ETF Sector Corner: Utility Group Building Basing Pattern into Strong Seasonality

Utilities Select Sector SPDR Fund (XLU) – This Sector SPDR is one of the most popular options for investors looking to gain exposure to the U.S. utilities sector, a corner of the domestic stock market known for relatively low volatility and relatively high distribution yields. A fund like XLU might be useful for establishing low risk equity exposure or for enhancing the current returns generated by the equity side of a portfolio. Like most sector-specific ETFs, XLU is probably most appealing to those implementing a sector rotation strategy or looking to establish a tactical tilt towards this low beta sector of the U.S. market. Those building a long-term buy-and-hold portfolio will likely achieve utilities exposure through broad-based equity funds (though the allocation to this sector can be relatively small). Investors should be wary of unintentional over-concentrations, since many dividend ETFs and low-volatility funds have a significant slice of their assets invested in utility stocks.

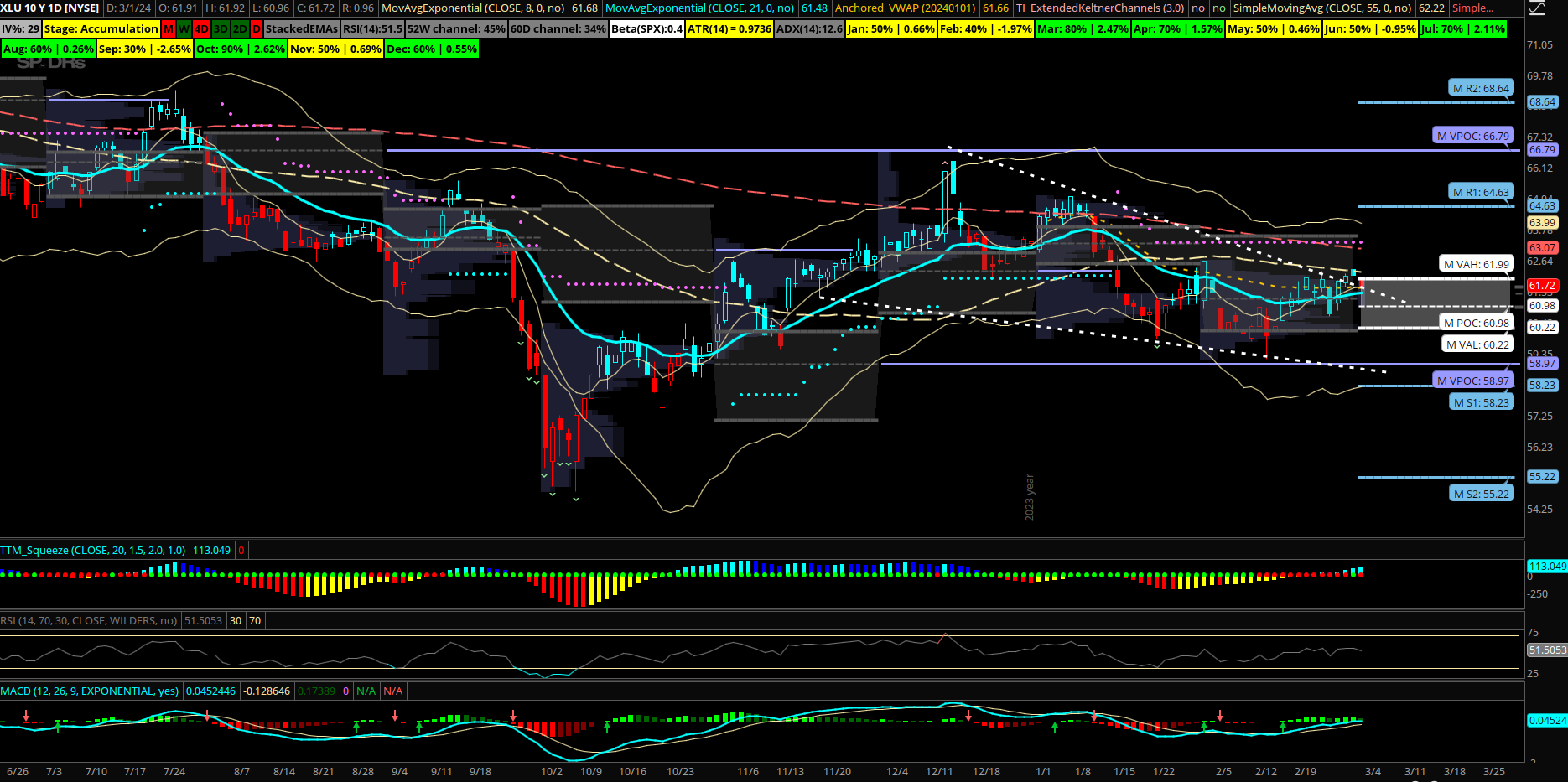

The ETF’s top holdings in order of weight include NEE, SO, DUK, CEG, SRE, AEP, AEP, D, EXC, PCG, XEL, PEG, ED, EIX, WEC, AWK. The ETF has 31 holdings and uses a market cap weighting scheme. The top 10 names make up 59% of the fund. Large caps (>$13B) make up 93% of the index. Mid-caps ($2.7B-$13B) make up 7% of the fund, while small caps (<$2.7B) are at 0%. The highest weighting in the fund is currently NEE at a 12.4% weighting. Shares have been forming a bullish falling wedge near the 60 level after a choppy start to the year but could be turning higher now above 63 where the 200-day MA sits overhead as a key line in sand. A rally above that can see 67 as a large VPOC while the 70 level would line up with 2023 yearly value area.

The XLU has strong Seasonality in March and April showing the past 10 years higher 8 times in March with an average return of +2.5%, sizeable gains for a utility fund. Average gains in April were also positive at +1.6% the past decade. Going back 20 years also shows similar returns in March being higher 15 of 20 years for +1.7% gains while April has been positive in 16 of the past 20 years for an average return of +2%. XLU last week saw a large trade with 5000 January 2026 $54 puts sold to open for 2.40.