Credit Spread of the Week: Aerospace Leader Due for Flight

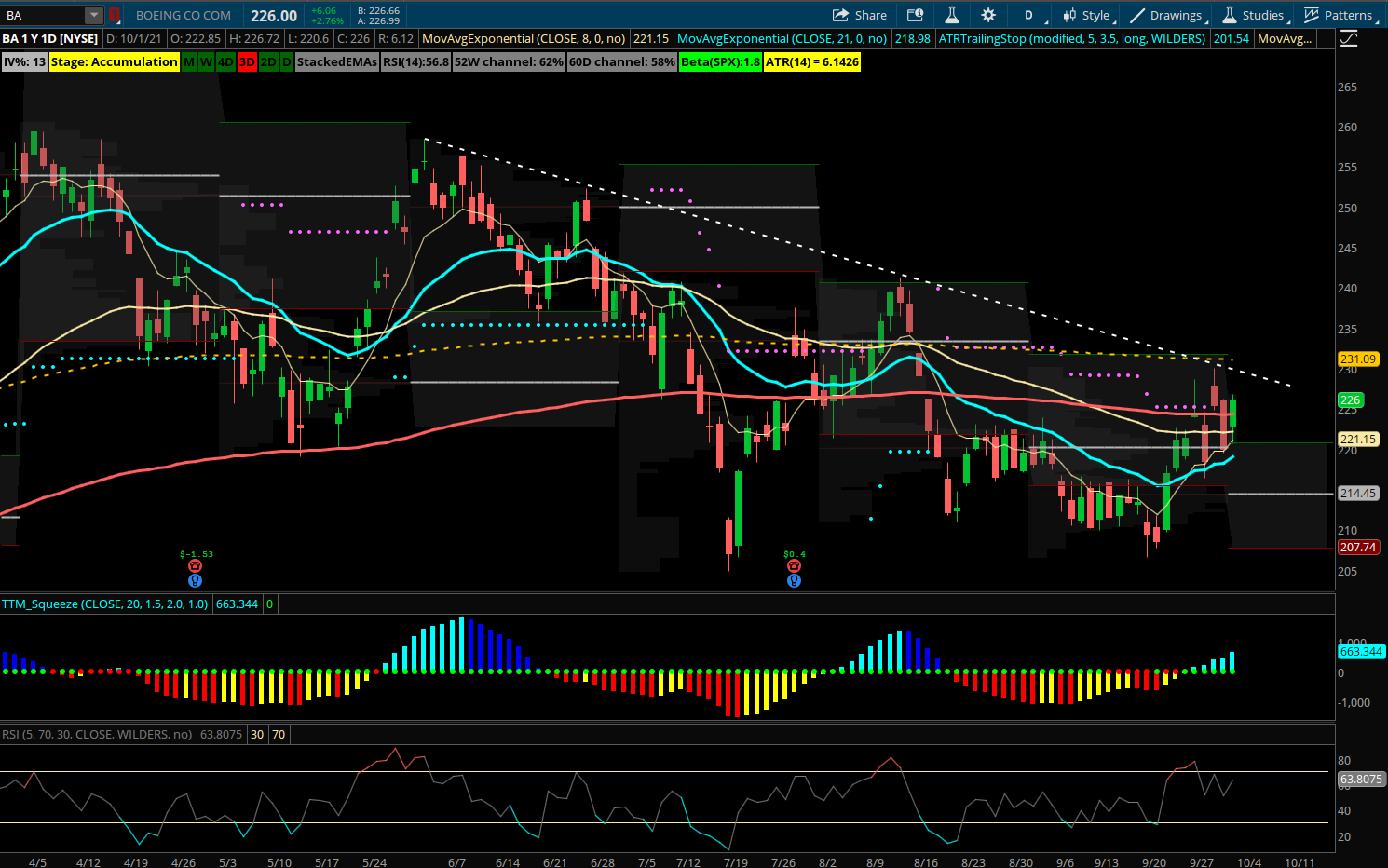

Boeing (BA) – Boeing has been in a downtrend most of the summer as industrials have underperformed but on a longer term timeframe came back down to year to date value low and held support near 210. The stock is back above its 55 and 200 EMA as the 8/21 EMA had a recent bull cross. RSI has pushed back over the 50 level and now at 56 leading the move up. It appears BA is on track to work back above its trendline from the May highs and a bull put spread is a good way to play the move off lows once a name regains its key moving averages. 220 is a solid support with the cluster of EMA’s and monthly value area down under that. Looking for some more of the value sectors to possibly see money flows into Q4 should give BA a chance to stay above these current levels. BA has recently seen a few large opening put sales in long term expirations. The Jan 2023 $175 puts were sold for $2.4M, and the Jan 2024 $205 puts sold for $2.3M.

Trade to consider: Sell BA November 220/210 put spread for 3.25 credit or better