A Small Cap AI Data Partner for All Models

Innodata (INOD) shares are down 10% over the past month though still higher by 95% YTD and recently say buyers in November $24 and $26 call spreading with 2X the $30 and $35 calls. INOD is worth taking a closer look at as a small cap growth name.

INOD is a leading data engineering company that is delivering the highest quality data for some of the world’s most innovative technology companies to use to train the AI models of the future. AI learns from data, and the highest-performing AI will have learned from the highest-quality data. INOD is also helping companies deploy and integrate AI into their operations and products and providing innovative AI-enabled industry platforms, helping ensure that our customers’ businesses are prepared for a world in which machines augment human activity in ways previously unimaginable. Companies across industry verticals are seeking to develop AI-based applications for an ever-increasing variety of use cases such as self-driving cars, surveillance systems, automated medical diagnostics, digital assistants, chatbots, content moderation, robotics, fraud detection and contract review.

Data science teams at some of the largest technology companies are accelerating development of generative AI technologies that produce high quality text, code, and images in response to user prompts. At their core, they rely upon large language models (LLMs), which are deep neural networks (an artificial intelligence architecture) with billions of parameters and requiring massive amounts of training data to encode the essence of human language. They require fine-tuning through supervised learning and reinforcement learning from human feedback (RLHF) to render them suitable for specialized tasks and domains, to control hallucinations (the tendency of these models to make up things on the fly), and to minimize the risk that they generate unsafe or biased results. Developing high-quality training data is critical for the AI to perform correctly, but often requires technology and skilled human resources that data science teams lack. Moreover, developing high-quality data takes up 80% of the time for most AI and ML projects. Data sciences teams seek partners that can perform these data preparation functions for them at large-scale and at high quality, while using automated tools to minimize cost. As AI projects become more specialized and mission-critical and data preparation becomes increasingly complex, data science teams seek partners with deep domain knowledge and an infrastructure in which data security is assured. Innodata is ideally situated to partner with data science teams. INOD is working with five of the largest technology companies, and several of the world’s leading brands spanning multiple verticals, to enable, accelerate or enrich the services they deliver to end users around generative AI foundation models and other AI that supports chatbot assistance, facial recognition, social networking, gaming, drones, medical diagnostics and robotics, to name a few.

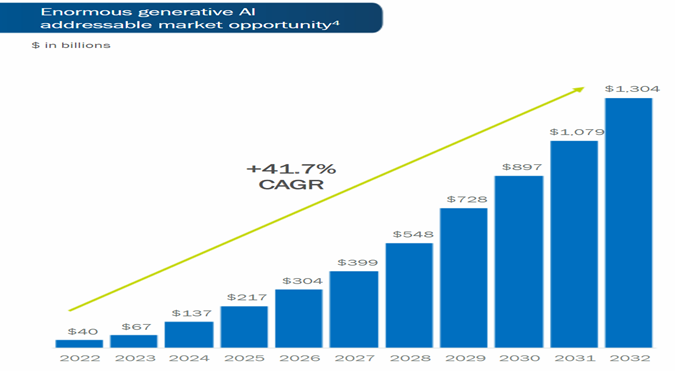

The AI data training market is estimated to be $2.57 billion in 2024, projected to grow at a CAGR of 18% to reach $13.45 billion by 2034, essentially proxying the enormous growth expected in AI system spending overall ($154 billion in 2023, $300 billion in 2026, a 27% CAGR). Similarly, the global data annotation tools market was valued at $1.8 billion in 2022, projected to reach $25 billion by 2032, which is a CAGR of 25%.

INOD has a market cap of $460M and trades 27X Earnings, 2.7X EV/Sales and 16.4X EBITDA for the next twelve months. INOD revenues are seen rising 30% in FY25 and 21% in FY26. EBIT is seen rising 78.7% in FY25 and 25% in FY26. INOD has contracts with five of the Magnificent 7. In Q2, INOD posted 66% Y/Y organic revenue growth while adding two new large tech customers. INOD has a clean balance sheet lacking debt while having $16.5M in Cash. INOD is expected to shortly sign a prominent social media platform that is building its own Generative AI models and would be a new customer for Innodata. INOD has started to integrate Agility, purpose built generative AI layer that enables PR professionals to get more done in less time and at lower costs, and strong early win rates.

Short interest is elevated at 12.5% of the float. Analysts have an average target of $30. Maxim and BWS Financial both have $30 targets and Craig Hallum recently started shares at Buy with a $23 target. Wolfpack Capital and J Capital have each issued short reports on INOD, not believing the hype, but to this point INOD is delivering very strong numbers.