Small Cap Profile: Modernizing Bill Payments a Massive Opportunity for this Disruptor

Paymentus (PAY) has been impressive, shares +29% YTD and quickly recovered from as much as a 19% drop on results in the May earnings report and were higher sharply the six reports prior. PAY is near a two-year high with some resistance near $24 and room up to $30.

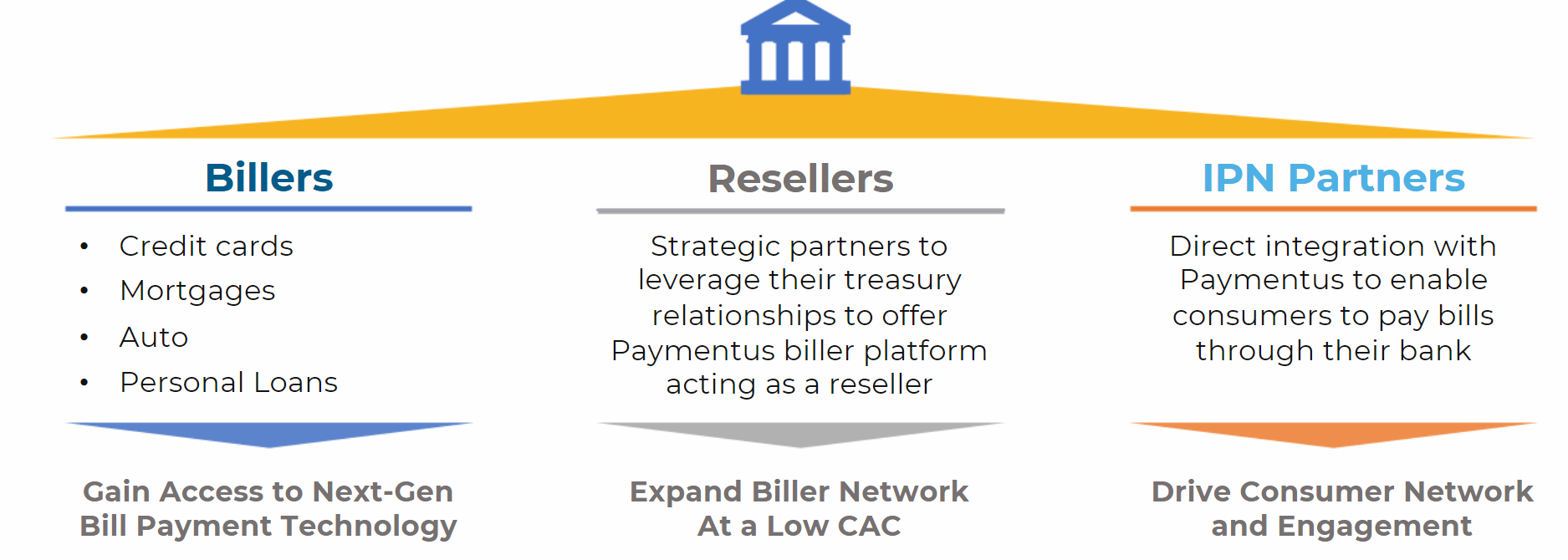

PAY is a leading provider of cloud-based bill payment technology and solutions to more than 2,200 biller business and financial institution clients. Its platform was used by approximately 34 million consumers and businesses globally in December 2023 to pay their bills, make money movements and engage with clients. PAY serves financial institutions by providing them with a modern platform that their customers use for bill payment, account-to-account transfers and person-to-person transfers. The platform provides clients with easy-to-use, flexible and secure electronic bill payment experiences powered by an omni-channel payment infrastructure that allows consumers to pay their bills using their preferred payment type and channel. PAY extended its platform’s reach through Instant Payment Network, a proprietary network, consisting of tens of thousands of billers, that connects integrated billing, payment and reconciliation capabilities with partner platforms. The platform supports omni-channel and multi-dimensional, electronic billing and payments across multiple commerce channels, including online, mobile, interactive voice response, or IVR, call center, chatbot, retail and voice-based assistants.

PAY’s market opportunity is the 16.8B bills paid annually in the US where it has a 2.7% market share. PAY reduces operational expenses and cost to serve through process automation, digital adoption and elimination of disparate systems. PAY is growing through direct sales into large industries, channel partners, SMBs, Banks and more. Paymentus is winning business from legacy providers and displacing in-house solutions by offering a platform that simplifies payments and provides an attractive business case and ROI for billing companies across various verticals. The company’s vertical mix includes utilities (50% of business), insurance, financial services, telecommunications, and healthcare, with opportunities for growth across all verticals.

PAY has a market cap of $2.87B and trades 44.5X Earnings, 30X EBITDA and 43.5X FCF with revenues seen growing near 20% annually and 25% EPS growth, a very strong growth story. PAY is a strongly growing profitable business with 26.8% CAGRs for revenues and EBITDA since 2020, operating at 24% Adjusted EBITDA margins. The company’s same-store sales growth is the biggest contributor to its growth, driven by the digitalization tailwinds as new generations prefer to pay using the latest platforms and better user interfaces. PAY has seen improving trends in its pipeline and backlog in the past few quarters. Paymentus is seeing strong demand for its non-discretionary bill payment services, which it believes will continue to perform well even in a potential recession, given its pricing model and ability to improve customer experience and reduce costs for its customers.

PAY valuation is certainly full but the company has a massive opportunity for durable growth and is a quality name to own as the billing process is modernized.