Hasbro (HAS) Earnings Preview

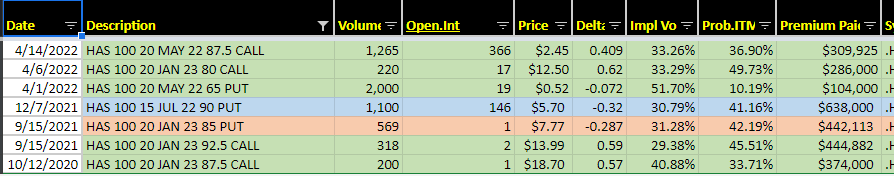

Hasbro (HAS) set to report earnings on 4/19 before the open with the Street looking for $0.61 on $1.15B in sales. Next quarter is guided to $0.94/$1.32B while the FY is $5.15/$6.61B. HAS shares have closed higher in three of the last four with a nearly 7% average closing move and 12.24% max move. The current implied move is 5.15%. HAS flows have been bullish recently with a buyer of 1250 May $87.50 calls on 4/14, 2000 May $65 short puts on 4/1, and the January $87.50 and $92.50 calls with smaller buys. Shares have pulled back to a key breakout spot from late 2020 at $81.50 and starting to turn the corner last week with room above $86 to run up to $89 and then $94. The $11.65B company trades 14.65X earnings, 1.8X sales, and 37.5X FCF with a 3.3% yield. HAS is coming off of a mixed quarter but optimistic on the FY as they branch out further into consumer products, gaming and entertainment including feature films which are expected to accelerate revenue and operating profit growth. HAS is focusing much more on digital gaming and entertainment which will best utilize their significant IP and brand names. HAS is facing a very public battle with activist Alta Fox who holds 2.5% of stock. The firm has nominated a slate to their board as they think new management is necessary to turning around years of underperformance including poor capital allocation choices. Alta Fox wants the company to consider a split. Goldman lowering estimates on 3/24 but positive on new products. The firm notes Hasbro is expanding more aggressively into preschool, with Peppa Pig, PJ Masks, and Baby Alive being supported by new video content to expand play patterns and create opportunities for toy innovation. DA Davidson lowering estimates in February as they think Q1 gross margin will be impacted by cost inflation.