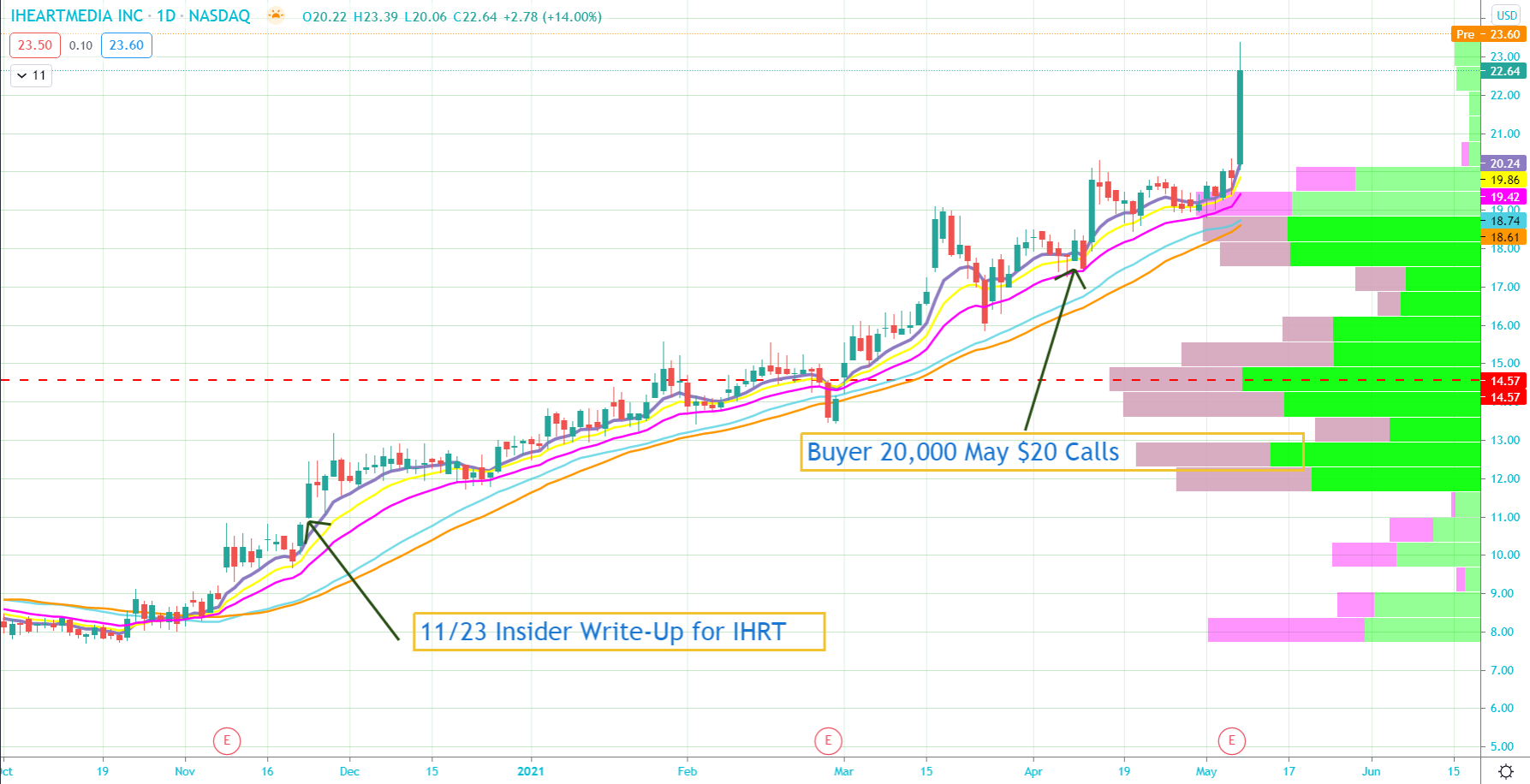

iHeartMedia (IHRT) Insiders and Option Traders Catch Sharp Rally

We pride ourselves with our ability to utilize all methods of equity research and IHRT is a nice example of a combination of factors leading to a strong return. On 11/23/2020 we posted an “Insider Write-Up” as follows:

“iHeartMedia (IHRT) large open market buy this week from CEO Robert Pittman of 20,000 shares at $10.15, a more than $200,000 investment. IHRT has seen buying from two other directors in 2020 with one over $500,000 at $8.85 and another $437,000 at $10.94. The $692M company has traded weak in 2020 down 35% but gaining some momentum recently and looking to clear a wide base above $11 with room back to as high as $18. Shares trade 39.3X earnings, 0.23X sales, and 1X cash with strong FCF and limited near-term debt. IHRT operates as a multi-faceted music and entertainment company with a primary focus on broadcast radio, digital streaming, and on-demand programming. They recently launched a sports network with 75M user reach. IHRT is also investing heavily in building out their podcasting business and monetization of some of their more popular hosts like Hillary Clinton, Will Ferrell and Shonda Rhimes. Their live events business has been basically a zero since March but would get a significant boost with a return to normalcy in mid-2021. They noted earlier this month on a potential vaccine impact, “if we get a vaccine, we can see the return of some big spenders, like movies, concerts, some of the retail that has not come back so much, local businesses like the local restaurants. So we think it’s has a tremendous, can have a tremendous impact on our business and are watching it carefully.” Analysts have an average target for shares of $10. B Riley with an $11 PT in July noting that IHRT remains an industry-leader and the most attractive way to play a potential recovery in radio and ad spending. Short interest is 16.5%. Hedge fund ownership fell 6% in Q3. Liberty Media buying 6.9M shares while Senator Investment, Hudson Bay Capital, and Half Sky Capital all new buyers. In July, Liberty got the greenlight from the DOJ to boost their ownership to 50% from 5%.”

On 4/9/2021 we posted multiple alerts on May $20 call buying with more than 20,000 contracts bought on the day. A few days later on 4/13 we posted a BAML upgrade to Buy note that served as another catalyst for a leg higher in shares. Our ability to bring together our significant reach of resources continues to capture great trades very early in the moves!