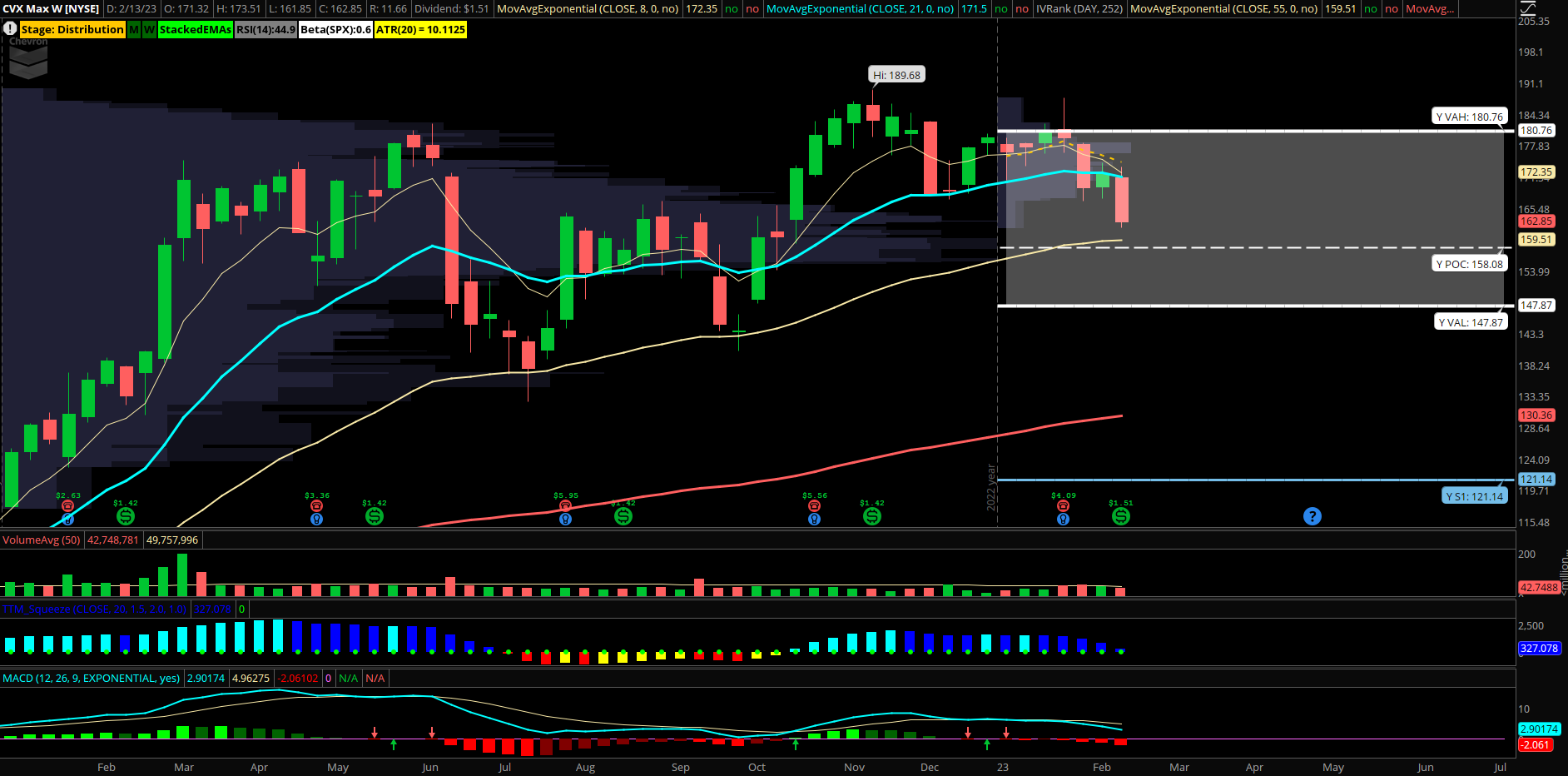

Bull Put Spreads in Mega Cap Integrated Oil Leader Pulling Back to Support

Chevron (CVX) has pulled back to the large volume node of the last year as it nears the 2022 yearly POC at 158 after a recent pop above the value area was rejected on the large buyback news. A quick 13% pullback offers up a support zone nearing to sell put spreads into for a bounce that can likely hold this 160 area and retest back to 170-175. Options flows have seen some recent opening put sales including on 2/15 an opening sale of 5900 March $170 puts at $5.50 looking for prices to stay near that level into March. CVX also has 650 September $150 short puts in OI sold at $6.25 and the massive 2500 January $200 ITM short puts still in OI from sellers on 10/19 at $43.25.

Trade to consider: Sell CVX April $160/$150 bull put spreads at $3.00 credit or better. Targeting 50% profit of the credit.