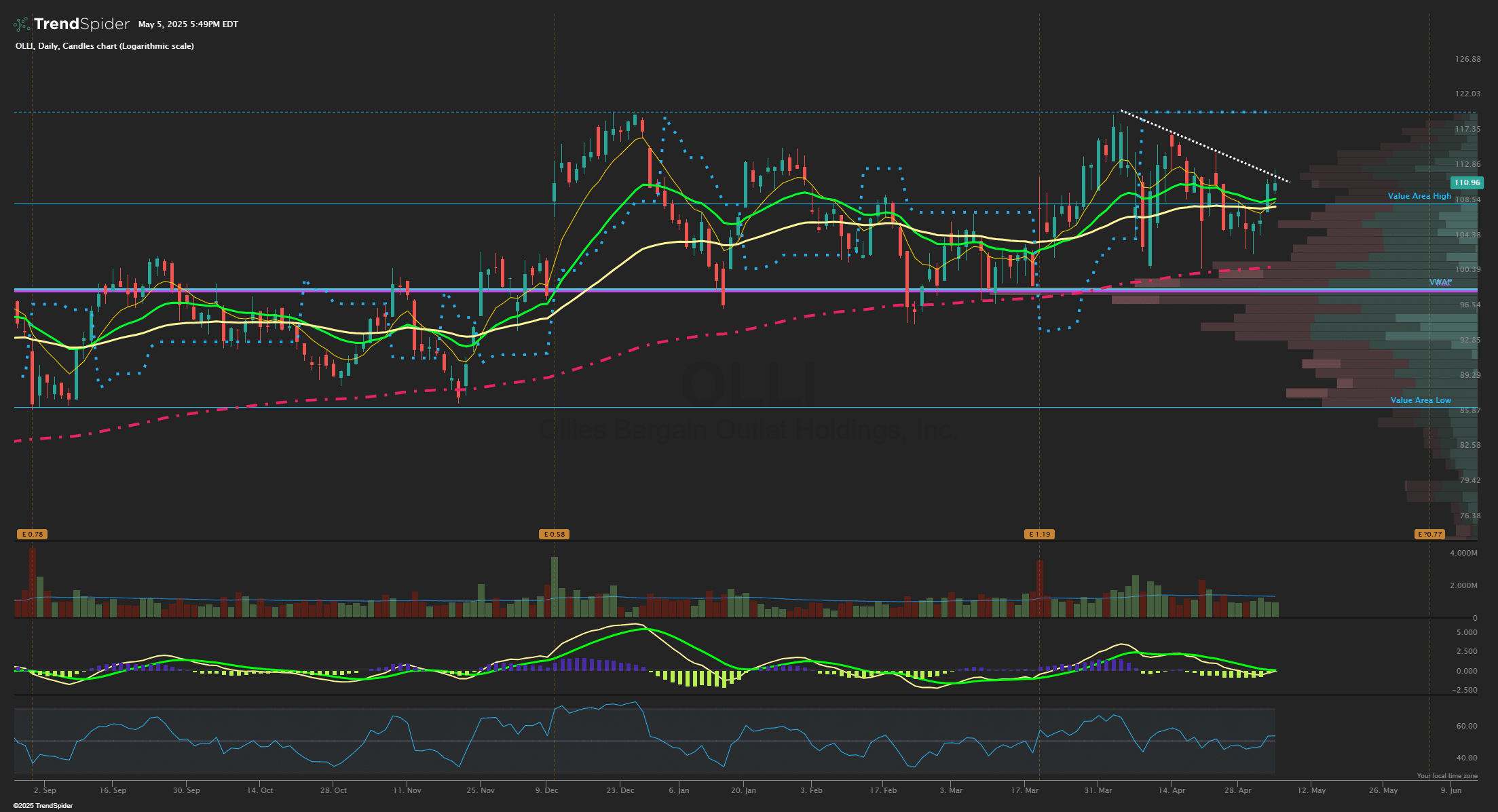

Defensive Retail Name Forms Relative Strength Bull Wedge

Ollie’s Bargain Outlet (OLLI) shares of the discount retailers are staying strong relative to the broad market as its up about 2% YTD thus far and held above its 200-day EMA during the entire March-April correction in stocks. OLLI has a bull MACD cross triggering now and looks ready to run above 110 for a move to new highs near 120 and beyond. OLLI is projecting double digit sales growth through FY27 and should do better as a defensive retailer than most stocks if the slowdown in the consumer materializes further this year.