Small Cap Biotech in Kidney Diseases with Bullish Options Positioning

Travere Therapeutics (TVTX) is worth taking a closer look as December 2025 short put open interest surged to 4,976 after sales at $3 on 8/26 added to former large sales from 5/7 at $3.7. These high Delta ITM put sales show major confidence in the small cap biotech.

TVTX shares are flat YTD and down 31% over the past year, but forming a monthly support base at key long-term support in the $6-$8.50 zone. TVTX shares have a large volume pocket above $10 back to the $15 level.

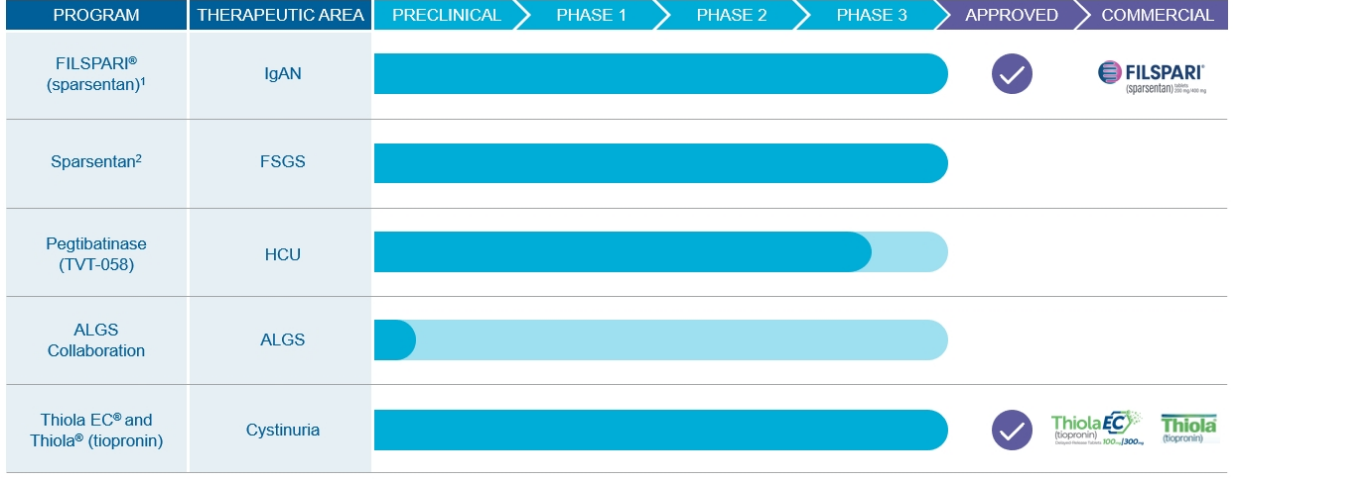

TVTX is a biopharmaceutical company focused on identifying, developing and delivering life-changing therapies to people living with rare kidney and metabolic diseases. In February 2023, the U.S. Food and Drug Administration (FDA) granted accelerated approval to its first development program, FILSPARI® (sparsentan), which is indicated to reduce proteinuria in adults with primary IgAN at risk of rapid disease progression. Sparsentan is also in late-stage development for focal segmental glomerulosclerosis (FSGS). IgAN and FSGS are rare kidney disorders that lead to kidney failure. TVTX is also advancing pegtibatinase, a novel investigational enzyme replacement therapy for the treatment of classical homocystinuria (HCU), a genetic disorder caused by a deficiency in a pivotal enzyme essential to the body. Pegtibatinase has the potential to become the first disease-modifying treatment for homocystinuria.

Travere estimates the addressable market for FILSPARI can grow from the initial 30,000-50,000 patients to up to 70,000 patients, driven by increased awareness and identification of patients, as well as potential changes to treatment guidelines. Travere expects the upcoming KDIGO guidelines to be important, as they will likely characterize combination therapy as the future for IgA nephropathy and position FILSPARI as the only medicine that can replace ACEs and ARBs and address the specific kidney activation.

TVTX has a market cap of $690M and trades 2.1X Cash and 12X FY27 revenue estimates which recently jumped higher after multiple quarters of fading estimates. TVTX revenue growth is seen at 55.6% in FY24 and 47.9% in FY25. Filspari continues to show a steady growth trajectory with Q2 revenue $27M beating the $25M consensus. Multiple APRIL/BAFF inhibitors enter the U.S. market in the 2026 which will result in competition in the IgA nephropathy, or IgAN, treatment space. TVTX has an upcoming 9-5-2024 PDUFA for full approval of FILSPARI.

TVTX short interest is at 13.2% of the float, dropping from June highs near 18%. Analysts have an average target near $15.