IPO Profile: Loar the Next Big Thing in Aerospace Compounders

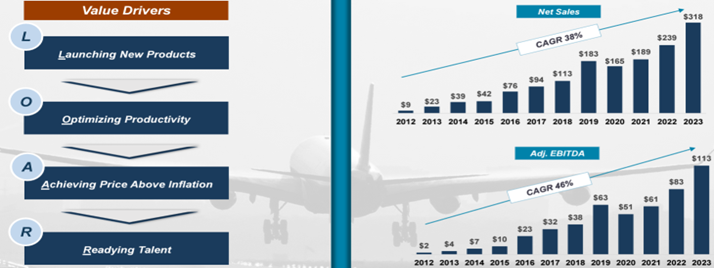

Loar Holdings (LOAR) shares have risen 50% since the IPO in April and shares currently forming a nice flag pattern following a surge higher on a very strong earnings report.

LOAR specializes in the design, manufacture, and sale of niche aerospace and defense components that are essential for today’s aircraft and aerospace and defense systems. LOAR saw 85% of 2023 net sales being derived from proprietary products where it is a market leader. LOAR has roughly 52% exposure to the highly recurring Aftermarket business. The commercial aerospace market represents 45% of sales, followed by 24% for business jets and 9% in Defense.

Products include auto throttles, lap-belt airbags, two- and three-point seat belts, water purification systems, fire barriers, polyimide washers and bushings, latches, hold-open and tie rods, temperature and fluid sensors and switches, carbon and metallic brake discs, fluid and pneumatic-based ice protection, RAM air components, sealing solutions and motion and actuation devices, among others.

Loar is benefitting from the current environment within Aerospace OEM as demand exceeds supply. This potentially extends the life of the current fleet allowing for continued revenue opportunities in the aftermarket, the higher profitability business for the company. Demand for assets in a supply constrained, strong demand environment provides the opportunity for pricing power. Additionally, air traffic remains ~32% below normalized levels in a no-Covid scenario providing further runway for growth.

LOAR now has a market cap of $6.55B and trades at wild valuation levels of 98X Earnings, 43.7X EBITDA and 370X FCF. LOAR revenues are seen rising 15-20% annually the next two years with 72% EPS growth in FY25 and 41% growth in FY26. LOAR has a limited float with insiders and equity owners at 82% of outstanding shares giving it scarcity value.

Citi sees a path to $115 per share over time given the firm’s forecasted five-year earnings power of the company expects low-teens organic growth over the next several years driven by the expansion of airline traffic, higher build rates, new product introductions, higher pricing, and share gains. It also expects acquisitions to play an important role in Loar’s growth.

Loar is essentially seen as a mini Heico (HEI) or TransDigm (TDG). TDG and HEI businesses have proven to be resilient, highly profitable, growth oriented, acquisitive, and highly cash generative, providing the stocks a premium valuation in the marketplace.