Data Center Pick and Shovels Play Positioned for Strong Multi-Year Growth

Applied Optoelectronics (AAOI) has been a hot momentum name gaining 240% over the last six months and with recent market weakness pulled back to test the rising 55-MA last week. AAOI is at an interesting spot as a large position of 4000 March $35 short puts remains in open interest along with 5000 March $50 calls bought and 6000 March $40 short straddles, so a potential spot to be buying the dip. AAOI next reports on 2-26 capturing the March positioning.

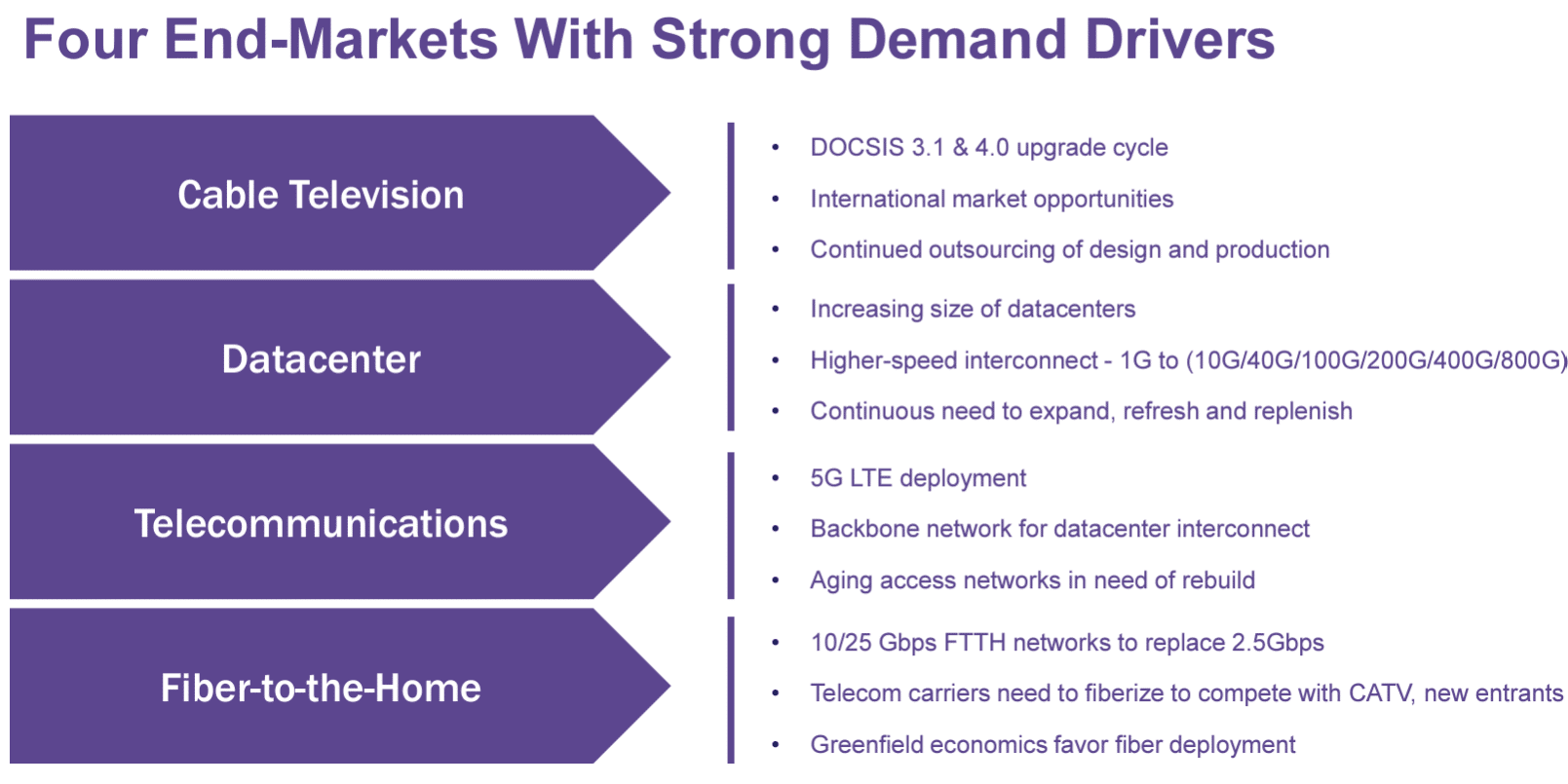

AAOI is a leading, vertically integrated provider of fiber-optic networking products, primarily for four networking end-markets: internet data center, cable television, telecommunications, and fiber-to-the-home. AAOI is primarily focused on the higher-performance segments within its segments which increasingly demand faster connectivity and innovation. Its end-markets are all driven by significant bandwidth demand fueled by the growth of network-connected devices, video traffic, cloud computing and online social networking. Fiber-optic networking technology is becoming essential and often the only economical way to deliver the desired bandwidth. The internet data center market is currently our largest and fastest-growing market. The rapid adoption of AI is fueling a new wave of investment by hyperscale data center operators, as AI computing is very compute and bandwidth intensive.

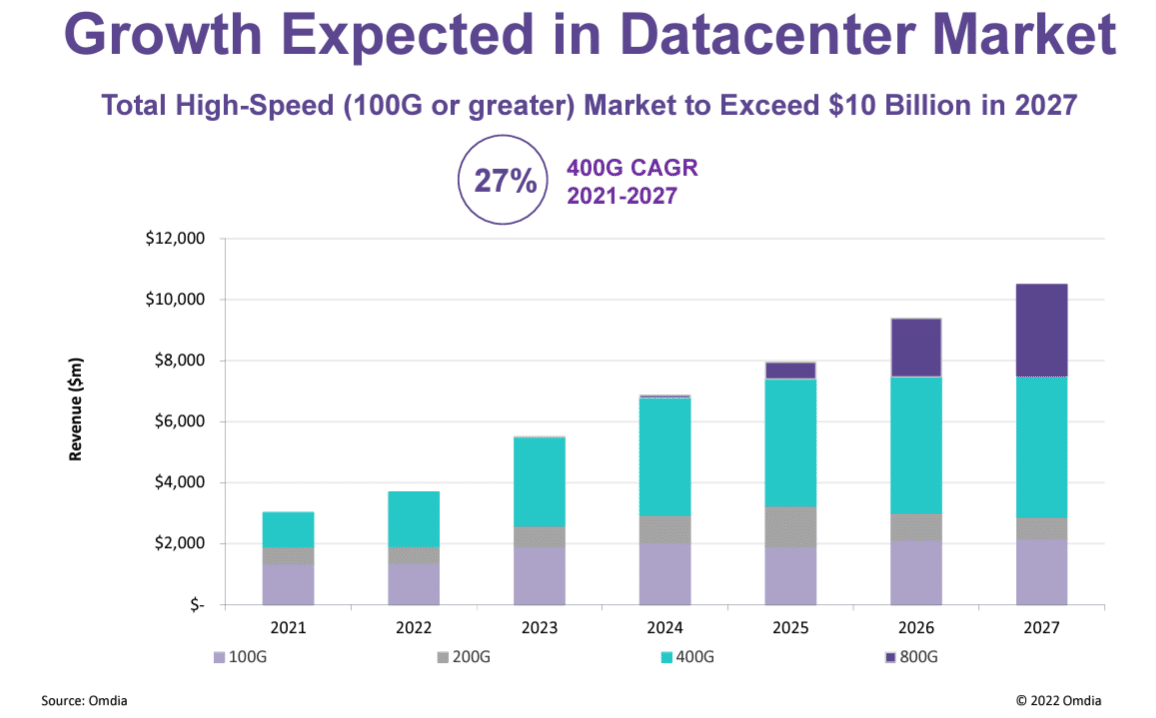

AAOI has a $1.5B market cap and trades 35X Earnings, 31X EBITDA and 3.2X EV/Sales with revenues seen surging 118% in FY25 and EBIT inflecting positively. AAOI FY26 revenue estimates have risen to $665M from $445M back in August showing strong upside revisions. AAOI’s short float remains high at 21% of the float but down from 28% in September. AAOI recently strengthened its balance sheet with a direct offering and convertible notes exchange. Applied’s U.S. based AI optical module capability is considered a unique asset and Northland sees potential for a strategic investment to expand capacity by major cloud customers. AAOI is also awaiting 800G qualification by hyperscalers as a key catalyst. The data center market is transitioning from 100Gbps and 400Gbps to 800Gbps and 1.6Tbps, driven by the growth in AI compute infrastructure. In the cable TV market, there is an upcoming upgrade cycle to increase bandwidth, particularly on the return path. This is driving demand for AAOI’s amplifier and monitoring products. AAOI expects the Microsoft contract for 400Gbps and 800Gbps active optical cables to ramp up in 2025 and be a $300 million opportunity over 3-4 years. AAOI anticipates the cable TV upgrade cycle to be a $5 billion opportunity over the next 5 years, and they expect 2025 to be an inflection point for their cable business.

AAOI is well-positioned to capitalize on the transition to higher speed data center interconnects and the upcoming cable TV network upgrade cycle, leveraging its technology leadership and manufacturing capabilities. The company’s strategic initiatives around automation and new product development are expected to drive growth in the coming years.