonacci extension target up at $160 on a breakout and weekly MACD in a buy signal. WWD is an independent designer, manufacturer, and service provider of control solutions for the aerospace and industrial markets. WWD’s sales to its top five customers account for 45% of revenues with Boing and GE its top customers. WWD has a market cap of $7.85B and trades 25.5X Earnings, 28.9X FCF and 17.4X EBITDA with EBITDA seen rising 11.4% in 2022 and 15% in 2023 as it nears a strong Y/Y growth phase. Truist raised shares to Buy in January with a $143 target citing the return of commercial aerospace and its outsized exposure to narrow body and increasing aftermarket demand.