ETF Sector Relative Strength Corner: Consumer Strength Leading into Q4

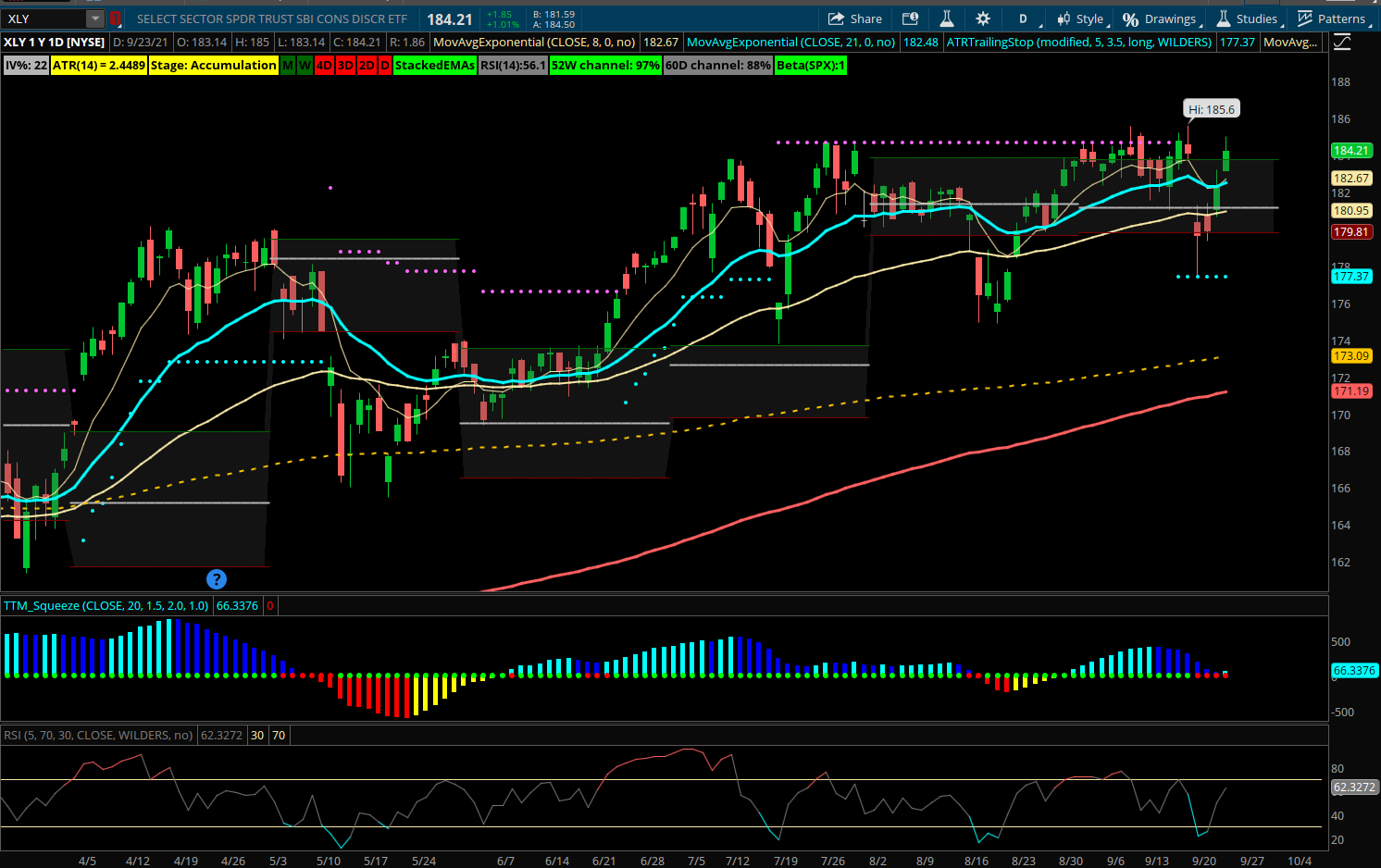

Consumer Discretionary (XLY) The Discretionary sector has been showing relative strength all month as it actually hit new 2021 highs last Friday before the market dip. After the market rebound this week, XLY is nearly at new highs again as it cleared its monthly value area already. XLY is up 13.5% YTD and has shown higher lows forming on pullbacks throughout the summer. A weekly close above 185 likely pushes to 190+ quickly as the daily squeeze is forming and often powers a market to breakout. Some of the key component stocks in the Discretionary ETF are looking poised to take out their recent highs as well.

The ETF’s top weightings are AMZN, TSLA, HD, MCD, NKE. The current best technical chart looks to be TSLA as it has trended strong above its 8/21 EMA’s and forming a bull flag near 750 with potential to rally to 800+ in the short term. AMZN has a positive chart pattern since its earnings gap-down and now looks to travel back higher to fill the gap towards 3600. MCD has formed a bull base pattern and looks to break higher above 245. Several of these top holdings have seen bullish options flows recently. Other uptrending names in the top weightings include HD, LOW, BKNG, GM and F.