CarMax (KMX) Earnings Preview

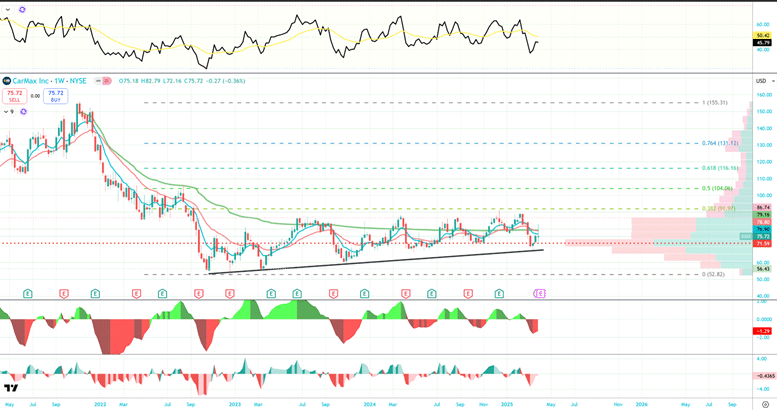

CarMax (KMX) will report earnings 4/10 before the market open and the Street consensus at $0.66 EPS and $5.964B in Revenues (+6%) while Q1/FY26 seen at $1.26/$7.46B and $3.92/$27.39B implying 2026 revenue growth of 4% with 7.8% EBITDA growth and 20% EPS growth. KMX shares have closed higher on earnings the last three reports and six of the last eight with a six-quarter average max move of 10.65%. CarMax, Inc. operates as a retailer of used vehicles and related products that offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services. The CarMax Auto Finance segment provides financing alternatives for retail customers across a range of credit spectrum and arrangements with various financial institutions. KMX has a market cap of $11.65B and trades 19.3X Earnings, 26.3X EBITDA and 34.5X FCF, valuation in the 60th to 75th percentiles on a profits basis with EBITDA margins at the 18th percentile which has been the major headwind for shares. KMX continues to see increased adoption of its omni-channel retail experience, with approximately 15% of retail unit sales being online in Q3, up from 14% YoY. KMX expects margins per unit to be up slightly YoY in Q4, not as much as experienced YTD, as it will be lapping over the initial rollout of margin increases that took place in Q4 of last year. KMX’s second consecutive quarter of >4% y/y same store growth, stability in GPUs, largely in-line SG&A, and a beat in CAF creates some optimism in operating momentum. KMX’s ability to source vehicles directly from consumers and dealers at competitive prices (over 70% self-sufficiency) plays a significant role in its pricing strategy and margin management. KMX may benefit from tariffs as the cost of new cars rise and consumers choose to buy used cars instead. As new car dealerships face challenges due to higher prices and constrained supply, CarMax could capture a larger share of the automotive market. However, an overall weakening consumer environment could offset many of the benefits. KMX held an Investor Day in October noting its transition period moving from heavy investment in their omnichannel platform to driving ongoing cost efficiency at scale. As KMX moves into execution mode, the key lever to unlock operating leverage is volume recovery. Analysts have an average target of $90.50 and short interest remains high at 7.7% of the float but down from 12% in November. Stephens upgraded to Overweight with a $90 target into its report on valuation, an analysis of both real-time unit sales and credit metrics and a belief that CarMax will likely marginally benefit from most tariff scenarios, at least in year one. Evercore upgraded in February to Outperform with a $110 target on improving comps with a widening used versus new car transaction price gap. It says the Street’s earnings estimates do not reflect CarMax’s sustained mid-single digit retail used unit comp trends, improving market share, and cost leverage. KMX’s chart actually has a promising set-up with shares making higher lows on the weekly since 2022 and holding up well during the latest market rout. KMX has major support at $70 while resistance has been the 38.2% Fibonacci at $92 and clearing $79 which is the 21-week EMA would open up a move to that level with the 50% retrace target up at $104. The $65/$86.50 zone contains years of value. KMX options are pricing in an 8.25% move and 30-day IV Skew at 0.3 compares to the 1.9 52-week average. KMX put/call open interest ratio is at the 1st percentile and average IV30 crush is -36.8%. KMX had some small September $72.5 and $65 put buys on 3/11 while 3000 April $82.5 calls sold to open on 4/1, 3000 April $85 calls sold with the $75 calls bought on 3/13, though some of the $75 calls have now closed and a large buy-write from 3/7 with June $77.50 calls sits in open interest 4000X with implied call away value at $84.

Trade to Consider: Long KMX April $75/$82.5 Call Spreads at $3